Broad Stock Market Futures Outlook for May 24, 2018

As volume drifts lower, buyers defended the tests of support in our range defined across the futures landscape.

The song remains the same – the charts are range bound but with enough range to make trading profitable at these edges – moving into short trades at tests of upper resistance that fail- and moving into long trades at tests of lower support that hold. This ‘song and dance’ works….until it doesn’t, so above all things, avoid throwing caution to the wind and manage your risk appropriately.

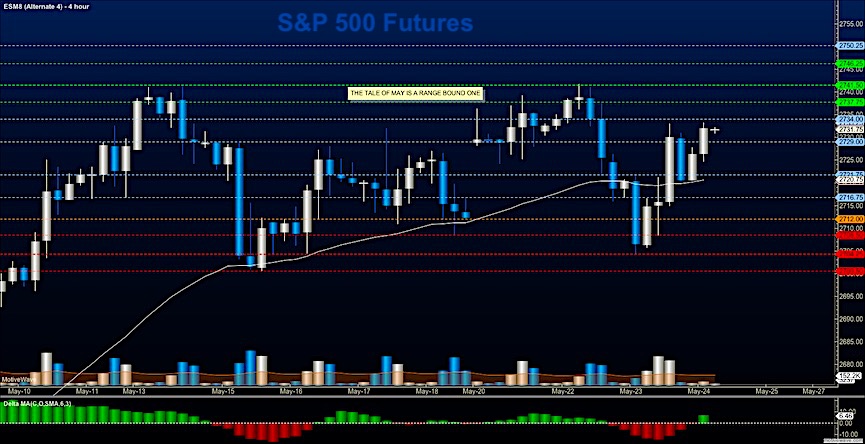

S&P 500 Futures

In the last few days, we’ve watched the ranges tighten as we approach a long weekend in the U.S.- Breaching 2734 will allow for the press upward into higher resistance, and below 2720, we will likely see the areas near 2712 again. The bullets below represent the likely shift of trading momentum at the successful or failed retests at the levels noted.

- Buying pressure intraday will likely strengthen with a bullish retest of 2734.75

- Selling pressure intraday will likely strengthen with a bearish retest of 2720.50

- Resistance sits near 2737.5. to 2741.75, with 2747.75 and 2754.5 above that.

- Support sits between 2727.5 and 2721.5, with 2716.5 and 2706.75

NASDAQ Futures

Traders piled in with force at the tests of deeper support yesterday – and pressed higher before beginning to drift back to support zones. Pullbacks will be buying opportunities for the patient and cautious trader but as you can see, those pullbacks can be quite deep. Failure to recapture of 6960 will spell trouble for buyers and intraday selling motion will catch hold. The bullets below represent the likely shift of trading momentum at the successful or failed retests at the levels noted.

- Buying pressure intraday will likely strengthen with a bullish retest of 6962.75

- Selling pressure intraday will likely strengthen with a bearish retest of 6934.50

- Resistance sits near 6954.25 to 6962.5 with 6976.5 and 6994.25 above that.

- Support sits between 6944.75 and 6924.5, with 6906.75 and 6884.5 below that.

WTI Crude Oil

The weight of hedge funds is seen here as they continue to sell this contract down. Bounces are likely to fade into deeper support as the chart inches closer to the breakout levels near 68.6. There is a clear shift of momentum here as traders trim long positions. The bullets below represent the likely shift of trading momentum at the successful or failed retests at the levels noted.

- Buying pressure intraday will likely strengthen with a bullish retest of 71.47

- Selling pressure intraday will strengthen with a bearish retest of 71.06

- Resistance sits near 71.24 to 71.56, with 71.86 and 72.24 above that.

- Support holds near 70.86 to 70.43, with 70.16 and 69.78 below that.

Twitter: @AnneMarieTrades

The author trades stock market futures every day and may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.