As equities prepare to blast off into outer space, I am taking a cautious approach here. The first cracks appeared with the small caps, and that was followed by some exhaustion signals with tech stocks. Each of those proved to be early warnings, and the market has bumped marginally higher. But the atmosphere may be shaping up for another burst higher towards 1800… that gets sold. Here are 3 reasons why I’m expecting a corrective move of at least 5 percent to hit stocks soon:

As equities prepare to blast off into outer space, I am taking a cautious approach here. The first cracks appeared with the small caps, and that was followed by some exhaustion signals with tech stocks. Each of those proved to be early warnings, and the market has bumped marginally higher. But the atmosphere may be shaping up for another burst higher towards 1800… that gets sold. Here are 3 reasons why I’m expecting a corrective move of at least 5 percent to hit stocks soon:

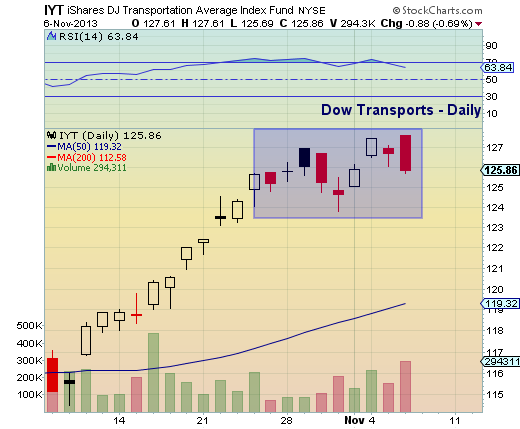

1. Stocks looking tired – Daily and weekly time frames are showing some exhaustion signals. Last week the Nasdaq 100 recorded bar 9 of a weekly DeMark sell setup, and this week the S&P 500 and German DAX (among others) will join them. As well, the Dow Jones is nearing rising channel resistance (again!) and Small Caps and Tech have begun to show some relative underperformance. Any move higher will likely need a refresh and recharge, at a minimum. Also check out Andrew Kassen’s recent work, including his research note on the McClellan Oscillator.

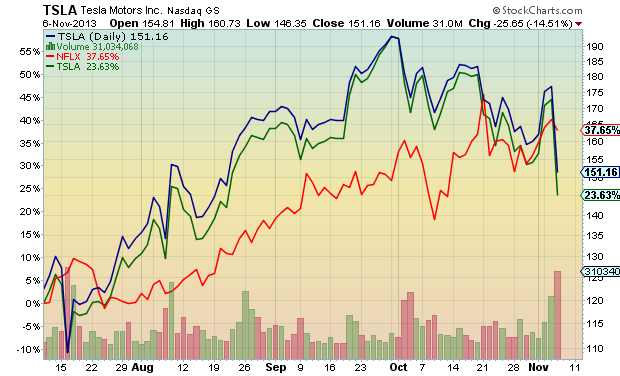

2. Momo stocks getting hit. Momentum stocks such as Tesla (TSLA), Netflix (NFLX), and LinkedIn (LNKD), amongst others, have recently taken it on the chin.

3. Sentiment and News. Likely ripe for a burst higher… that gets sold. This morning, the ECB cut rates 25 bps to 0.25%… And twitter exploded. Yep, all pun’s intended there, as the Twitter IPO price is set and TWTR stock is expected to start trading at some point today. Yep, sentiment is getting a bit juicy near-term and the bullish news and atmosphere at all time highs often accompanies a burst higher followed by a corrective move.

To be clear, these signs are all of a short to intermediate term time frame. The primary and secondary trends are up (hey, we are at all-time highs) and any corrective action would need to be monitored to determine the severity of any pullback. But, that said, active investors that monitor investments and capital on a day to day basis may want to watch these developments. I am.

Thanks for reading.

Twitter: @andrewnyquist

Positions in SPY and SH at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.