Broad Stock Market Outlook for March 20, 2018

If you had watched the support zones yesterday, you did well with the breakaway short formations that came into play.

We must watch support again carefully today as buyers are not as enthusiastic as they have been in times past. Important resistance sits ahead and the quiet hours here need to see buying strength, or we’ll have another tumble on our hands.

S&P 500 Futures

Support is lower again -first near 2715 and then again near 2701 as lower highs continue to present themselves. We are clearly developing different patterns than seen over the last six months but volatility intraday keeps traders guessing as they manage risk and stops. We sit in bearish patterns but at key support. First pass bounces should fade. The bullets below represent the likely shift of trading momentum at the positive or failed retests at the levels noted.

- Buying pressure intraday will likely strengthen with a bullish retest of 2731.5

- Selling pressure intraday will likely strengthen with a bearish retest of 2715

- Resistance sits near 2736.5 to 2746.5, with 2754.75 and 2767.75 above that.

- Support sits between 2721.75 and 2715.75, with 2702.5 and 2688.50.

NASDAQ Futures

Slow recovery here and now testing old support near 6920. We saw failed retests that took us below 6827. We will need to recover 6935 and hold there before making any further moves north. Buyers are doing their best but formidable resistance lies ahead. The bullets below represent the likely shift of intraday trading momentum at the positive or failed tests at the levels noted.

- Buying pressure intraday will likely strengthen with a bullish retest of 6935

- Selling pressure intraday will likely strengthen with a bearish retest of 6906.50

- Resistance sits near 6927.5 to 6948 with 6978.5 and 7006.5 above that.

- Support sits between 6950.5 and 6940.75, with 6928.75 and 6878.75 below that.

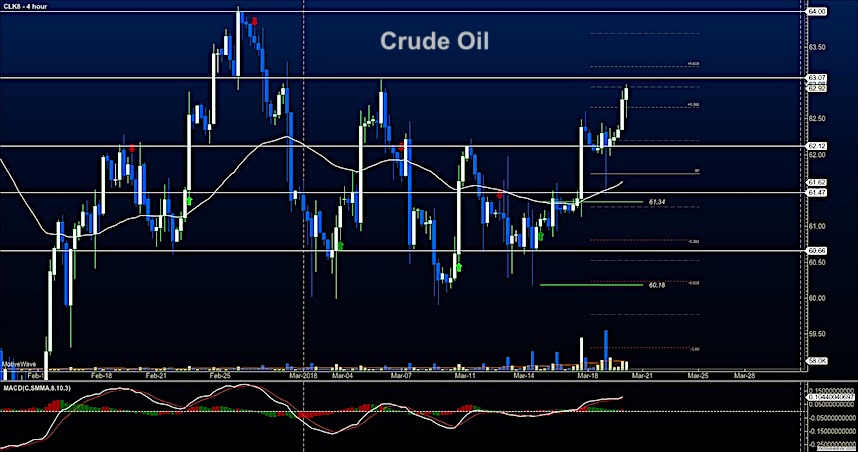

WTI Crude Oil

We approach the top of that trading range as traders have pushed us to the edge of 63. Momentum suggests that pullbacks will be buying zones with higher support showing near 62.45. The bullets below represent the likely shift of intraday trading momentum at the positive or failed tests at the levels noted.

- Buying pressure intraday will likely strengthen with a bullish retest of 63.14

- Selling pressure intraday will strengthen with a bearish retest of 62.4

- Resistance sits near 62.96 to 63.13, with 63.42 and 64.05 above that.

- Support holds near 62.4 to 62.12, with 61.87 and 61.55 below that.

Twitter: @AnneMarieTrades

The author trades stock market futures every day and may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.