The McClellan Oscillator (NYMO) and its longer-term complement the McClellan Summation Index (NYSI) comprise a set of technical tools widely followed among market technicians as a versatile measurement of market breadth.

The McClellan Oscillator (NYMO) and its longer-term complement the McClellan Summation Index (NYSI) comprise a set of technical tools widely followed among market technicians as a versatile measurement of market breadth.

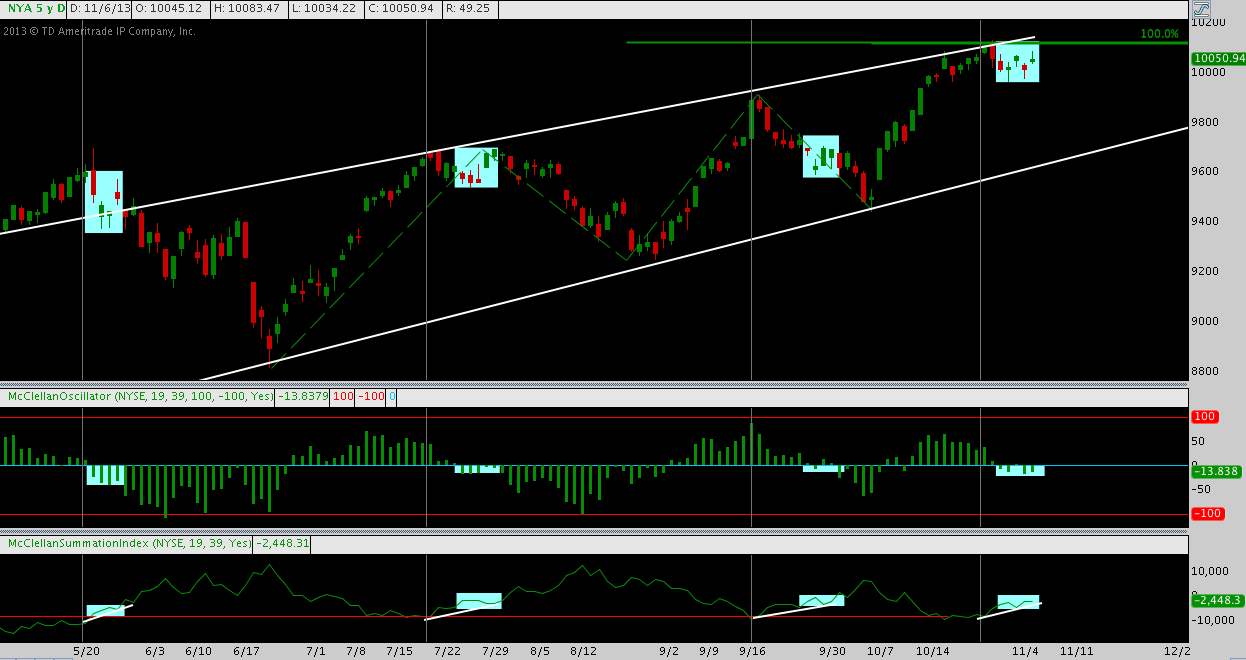

Plotted against the NYSE Composite Index ($NYA), crosses above and below the NYMO’s zero-line (especially following amidst a thrust from +100 or -100) often mark the beginning of or provide confirmation of newly-unfolding directional moves index. Paired with constructive and deteriorating moves in the Summation Index – especially during narrow congestion zones – the McClellan Oscillator is adept at signaling probable short and medium-term market turns (to learn more about NYMO and NYSI, go here).

The NYA throughout the second half of 2013 has provided several excellent examples thus far; and appears to be setting up another.

NYSE Composite Index (NYA) – Daily: Rising Channel Pullbacks

In the chart below, you’ll note a series of blue rectangles on the main chart panel, aligned with rectangles on the first (NYMO) and second (NYSI) panels below it. These rectangles mark a period during which a) price is meandering aimlessly in a short-term congestion zone, b) the McClellan Oscillator prints multiple consecutive bars below its zero-line; and c) the McClellan Summation Index has reversed at a locally-defined low (varies with context; here around -10,000) and is trending up in the context of the price congestion.

These conditions generally signal deteriorating breadth, presaging a price pullback while NYMO breaks down toward -100 and NYSI continues trending higher.

NYMO and NYSI can and do present similar signals at larger marker turns; but even in the context of 2013’s muted and brief pullbacks, it continues to function remarkably well. In combination with the rising trend line and fibonacci cluster resistance just overhead, a pullback to rising trend line support at bare minimum looks probable.

Twitter: @andrewunknown and @seeitmarket

Author holds no exposure to securities mentioned at the time of publication.

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.