Stock Market Futures Overview & Trading Outlook for September 12, 2016

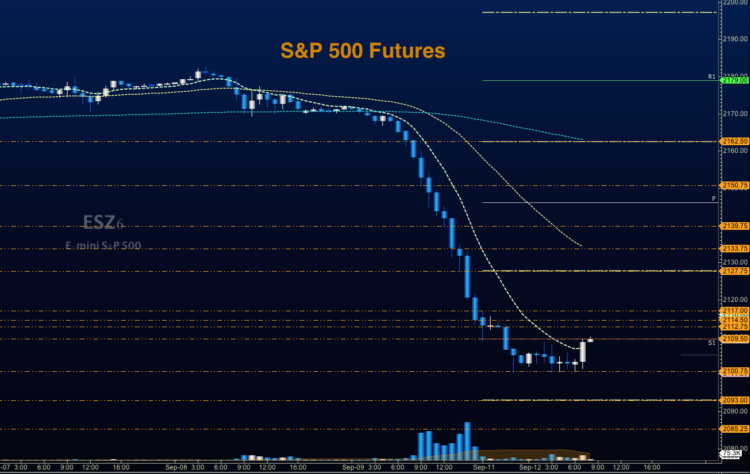

S&P 500 Futures have been trying to hold morning support, but it seems very likely that the first bounces will fail. Only the positive retest of prior resistance will give the go-ahead to buyers in this environment. The key price support level today on S&P 500 futures is 2099.75. And further, a break lower here will give sellers further advantage. Price resistance sits at 2117. Picking a bottom here will be dangerous without a positive retest of higher lows. S&P 500 (INDEXSP:.INX) momentum is bearish on shorter time frames, but slowly reversing as buyers try to prop up the market. The key is to be patient and wait for the right setup.

See today’s economic calendar with a rundown of releases.

RANGE OF TODAY’S MOTION

S&P 500 Futures Trading Outlook For September 12

Upside trades on S&P 500 futures – Favorable setups sit on a positive retest of 2117, or a positive retest of the bounce off 2100.25 (with upward momentum). I use the 30min to 1hr chart for the breach and retest mechanic. Price targets from 2100.25 are 2102.25, 2104.25, 2108.25, 2112.5, 2115.25, 2117, and 2120.5. As always, additional targets are offered in the Members only portion of the morning blog and live trading room.

Downside trades on S&P 500 futures – Favorable setups sit below the failed retest of 2099, or at the failed retest of 2105 with negative divergence. Retracement into lower levels from 2105 give us the price targets 2103, 2101.25, 2099.75, 2096.75, and 2092.75.

Nasdaq Futures Trading Outlook

The NQ_F is also bouncing off support held for several hours, so a press into higher levels of broken support is likely. Support sits near 4622, with 4608.5 below that. Resistance sits between 4661, and 4705.25 above that.

Upside trades on Nasdaq futures – Favorable setups sit on the positive retest of 4651, or a positive retest of 4625.25 with positive momentum. I use the 30min to 1hr chart for the breach and retest mechanic. Targets from 4625.25 are 4630.75, 4634.5, 4638.5, 4640, 4643.75, 4651, 4657.75, and 4661. As always, additional targets will be in the Members only portion of the morning blog, and in the live trading room.

Downside trades on Nasdaq futures – Favorable setups sit below the failed retest of 4625, or at the failed retest of 4650 with negative divergence. Retracement into lower levels from 4650 are 4646.5, 4642.75, 4635.75, 4630.25, 4627.75, 4625, 4622.25, and 4620.75. See the blog for additional targets.

Crude Oil Trading Outlook

The sharp fade in oil has continued with a recent loss of important support at 44.86. Lower price support sits near 44.45, with 44.04 below that. Price resistance sits near 45.26, but could stretch into 45.57 if buyers can gain any footing.

Trading ranges for crude oil prices should hold between 43.94 and 45.89 today.

Upside trades on crude oil futures can be staged on the positive retest of 45.26, or at a positive retest off 44.84 (with positive momentum). I often use the 30min to 1hr chart for the breach and retest mechanic. Targets from 44.72 are 44.86, 45.02, 45.14, 45.26, 45.47, 45.57, and 45.89. See the blog for more details on the chart action.

Downside trades on crude oil futures can be staged on the failed retest of 44.83 or at the failed retest of 45.06 with negative divergence. Targets from 45.06 are 44.96, 44.84, 44.62, and 44.24. Additional targets will be in the Members only portion of the morning blog, and in the live trading room.

If you’re interested in watching these trades go live, join us in the live trading room from 9am to 11:30am each trading day.

Visit TheTradingBook.com for more information.

If you’re interested in the live trading room, it is now primarily futures content, though we do track heavily traded stocks and their likely daily trajectories as well – we begin at 9am with a morning report and likely chart movements along with trade setups for the day.

As long as the trader keeps himself aware of support and resistance levels, risk can be very adequately managed to play in either direction as bottom picking remains a behavior pattern that is developing with value buyers and speculative traders.

Twitter: @AnneMarieTrades

The author trades stock market futures every day and may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.