Stock Market Outlook for November 28, 2016 –

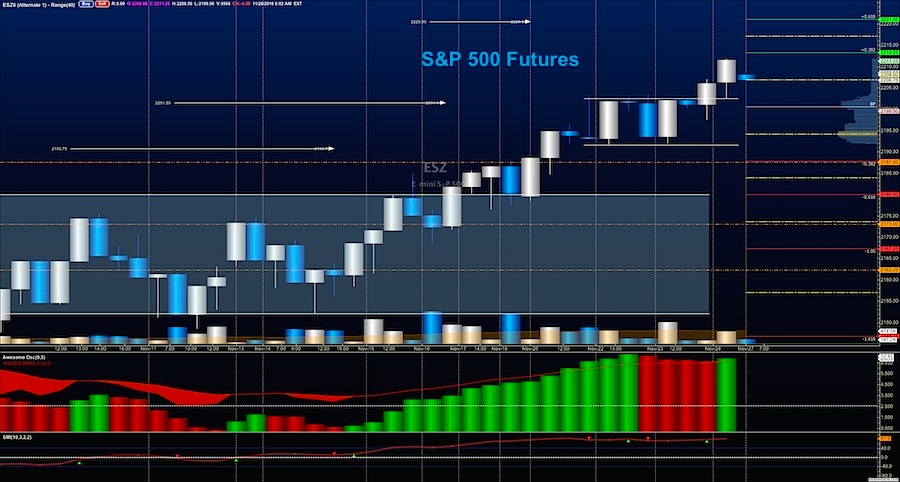

We stopped three ticks shy of the top price resistance level quoted on Friday near 2212.5 on S&P 500 futures. This will remain resistance for the S&P 500 (INDEXSP:.INX) today if sellers fail to breach and recapture 2211.75, else the levels near 2220.5 to 2224.5 looms as the upper price target.

Careful, though, as traders will be struggling with lower stock market volume and mixed views on the market’s direction today.

The line in the sand for buying support intraday will be 2199 – a test of that region should bring buyers to the table. Failure to hold there will be a tipping point back into 2194-2191. Resistance is between 2212.5 and 2220.5 intraday. Momentum is bullish but not building higher.

See today’s economic calendar with a rundown of releases.

TODAY’S RANGE OF MOTION

S&P 500 Futures Trading Chart – November 28

Upside trades on S&P 500 futures – Two options for entry

Positive retest of continuation level – 2208.50

Positive retest of support level – 2199.75

Opening targets ranges: 2203.5, 2206.75, 2209.5, 2211.75, and 2215.50

Downside trades on S&P 500 futures – Two options for entry

Failed retest of resistance level – 2210.25

Failed retest of support level – 2202.25 (watch 2199.50 for potential buying support)

Opening targets ranges: 2208.5, 2204.75, 2200.75, 2199.50, 2197.25, 2194.50, 2191.25, and 2187.50

Nasdaq Futures

The NQ_F has been grinding sideways in a tighter range over the last two days. Support levels to watch today will be near 4830-4842. Resistance remains within the region from 4870.5 to 4880. Watch these edges on either side. If they break, we will be watching for a swift rejection, or we will certainly have expansion in the direction of the break. Volume continues to be light and momentum remains positive, but is not building. The NQ_F continues in its state of under performance.

Upside trades Nasdaq futures – Two options

Positive retest of continuation level – 4868

Positive retest of support level – 4844

Opening targets ranges: 4854.25, 4857.5, 4864.50, 4868.5, 4871.75, 4878.75, 4880, 4884.50, 4890.50, and 4894 to 4899 if we expand (very unlikely)

Downside trades on Nasdaq futures – Two options

Failed retest of resistance level – 4864.75

Failed retest of support level – 4853.75

Opening targets ranges: 4857.50, 4852.25, 4848.75, 4842.75, and 4837.50

Crude Oil

The WTI contract continued to give back gains until testing 45.14 as support. This should hold as support unless news drags on the weight of price sending us close to 44.4 support zones. Failure to recapture 47.4 in the bounce that is currently afoot, we are likely to see the targets below near 46.4, and perhaps all the way to 44.4. Resistance rests between 47.4 and 48.38.

Upside Trades on Crude Oil – Two options

Positive retest of continuation level -47.46

Positive retest of support level– 45.94

Opening targets ranges for non-members -46.34, 46.78, 47.10, 47.4, 47.70, 48.3, 48.54, 48.74, 48.94, and 49.14

Downside Trades on Crude Oil – Two options

Failed retest of resistance level -47.37

Failed retest of support level– 46.4

Opening targets ranges for non-members –47.21, 46.92, 46.77, 46.46, 45.95, 45.64, 45.36, and 44.79 if we fail to recover the low test of the morning.

If you’re interested in watching these trades go live, join us in the live trading room from 9am to 11:30am each trading day.

Visit TheTradingBook for more information.

If you’re interested in the live trading room, it is now primarily stock market futures content, though we do track heavily traded stocks and their likely daily trajectories as well – we begin at 9am with a morning report and likely chart movements along with trade setups for the day.

As long as the trader keeps himself aware of support and resistance levels, risk can be very adequately managed to play in either direction as bottom picking remains a behavior pattern that is developing with value buyers and speculative traders.

Twitter: @AnneMarieTrades

The author trades stock market futures every day and may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.