Broad Stock Market Futures Outlook for May 4, 2018

Yesterday’s commentary gave us a textbook motion for the charts. Today, we wait for news that may or may not move the market significantly from these lower regions of support.

Deeper breakdowns intraday will still be very likely to bounce so look for those first lower highs on tighter time frames after the lower lows to see if there is continuation downside. I suspect we will hold the low region as support and bounce again.

S&P 500 Futures

Congested lower regions give us a line in the sand near 2622 in the continued game of finding the tipping point. I suspect we hold our support zones even if they initially break. What happens AFTER that will be the key for motion after the fact. Our numbers today look very similar to prior days. The bullets below represent the likely shift of trading momentum at the successful or failed retests at the levels noted.

- Buying pressure intraday will likely strengthen with a bullish retest of 2636.75

- Selling pressure intraday will likely strengthen with a bearish retest of 2621.50

- Resistance sits near 2634.75 to 2645.75, with 2658.25 and 2676.75 above that.

- Support sits between 2624.75 and 2612.5, with 2596.5 and 2587.50

NASDAQ Futures

Significant congestion greets us this morning with a range between 6630 and 6674. Outside of these levels we should see range expansion but use caution with size and anticipate reversal at some juncture. The first dip below will likely bounce to test this but lower highs will send us further south as it did yesterday. The bullets below represent the likely shift of trading momentum at the successful or failed retests at the levels noted.

- Buying pressure intraday will likely strengthen with a bullish retest of 6674.75

- Selling pressure intraday will likely strengthen with a bearish retest of 6620

- Resistance sits near 6654.5 to 6674.5 with 6696.25 and 67774.5 above that.

- Support sits between 6622.5 and 6578.5, with 6530.5 and 6480.75 below that.

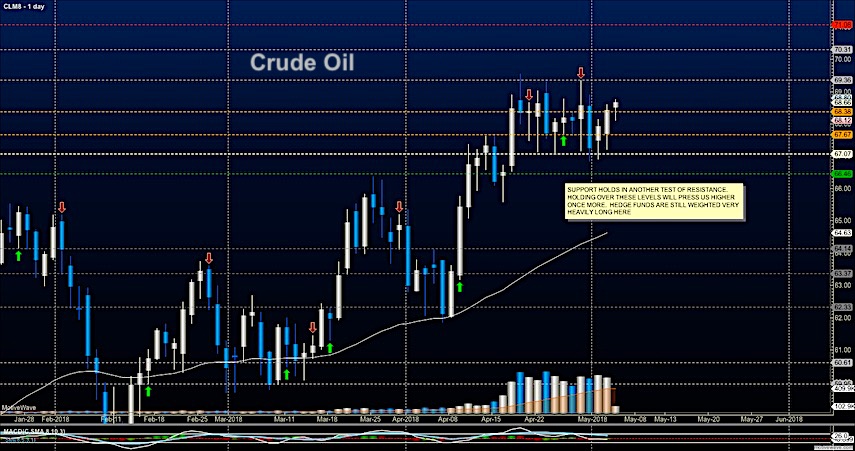

WTI Crude Oil

Upside breach of 68.3 bodes well for buyers but we still hold below 69 which still holds as resistance. Big bounces upward should still fade The bullets below represent the likely shift of trading momentum at the successful or failed retests at the levels noted.

- Buying pressure intraday will likely strengthen with a bullish retest of 68.38

- Selling pressure intraday will strengthen with a bearish retest of 68.04

- Resistance sits near 68.32 to 68.87, with 69.23 and 70.23 above that.

- Support holds near 68.12 to 67.57, with 66.84 and 65.94 below that.

Twitter: @AnneMarieTrades

The author trades stock market futures every day and may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.