Euro STOXX 50 Index

While conditions have deteriorated somewhat at home, international stocks are showing absolute and relative price strength. Currency volatility can add to the noise, but European stocks have followed last year’s breaking of the absolute price down-trend with a breakout (and re-test) of the trend versus the S&P 500. While it is not yet clear that international stocks are poised for an extended period of outperformance, the extended period of underperformance (relative to the U.S.) may be winding down.

10 Year US Treasury Yield

Bond yields appear poised to move higher. Momentum trends for the 10-year T-Note yield have continued to improve even as yields themselves have been largely range-bound (between 2.30% and 2.60%).

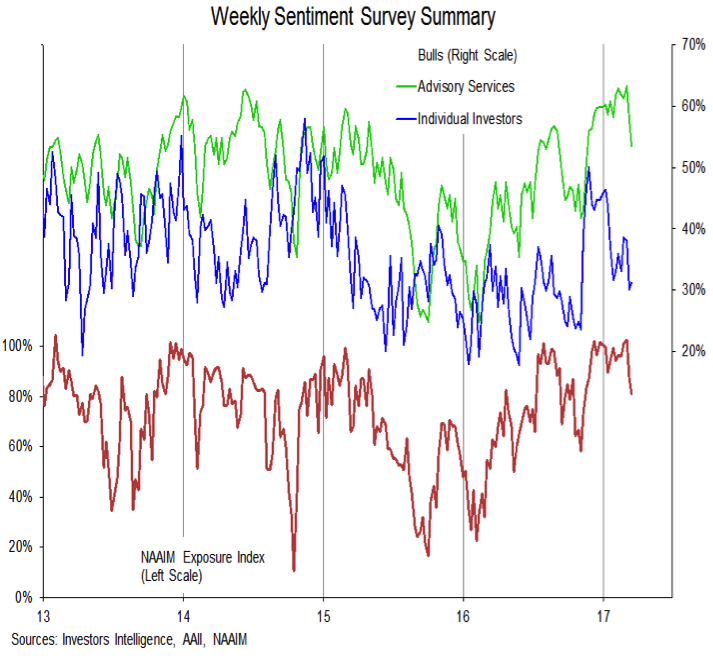

Investor Sentiment

The sentiment surveys over the past two weeks suggest that excessive optimism has peaked and is now beginning to reverse. Historically this would be a period of increased risk for stocks as the crowd is reversing at an extreme. Advisory service bulls (as measured by Investors Intelligence) have retreated from a 30-year high and the active investment managers are reducing equity exposure (the NAAIM index has dropped from 102% to 81% over the past two weeks). Now we will be watching for evidence that pessimism is rising. This could first show up in the options data, but we would also expect to see a meaningful uptick in bears (and further reduction in equity exposure) in these surveys.

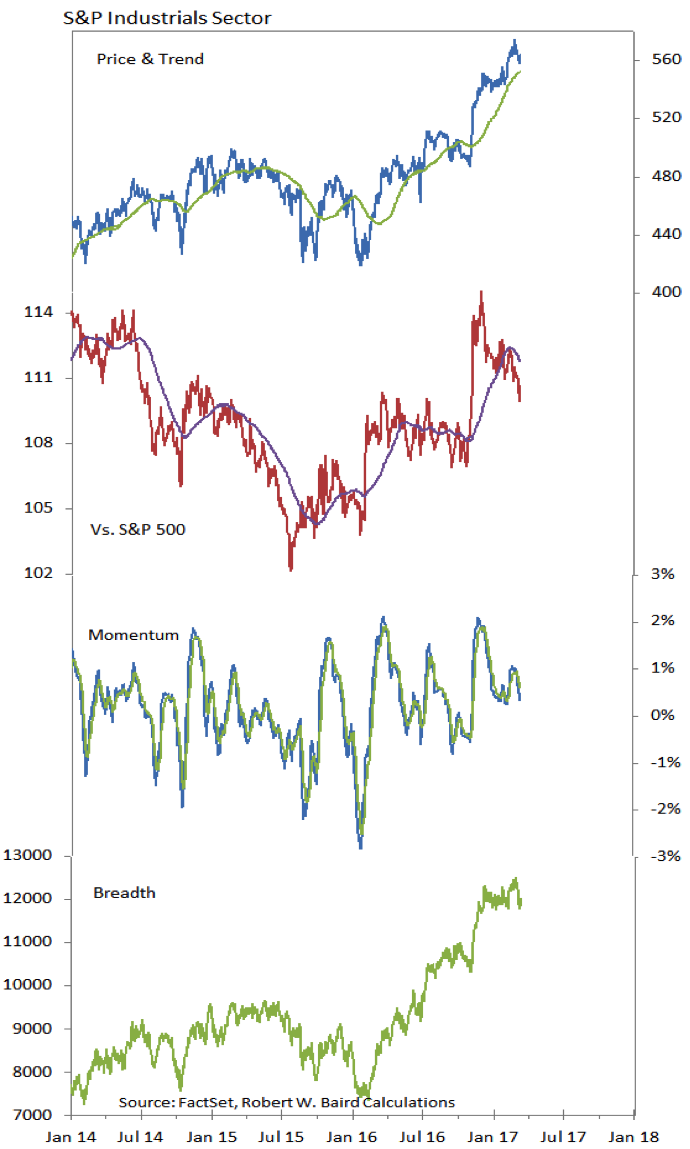

S&P Industrials Sector

The Industrials sector remains in the relative strength leadership group in our sector-level relative strength rankings, but on a short-term basis the sector has given up ground relative to the S&P 500. The most recent rally to new highs for the sector was not accompanied by new highs in momentum or the relative price line. While breadth remains positive, the sector could be poised for further relative consolidation before re-assert leadership.

Thanks for reading.

Twitter: @WillieDelwiche

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.