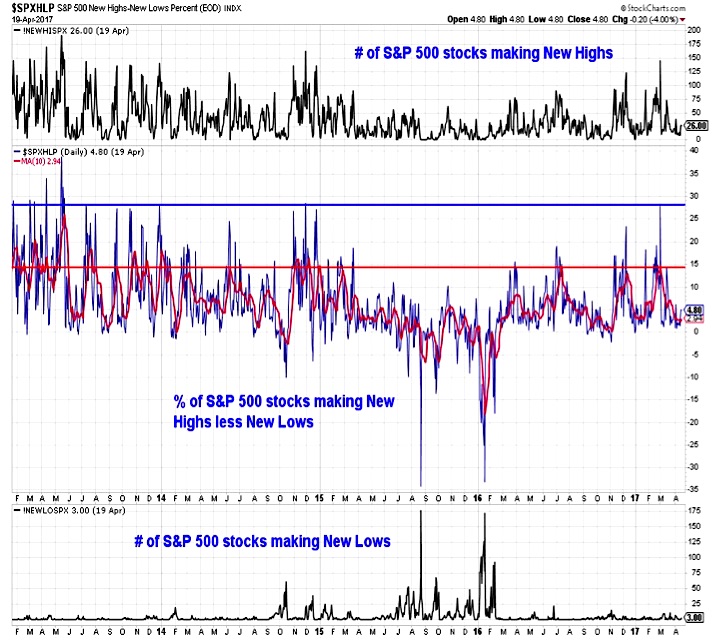

S&P 500 – Market Breadth Indicators

While we have been in a period of consolidation, the path of least resistance over the intermediate term still appears to be higher. As such, the consolidation may peter out and not produce a climactic downside move. As such, we need to keep an open mind and be aware of evidence that the cyclical rally is getting back in gear. If a sustainable move higher is emerging, we would expect to see an expansion in the number of stocks making new highs. So far, that has not been seen.

Broker/Dealer Index

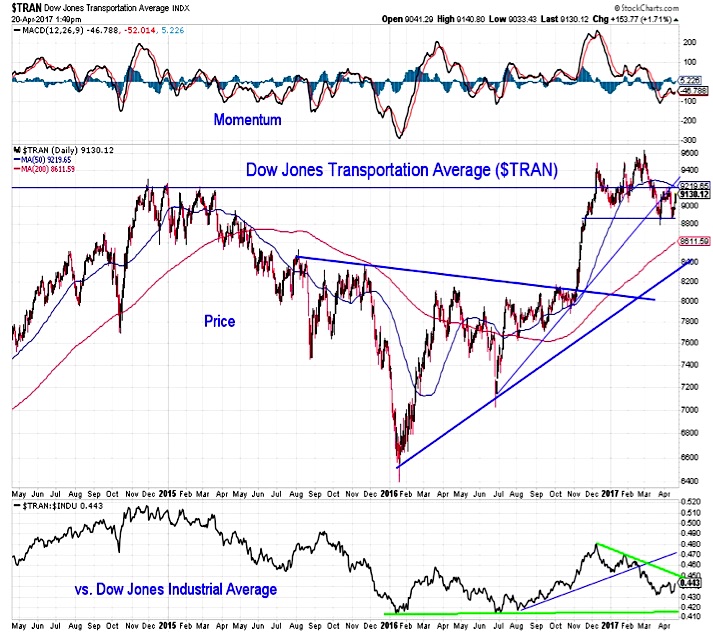

Additional evidence that the cyclical rally is resuming could come from the Broker/Dealer Index and/or the Dow Transports.

The Broker Dealer index has found support at the 2015 highs (which coincides with the rising trend line off of the 2016 lows). Still missing, however, is a meaningful upturn in momentum. Regaining the relative price trend line (which as broken in March) would also be evidence that this index, and the broader market with it, could be poised to move higher in a sustained fashion.

Dow Jones Transportation Average

The Dow Transportation Average is also improving. On both an absolute and relative price basis, the April lows have remained above the March lows (whereas the April low for the Dow Industrials undercut its March low). Getting through resistance near 9000 would be another step in the right direction for the Transports, as would breaking above the down-trend relative to the Industrials that has emerged since December.

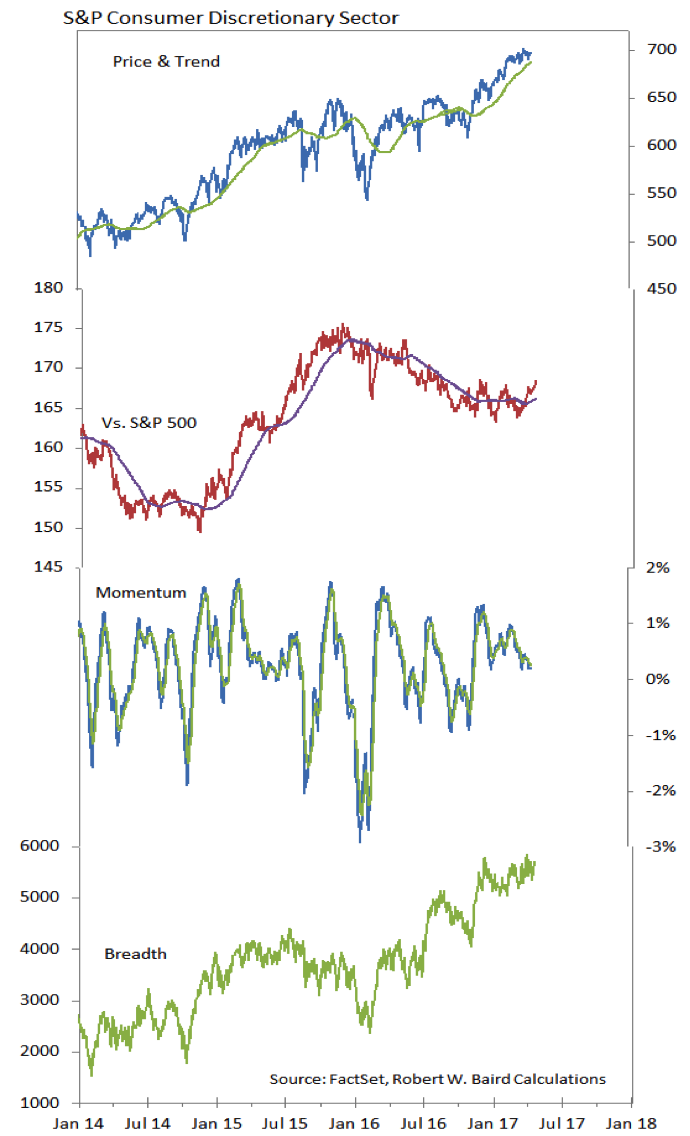

Consumer Discretionary Sector

The Consumer Discretionary sector has broken out of a relative price down-trend and has joined the leadership group based on our sector-level relative strength rankings. The sector is the first sector in a month to move to a new high. Sector-level momentum is at support and the trend in breadth remains strong. Sub-industry trends for the sector show a heavy tilt toward relative strength improvement versus deterioration, evidence that the recent strength in the sector is relatively broadly based.

Thanks for reading.

Twitter: @WillieDelwiche

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.