Stock Market Futures Trading Considerations For May 1, 2017

It should be an interesting week with the Federal Reserve on tap and the French elections on Sunday. The S&P 500 (INDEXSP:.INX) has been consolidating recent gains and is showing mixed momentum into today. The Nasdaq (INDEXNASDAQ:.IXIC) has been leading the market higher but is stretched.

Check out today’s economic calendar with a full rundown of releases. And note that the charts below are from our premium service at The Trading Book and are shared exclusively with See It Market readers.

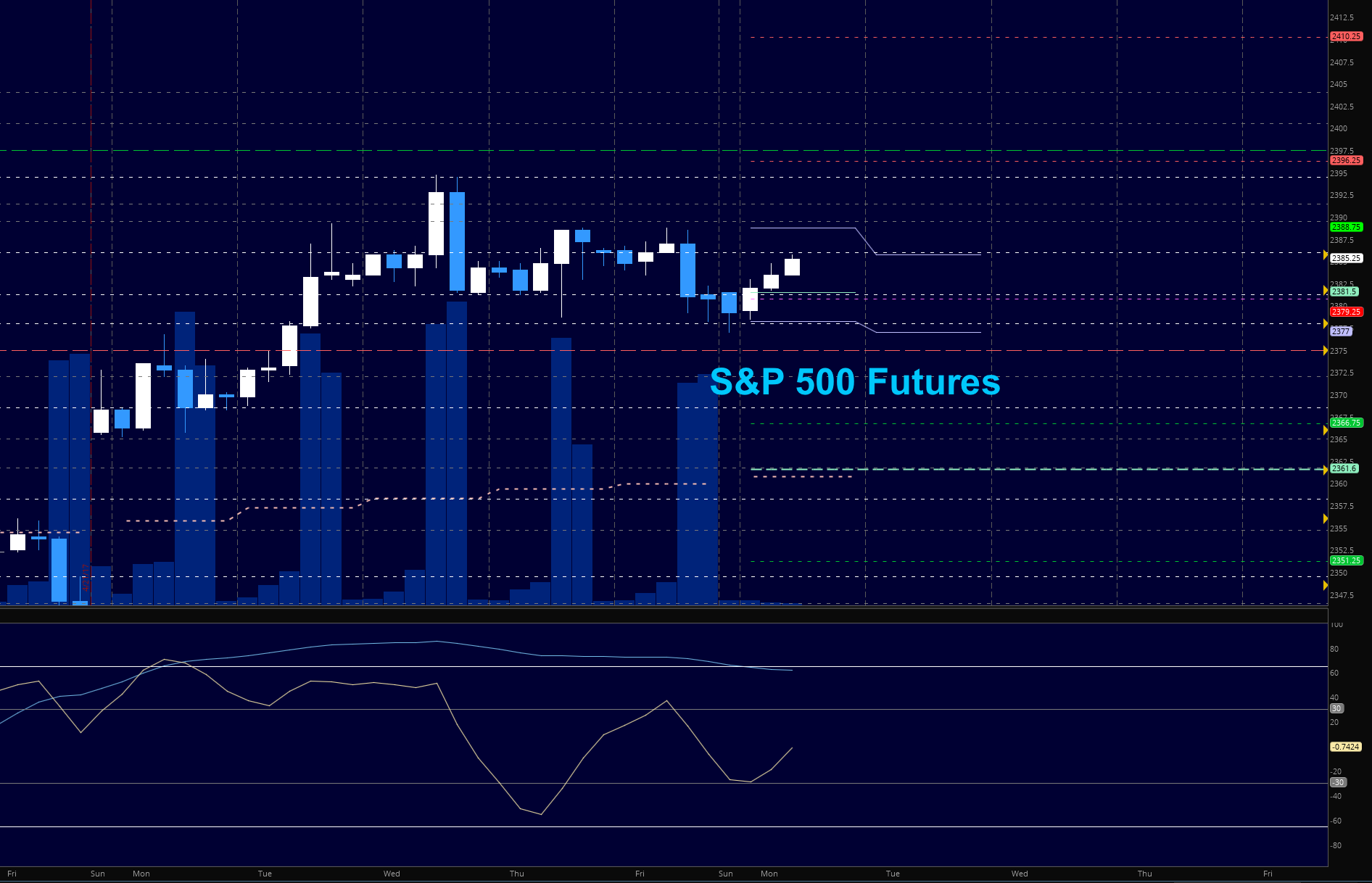

S&P 500 Futures (ES)

We begin the morning just below a breakout level of 2386. If we recapture this area, it may be a sign that buyers are willing to enter again at value areas. Momentum remains mixed today with deeper support still finding buyers. The level 2381 holds as support with 2378 just below- resistance sits just below 2392.

- Buying pressure intraday will likely strengthen above a positive retest of 2389.25 (careful here as sellers will try to push them down)

- Selling pressure intraday will likely strengthen with a failed retest of 2380.5

- Resistance sits near 2389.25 to 2392.25, with 2394.5 and 2397.75 above that

- Support holds between 2380.5 and 2377.5, with 2374.75 and 2365.5 below that

NASDAQ Futures (NQ)

A potential double topping formation on the Nasdaq Futures is nearing support.Pullbacks will continue to find buying support at the first pass. What is important is that we do not step in front of the trade, but allow big money to position itself, then we follow along. Failure to hold the highs, or the break of 5570, could signal a bigger move of sellers into the trade.

- Buying pressure intraday will likely strengthen with a positive retest of 5599.75 – watch your size as this could be resistance

- Selling pressure intraday will likely strengthen with a failed retest of 5580

- Resistance sits near 5599.75 to 5615.5, with 5634.25 and 5643.38 above that

- Support holds between 5592.25 and 5580.25, with 5574.75 and 5562.5 below that

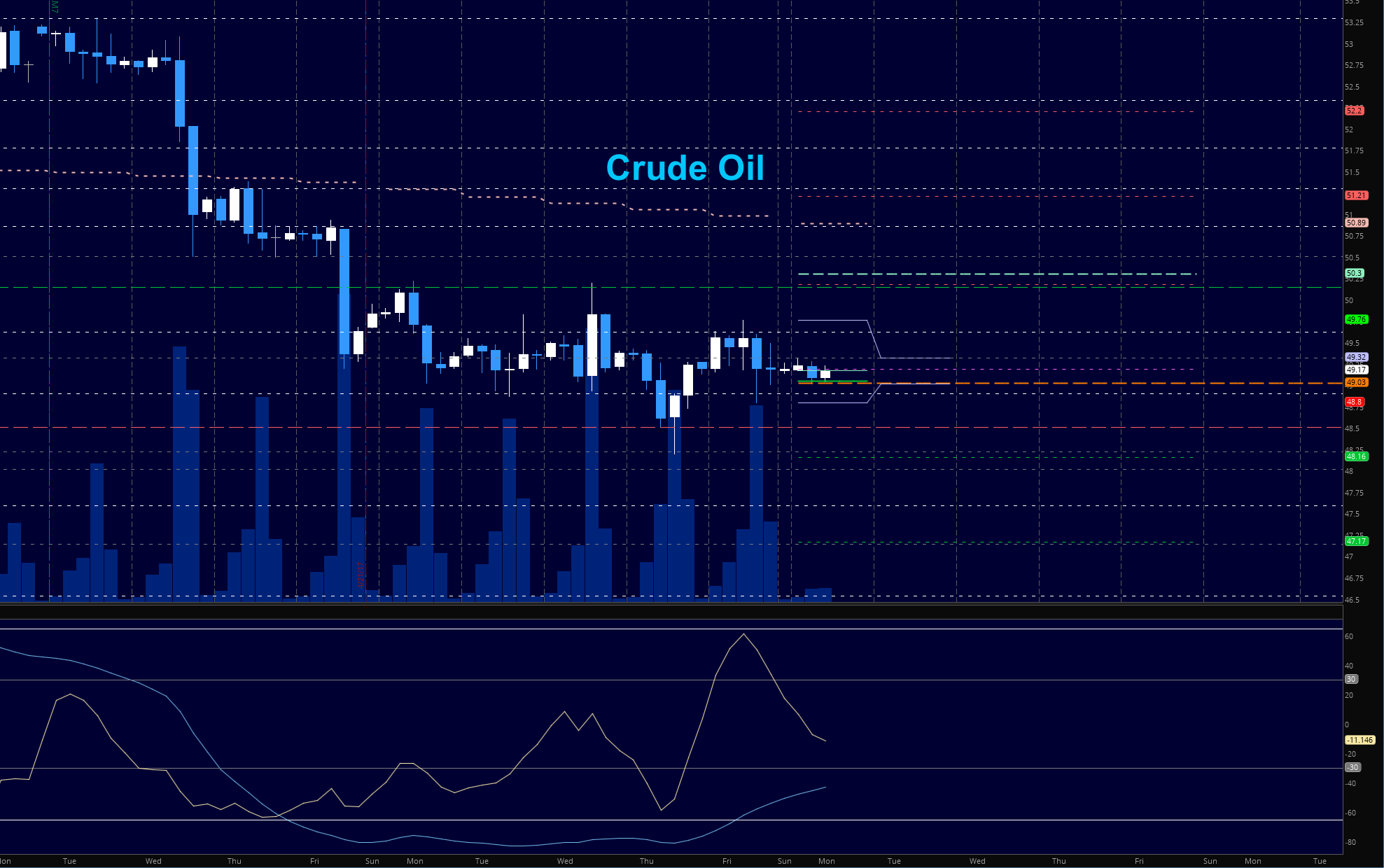

CRUDE OIL – WTI

The battle royale continues at monthly support levels near 49.1 for yet another day, with sellers presenting strongly near 49.6. Early morning sellers have drawn the line near 49.32. This will be the buy zone if the charts can breach and hold but momentum suggests that moves of consequence will not hold – Shaking out of weak hands in either direction will be the order of the day – for the fifth day in a row.

- Buying pressure intraday will likely strengthen with a positive retest of 49.62

- Selling pressure intraday will strengthen with a failed retest of 48.7 (note that even if it loses this level they will try to press price back to test the level)

- Resistance sits near 49.62 to 50.2, with 50.78 and 51.34 above that.

- Support holds between 48.86 and 48.53, with 48.16 and 48.02 below that.

If you’re interested in watching these trades go live, join us in the live trading room from 9am to 11:30am each trading day. Visit TheTradingBook for more information.

Our live trading room is now primarily stock market futures content, though we do track heavily traded stocks and their likely daily trajectories as well – we begin at 9am with a morning report and likely chart movements along with trade setups for the day.

As long as the trader keeps himself aware of support and resistance levels, risk can be very adequately managed to play in either direction as bottom picking remains a behavior pattern that is developing with value buyers and speculative traders.

Twitter: @AnneMarieTrades

The author trades stock market futures every day and may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.