Stock Market Considerations For April 28, 2017

The S&P 500 (INDEXSP:.INX) is showing a somewhat muted reaction to the GDP release. On S&P 500 futures, 2394.75 holds as primary resistance with 2389.25 just below. Thus far, we have seen willing buyers at value areas below (see more levels in trading commentary). Momentum remains mixed today.

Check out today’s economic calendar with a full rundown of releases. And note that the charts below are from our premium service at The Trading Book and are shared exclusively with See It Market readers.

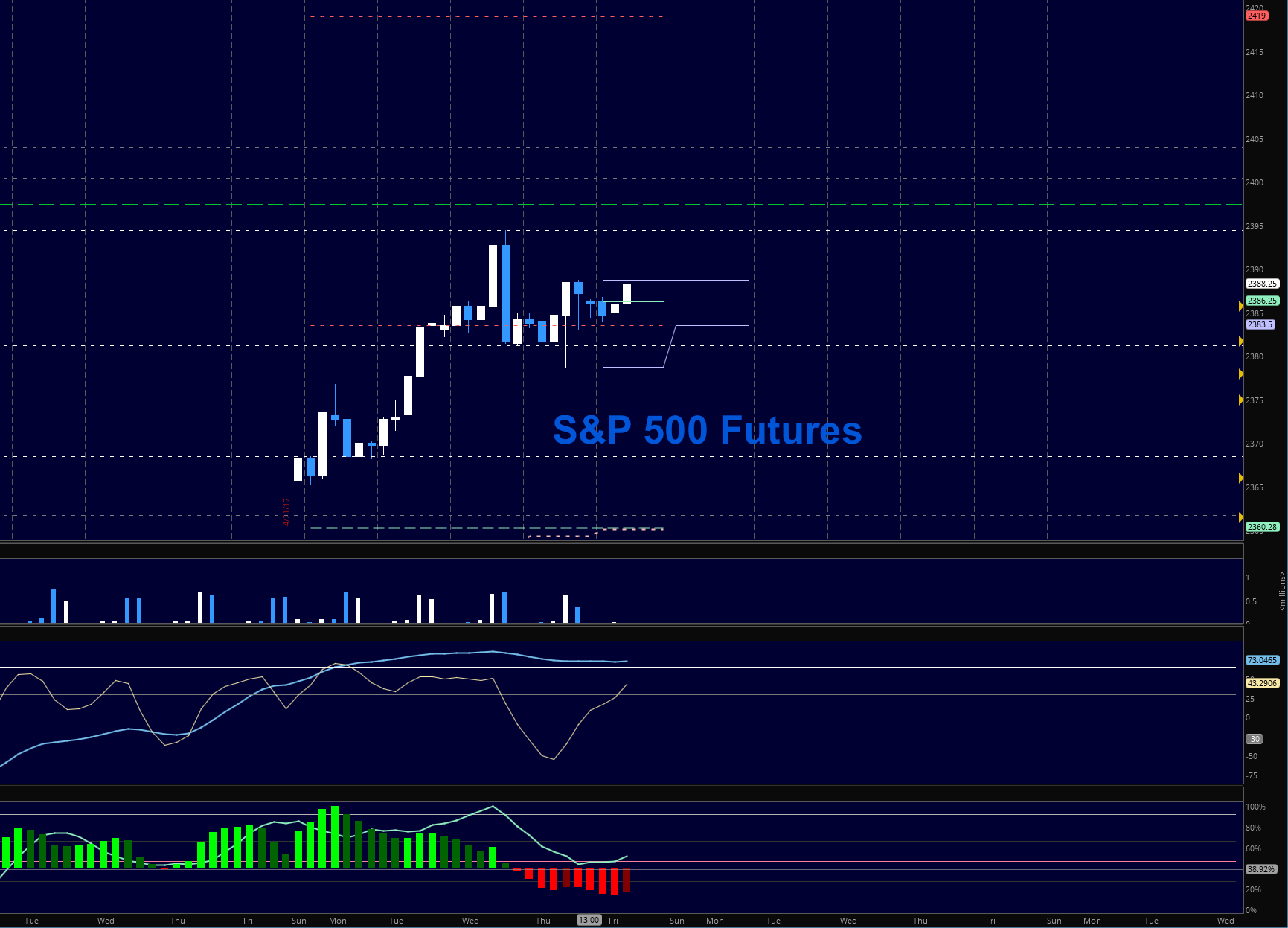

S&P 500 Futures (ES_F)

Momentum is mixed and volatility suggests a congested sideways day ahead with the likelihood of spikes in either direction – 2381 holds as support with 2378 just below

- Buying pressure intraday will likely strengthen above a positive retest of 2389.25 (careful here as sellers will try to push them down)

- Selling pressure intraday will likely strengthen with a failed retest of 2380.5

- Resistance sits near 2389.25 to 2392.25, with 2394.5 and 2397.75 above that

- Support holds between 2380.5 and 2377.5, with 2374.75 and 2365.5 below that

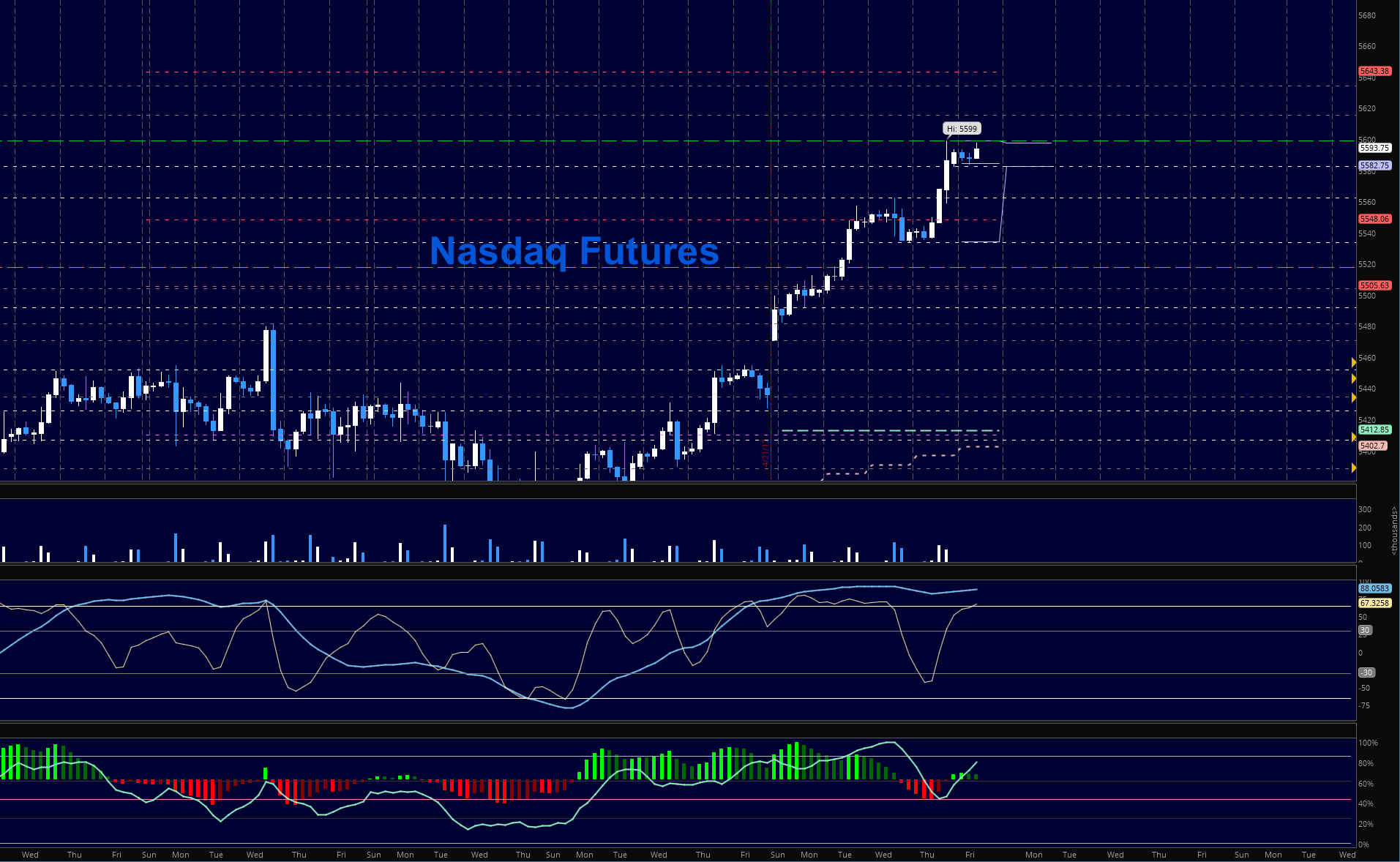

NASDAQ Futures (NQ_F)

New highs after hours with the reporting of powerhouses in the the NQ_F hold us ready to gap well above the close of the prior day with lots of bullish momentum ready to trade. This is a very big move in a short period of time so we should be approaching exhaustion. Pullbacks will continue to find buying support but as I have mentioned, a potential topping formation could be on the horizon. What is important is that we do not step in front of the trade, but allow big money to position, then we follow along. Pullbacks will find buyers at the first pass.

- Buying pressure intraday will likely strengthen with a positive retest of 5599.75 – watch your size as this could be resistance

- Selling pressure intraday will likely strengthen with a failed retest of 5582

- Resistance sits near 5599.75 to 5615.5, with 5634.25 and 5643.38 above that

- Support holds between 5592.25 and 5582.25, with 5574.75 and 5562.5 below that

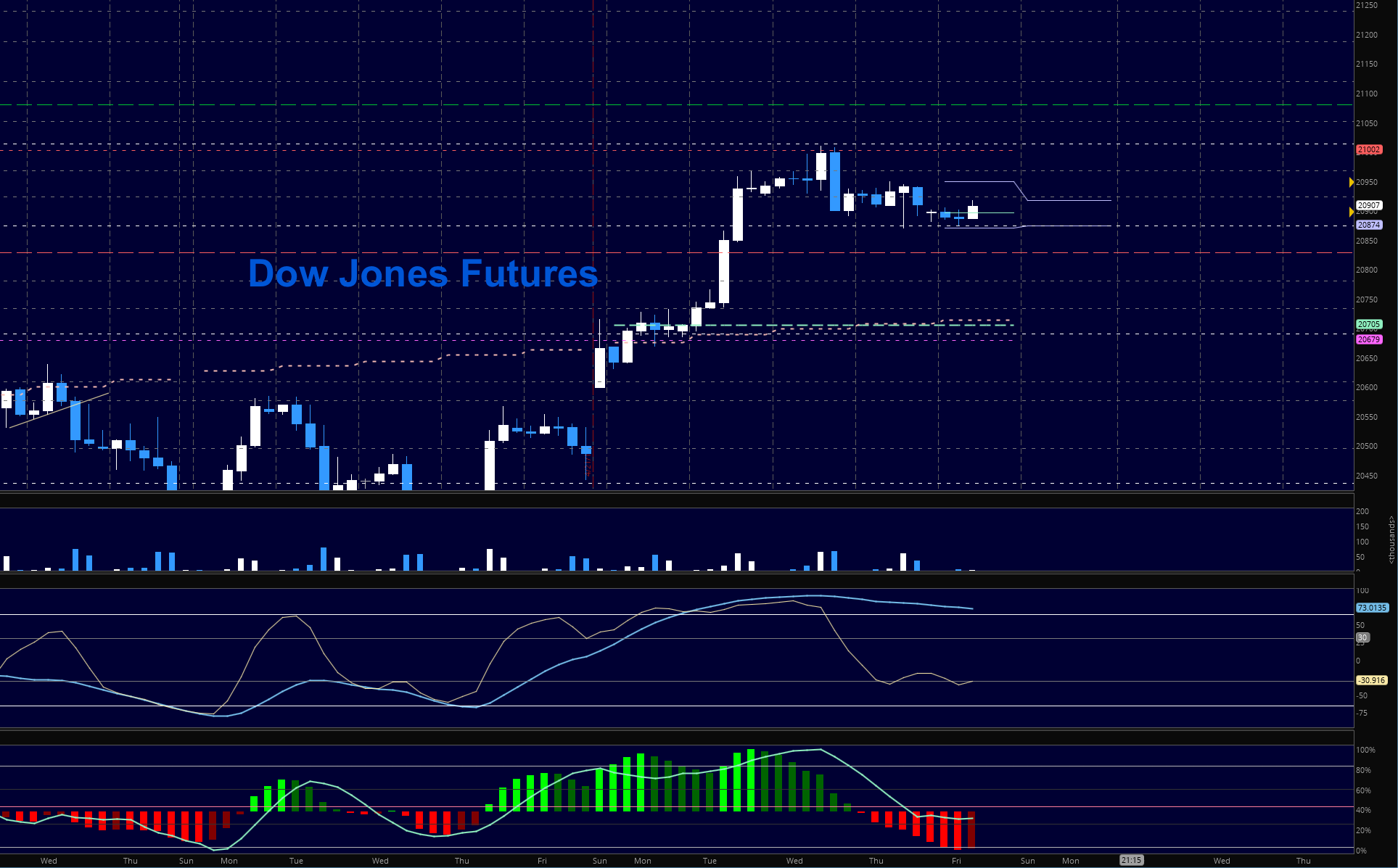

Mini DJIA Futures (YM_F)

A drift has appeared in the DJIA that does not seem as apparent in the other futures, so I’ll be keeping an eye on this one. Pullbacks are still finding buyers but resistance continues to press lower. Buyers will hold power above 20870, but as momentum intraday continues to look mixed, big moves in either direction are likely to retrace- just as they did much of the day yesterday. Key support is now near 20870-20830 with resistance near 20950 to 20970.

- Buying pressure intraday will likely strengthen above a positive retest of 20975

- Selling pressure intraday will likely strengthen with a failed retest of 20870

- Resistance sits near 21013 to 21052, with 21081 and 21188 above that

- Support holds between 20870 and 20830, with 20780 and 20736 below that

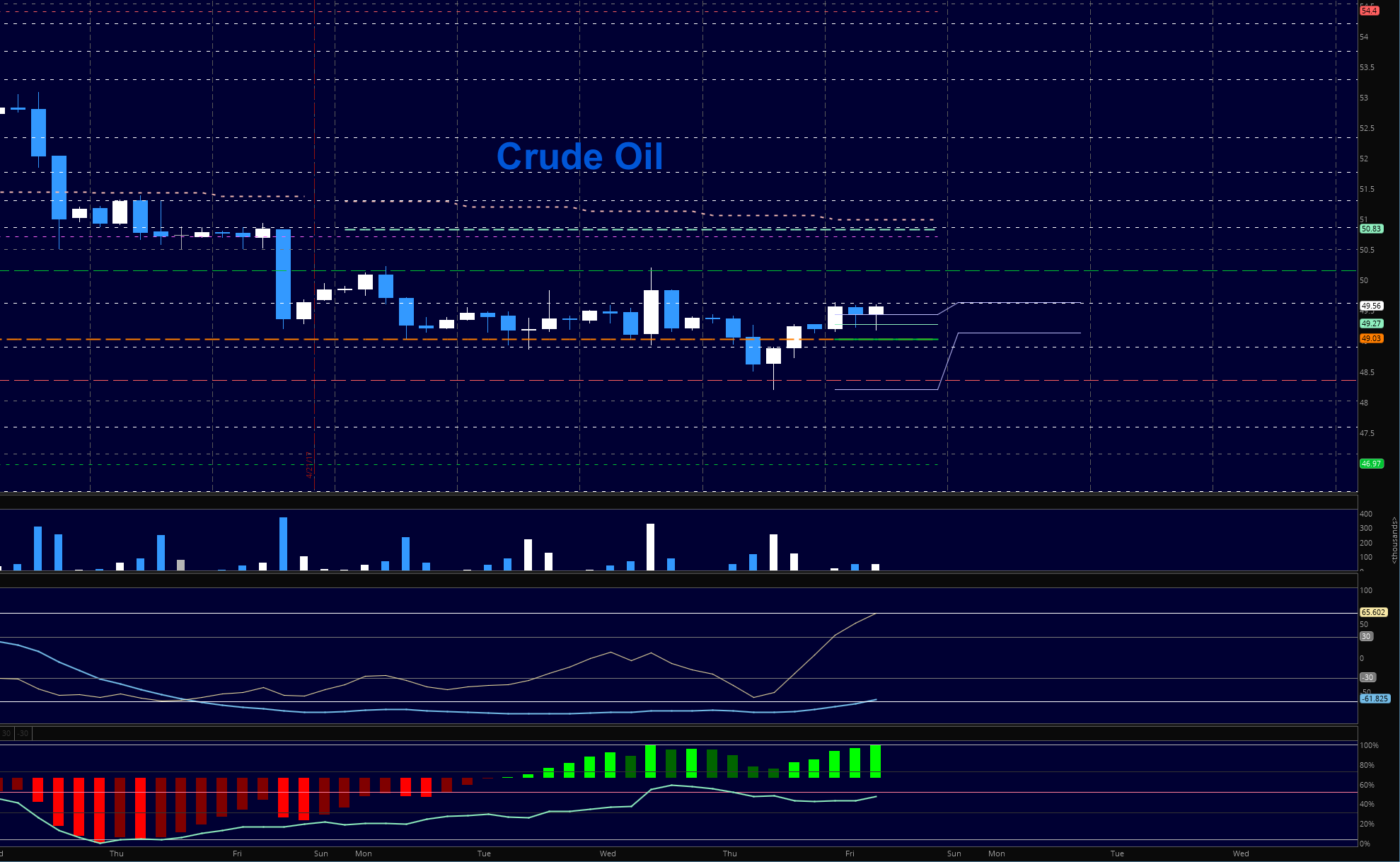

Crude Oil –WTI

The battle royale wages at monthly support levels near 49.1 for yet another day, with buyers showing more courage and will to push price above 49.6 and hold. This will be the buy zone if the charts can maintain power – Shaking out of weak hands in either direction will be the order of the day

- Buying pressure intraday will likely strengthen with a positive retest of 49.6

- Selling pressure intraday will strengthen with a failed retest of 48.9 (note that even if it loses this level they will try to press price back to test the level)

- Resistance sits near 49.59 to 50.2, with 50.78 and 51.34 above that.

- Support holds between 49.01 and 48.86, with 48.46 and 48.08 below that.

If you’re interested in watching these trades go live, join us in the live trading room from 9am to 11:30am each trading day. Visit TheTradingBook for more information.

Our live trading room is now primarily stock market futures content, though we do track heavily traded stocks and their likely daily trajectories as well – we begin at 9am with a morning report and likely chart movements along with trade setups for the day.

As long as the trader keeps himself aware of support and resistance levels, risk can be very adequately managed to play in either direction as bottom picking remains a behavior pattern that is developing with value buyers and speculative traders.

Twitter: @AnneMarieTrades

The author trades stock market futures every day and may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.