Since hitting 1775 on October 30th, the S&P 500 has gone into “grinding” mode. Already at elevated levels, many investors and pundits have thrown their hats into the ring to announce the beginning of a blow-off move higher or a countdown to a crash. No doubt, emotions are starting to run high… just in time for the holidays! And this is where the grind higher comes into play: the underinvested begin to worry, bears worry more, and bulls worry less (complacency). Eventually, something has to give.

Since hitting 1775 on October 30th, the S&P 500 has gone into “grinding” mode. Already at elevated levels, many investors and pundits have thrown their hats into the ring to announce the beginning of a blow-off move higher or a countdown to a crash. No doubt, emotions are starting to run high… just in time for the holidays! And this is where the grind higher comes into play: the underinvested begin to worry, bears worry more, and bulls worry less (complacency). Eventually, something has to give.

A few weeks back, I wrote about the potential for near-term equities exhaustion as the S&P 500 nears 1800… and even though I still think a pullback is in the offing, I’m not big on “look at me” top calling. As an active investor, I try to keep my primary focus on the week ahead. It’s not that I don’t ponder longer-term possibilities (or even comment on them), it’s just that it doesn’t serve my typical trading timeframe and discipline to “focus” on anything other than the days/weeks ahead. And this shorter-term “trade what’s in front of me” mindset fits well with technical analysis.

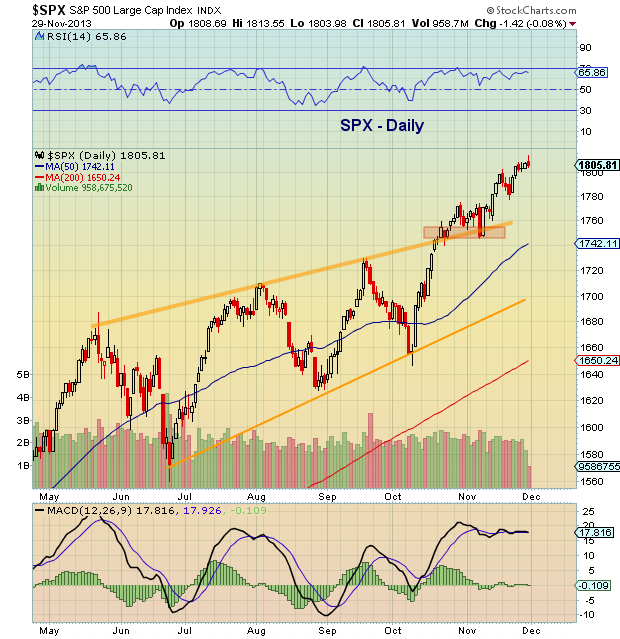

With this in mind, let’s look at some important technical levels to watch in the week ahead. As highlighted in the first chart, the rising wedge that has formed since the October bottom is beginning to narrow. Upside resistance currently resides around 1820, but that could morph into 1830 if the grind continues throughout the week. First support rests around 1800, followed by more important support at 1775/77 (November 20th low, November 7th high). Beyond that lies critical support around 1740-1750. Looking at the second chart below, you can see the breakout above the rising channel around 1740/50. This area is also supported by the 50 day moving average (currently at 1742). Trade safe, trade disciplined.

S&P 500 Rising Wedge Chart

S&P 500 Breakout Chart – 6 Month Rising Channel

S&P 500 Breakout Chart – 6 Month Rising Channel

Twitter: @andrewnyquist

Position in SH at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.