Stock Market Trading Considerations For June 1, 2017

The S&P 500 (INDEXSP:.INX) continues to find buyers on pullbacks but buyers need to be aware of the formation of lower highs and what that may mean if lower support levels breakdown.

Note that I’ll be back on planes tomorrow for more graduations, so there will be not be an update on Friday. I will have a weekend update, however, and I am quite pleased to be back into the full swing of trading on Monday, Jun 5, 2017.

Check out today’s economic calendar with a full rundown of releases. And note that the charts below are from our premium service at The Trading Book and are shared exclusively with See It Market readers.

S&P 500 Futures (ES)

Buyers continued to support key price levels, and from yesterday’s action, we can see the danger in shorting at support. Instead, watch for the failure of resistance as the S&P 500 continues with lower highs but holds at the lows.

I am inclined to short new highs of the day into support, but this is a bit aggressive with stops very tight. The more important level of 2402 noted yesterday proved itself out as real support for now, but we will watch it again. The key event formation will be lower highs and a breach below of key support to signal any continuing bearish action. The bullets below represent the likely shift of trading momentum at the positive or failed retests at the levels noted.

- Buying pressure intraday will likely strengthen above a positive retest of 2414.5 (though that is resistance for now)

- Selling pressure intraday will likely strengthen with a failed retest of 2402.25

- Resistance sits near 2414.5 to 2417, with 2421.5 and 2427.75 above that

- Support holds between 2402.5 and 2395.5, with 2391.5 and 2386.75 below that

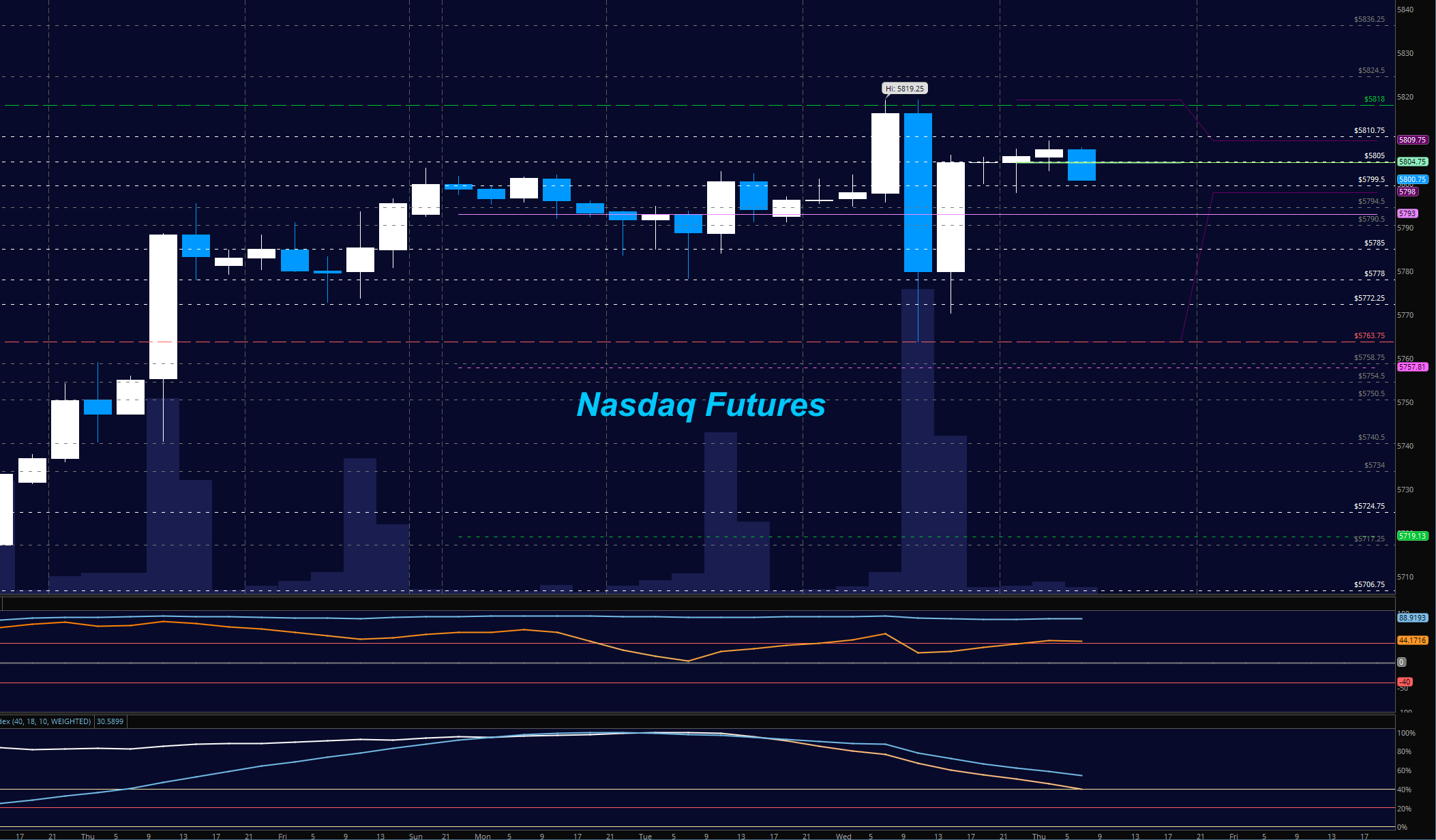

NASDAQ Futures (NQ)

New highs again yesterday, but breakouts continue to retrace into congestion. Bounces should fade into support regions. The formations are still bullish as the technology sector holds steady. The key to watch will be the higher lows and the potential loss of tested support. The levels to watch for support today seem to be 5790 to 5772. New highs are likely to reject under current pressure. The bullets below represent the likely shift of trading momentum at the positive or failed tests at the levels noted.

- Buying pressure intraday will likely strengthen with a positive retest of 5810

- Selling pressure intraday will likely strengthen with a failed retest of 5790

- Resistance sits near 5810.25 to 5815.25, with 5819.25 and 5826.75 above that

- Support holds between 5778.25 and 5772.5, with 5757.75 and 5740.5 below that

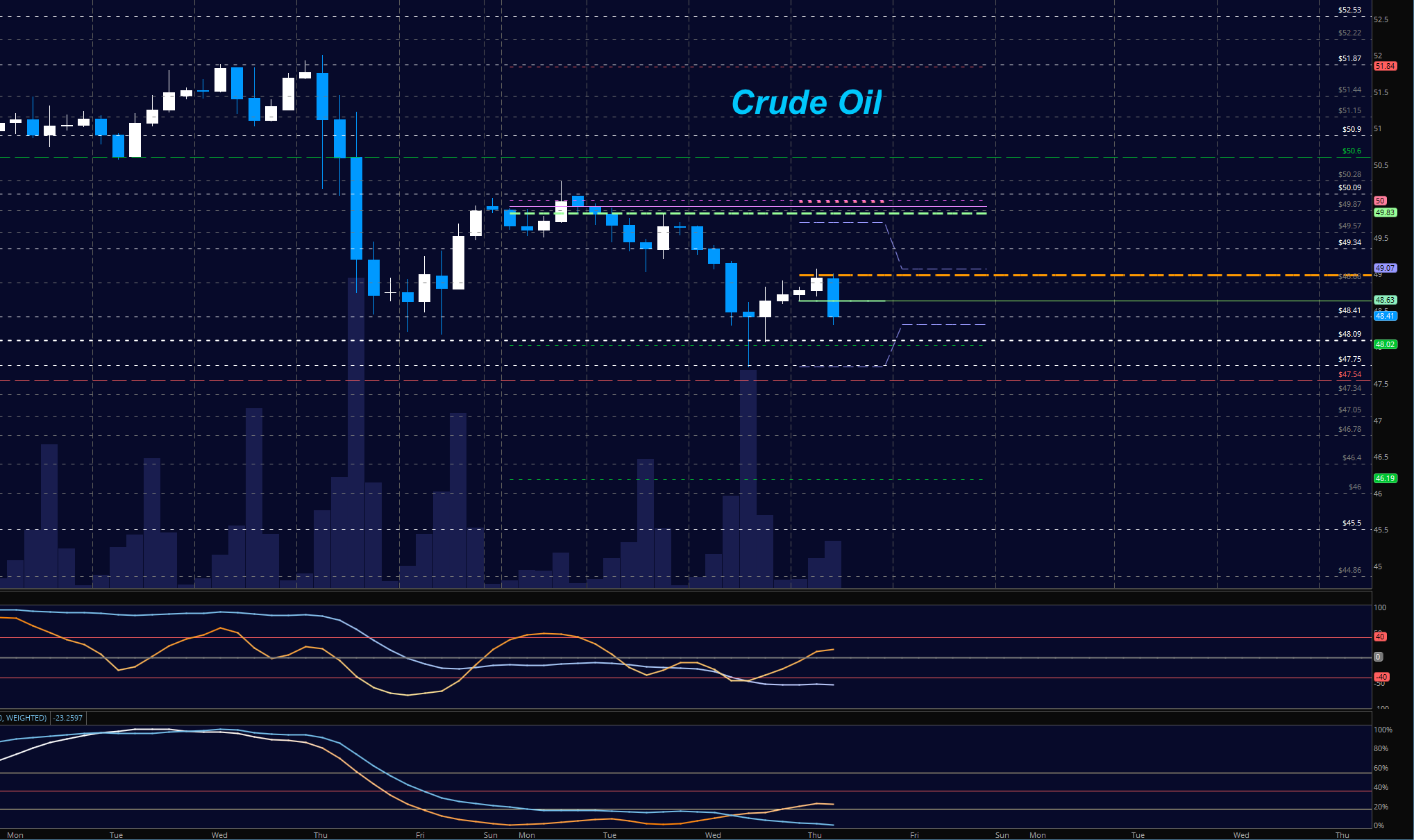

Crude Oil – WTI

Today’s EIA should provide a catalyst for motion as we are still in the midst of key weekly and monthly congestion levels – the API yesterday gave us a bounce that allowed trapped buyers to leave the trade. We are back near low congestion levels. Lows will find buyers, but only into resistance. The level at 49.12 is likely to shift the balance if buyers can breach and hold this region. Momentum is decidedly negative – it does seem people are trying to pick bottoms, but that is clearly a fool’s errand. Support levels to watch are now at 47.75 and 48.02. The bullets below represent the likely shift of trading momentum at the positive or failed tests at the levels noted.

- Buying pressure intraday will likely strengthen with a positive retest of 49.12

- Selling pressure intraday will strengthen with a failed retest of 48.02

- Resistance sits near 49.12 to 49.84, with 50.65 and 51.23 above that.

- Support holds between 48.02 and 47.75, with 47.34 and 47.06 below that.

Our live trading room is now primarily stock market futures content, though we do track heavily traded stocks and their likely daily trajectories as well – we begin at 9am with a morning report and likely chart movements along with trade setups for the day.

As long as the trader keeps himself aware of support and resistance levels, risk can be very adequately managed to play in either direction as bottom picking remains a behavior pattern that is developing with value buyers and speculative traders.

Twitter: @AnneMarieTrades

The author trades stock market futures every day and may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.