In this research note, we will look at some key stock market indicators, the health of the S&P 500 Index (INDEXSP:.INX), and a handful of emerging themes that we are watching in our investing research.

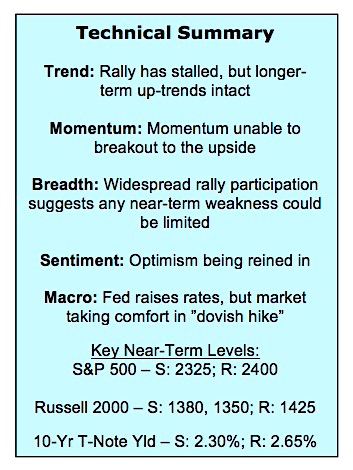

Here are some summary highlights:

Rally Losing Upside Momentum – The surge in momentum that emerged in late 2016 that helped fuel the early 2017 rally to new all-time highs across most U.S. stock market indexes has stalled out. While the longer-trends suggest the path of least resistance may by higher over time, the lack of near-term momentum may keep stocks in consolidation mode as we move toward the second quarter.

As U.S. Stocks Consolidate, Leadership Shifts Overseas – While the rally at home seems to have stalled out for now and sector-level trends have cooled considerably, conditions are improving internationally. Emerging markets equities gained strength over the course of 2016. And now in 2017, the emerging markets developed counterparts are showing signs of breaking out of a multi-year down-trend versus U.S. stocks.

Optimism Starting to Wane – The latest data from the investor sentiment surveys suggests that optimism has peaked and is beginning to reverse from excessive levels. Typically this is a period of heightened risk for stocks. It comes now at a time when near-term breadth and momentum is already cooling. While a relief from excessive optimism is welcome, stocks could struggle to rally until a meaningful level of pessimism emerges.

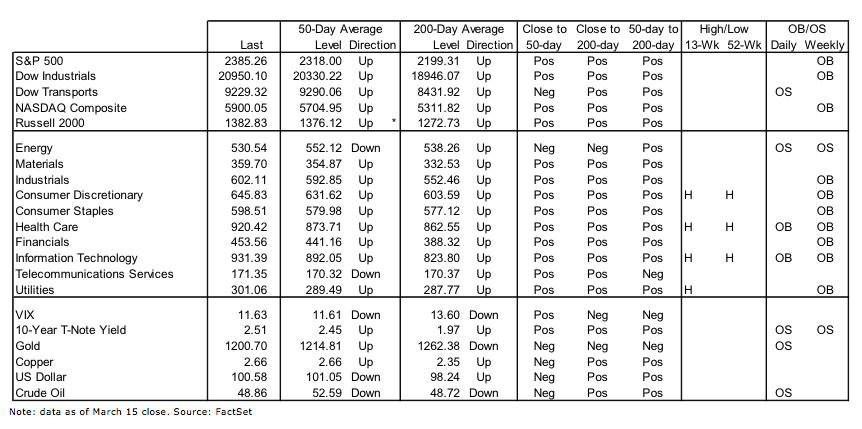

Stock Market Technical Indicators

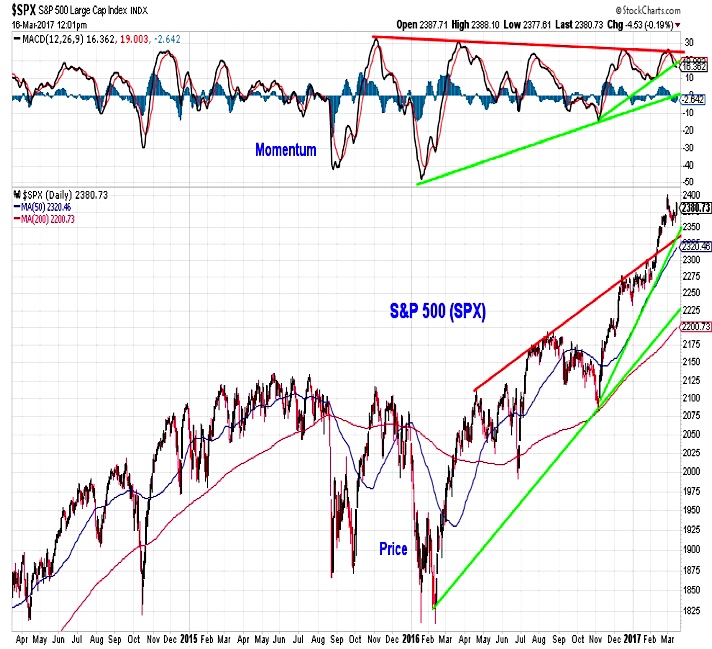

S&P 500 Index

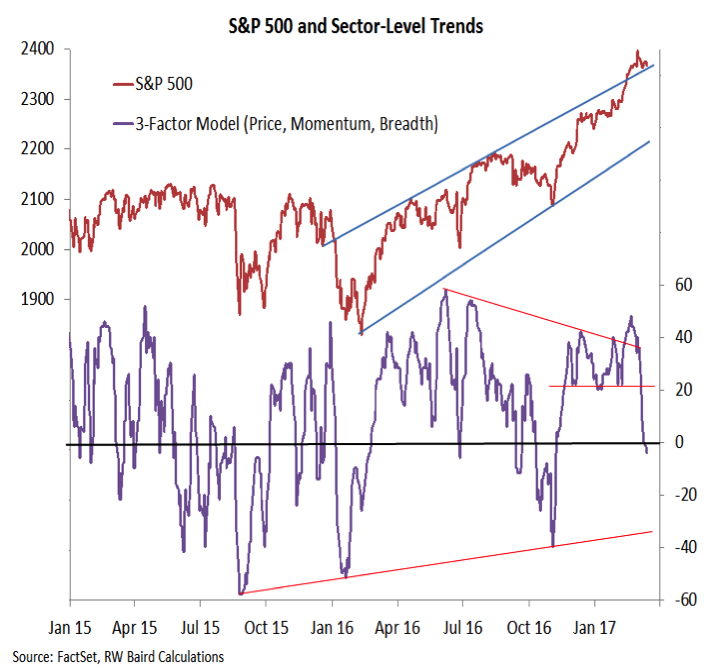

While the longer-term momentum up-trend for the S&P 500 that emerged over the course of 2016 remains intact, the upswing in momentum that emerged late in the year has been unable to break-out to the upside. This sets up a divergence between momentum and price (which has moved to new highs). Stock prices may need to re-set before moving further into record territory. It looks like the first level of support emerges in the 2325 to 2350 range.

Market trends at the sector-level have cooled considerably over the past week. While it may be the case that near-term breadth has simply been unwound and is now ready to re-load (i.e., sector-level trends could quickly get back in gear as the S&P 500 rallies), it seems more likely that this near-term divergence is signaling increased risk of further consolidation in the indexes. This week’s Fed-inspired strength notwithstanding, we would be cautious about chasing strength without improvement in the near-term momentum and breadth trends.

Russell 2000 Index

Small-caps have struggled to build on their late-2016 gains. The Russell 2000 (INDEXRUSSELL:RUT) has spent most of the past four months trading between 1350 and 1400. Momentum has cooled, and so has the price trend relative to the S&P 500. So far support near 1350 has held, but a break of that level could suggest that the risk of a more meaningful pullback (as opposed to just a near-term consolidation) is being realized.

continue reading on the next page…