“Don’t Fight the Fed” echoes through the financial media, Wall Street, and in the minds of retail and institutional investors. The phrasing pertaining to Fed-generated liquidity is often the sole basis for investors to chase bull markets when the Fed employs easy monetary policy.

Unfortunately, some investors forget the phrase is equally meaningful when the Fed is not friendly to markets. As we share in this article, we have developed a model to track Fed liquidity, allowing us to quantify the Fed’s influence on the S&P 500.

Before unveiling our liquidity formula and its forecast for the S&P 500, it’s essential to discuss the three primary drivers by which the Fed is influencing liquidity: Reverse Repurchase (RRP), Treasury General Account (TGA), and the Fed’s balance sheet.

Reverse Repurchase Agreements (RRP)

The New York Fed uses numerous repo programs to manage the supply of cash in the banking system, thereby maintaining the Fed Funds rates within the FOMC’s target range. Currently, they are employing its RRP program to accomplish this task. In an RRP transaction, the Fed sells securities to a counterparty and simultaneously agrees to repurchase them at a future date. The duration is often overnight. The transaction temporarily reduces the supply of money from the banking system. Increasing daily RRP balances results in less system liquidity, and a declining balance reduces liquidity.

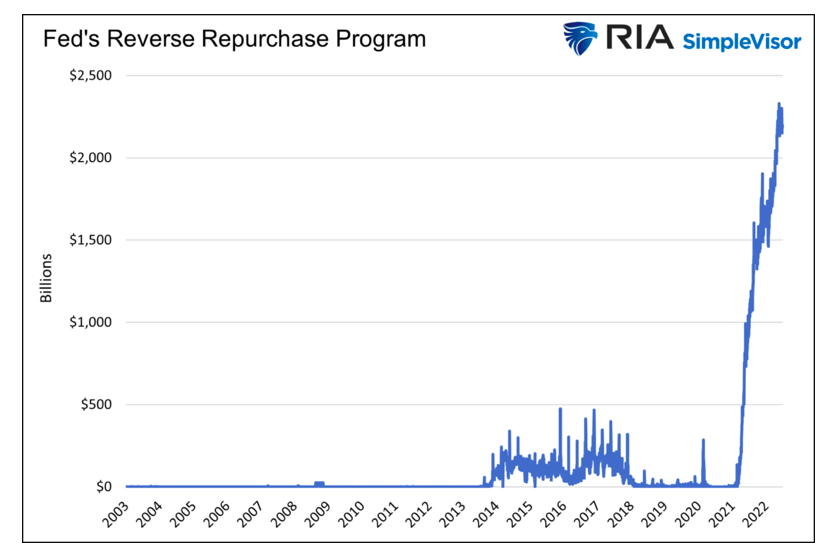

As shown below, RRP has been around for 20 years but was scarcely used until early 2021. The various pandemic-related rounds of fiscal stimulus and massive Fed liquidity efforts left banks and money market funds with excessive levels of cash. The excess liquidity would have pushed the Fed Funds rate lower than the target rate without the RRP program. As such, RRP sucks up liquidity, making Fed Funds easier for the Fed to manage.

The Fed has other repo tools, such as repurchase agreements and the standing repo facility, which can dampen money market rates by providing the banking system with liquidity.

The RRP facility has been increasing rapidly and now sits at over $2 trillion daily. Rising RRP balances are a drain on liquidity.

As money market yields rise with Fed Funds and asset markets perform poorly, investors tend to prefer higher cash balances. Such should keep RRP levels elevated for the time being.

Treasury General Account (TGA)

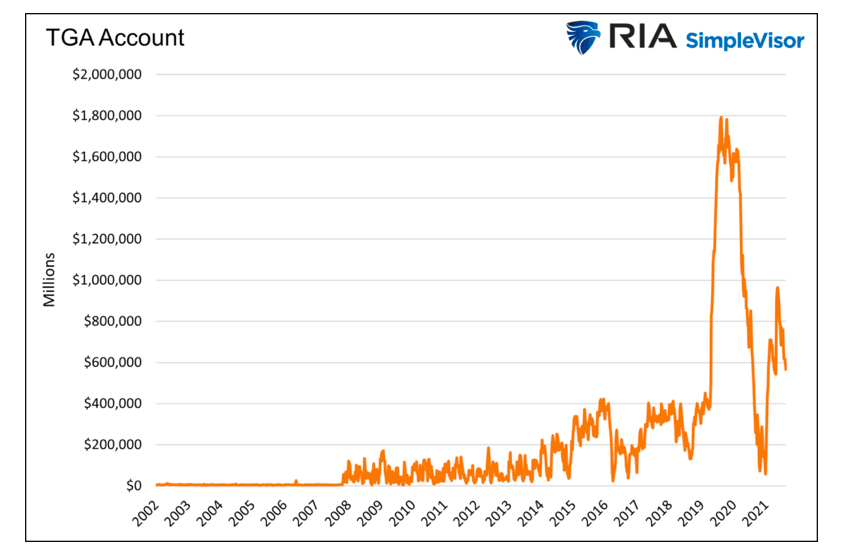

The Treasury General Account is the U.S. Treasury Department’s checking account. The account is held at the Federal Reserve Bank of New York. Like your checking account, the TGA receives deposits (tax receipts and proceeds from debt issuance) and makes payments.

The Fed doesn’t manage the TGA balances, but the surplus cash balance held at the Fed affects banking system liquidity. Fed liabilities (bank reserves) must equal its assets. Bank reserves are fodder allowing banks to make loans and, by default, print money. When the TGA account increases, bank reserves must fall, reducing banking system liquidity. Conversely, a shrinking TGA account adds reserves and liquidity to the banking system.

The graph below shows that TGA balances are elevated versus the pre-pandemic years but have fallen as the banking system normalizes from the massive fiscal cash injections. It will likely drop a bit more, but the TGA will not significantly impact liquidity, barring unusual circumstances.

Fed Balance Sheet

The Fed’s assets, mainly Treasury bonds and Mortgage-Backed Securities (MBS), are the liquidity elephant in the room. Its assets currently account for 75% of total Fed-sponsored liquidity and historically average over 90%.

When the Fed does Quantitative Easing (QE), they remove securities from the bond markets and, in their place, leaves reserves with the banks. Again, bank reserves can lead to loan creation which is the creation of new money. Ergo, QE adds to the system’s liquidity. Conversely, Quantitative Tightening (QT) removes liquidity and reserves from the system and increases the amount of securities in the market.

For this reason, QE tends to be bullish for stocks, and QT is bearish.

Liquidity and Stock Prices

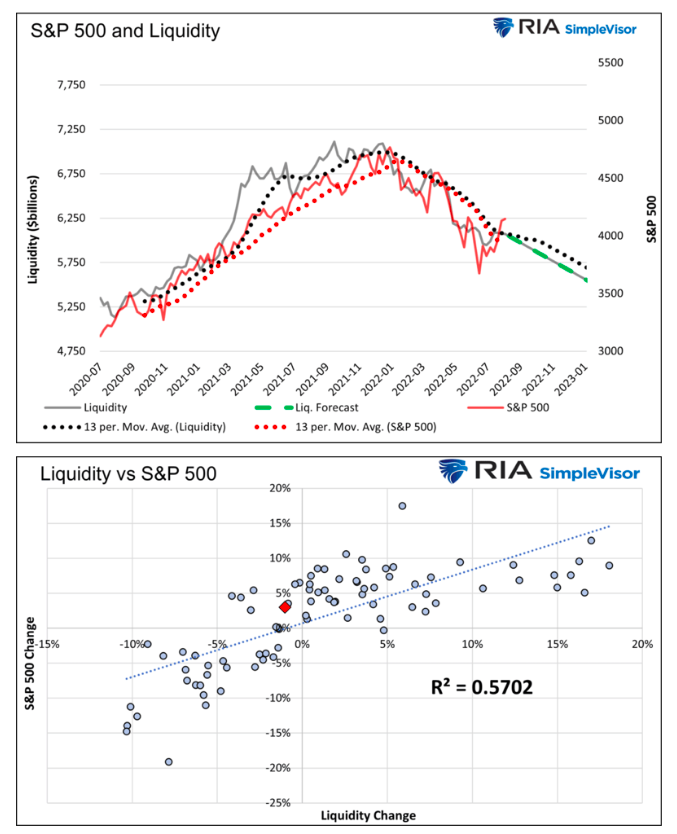

With an understanding of the three key factors driving banking system liquidity, we can create a Fed liquidity model. The size of the Fed’s assets less the sum of the TGA and RRP equals the amount of Fed-generated liquidity in the system. Recent changes in net liquidity shed light on how the S&P 500 trends.

The two graphs below compare the liquidity measure and the S&P 500. The first graph shows how the S&P 500 rose in line with liquidity through 2021, and both reversed simultaneously to start 2022. The dotted lines are quarterly moving averages to help smooth out the data. The moving averages track each other almost perfectly this year. The green dashed line forecasts liquidity based solely on the Fed’s plan to reduce its balance sheet by $95 billion a month. The S&P 500 could be close to 3500 by year-end if they follow through with their QT plans and the correlation holds up.

The second graph shares the same data but in scatter plot form. The correlation between liquidity and the S&P 500 is statistically significant, with an R-squared of 0.57. The orange dot shows the S&P 500 is about 3% overpriced based on liquidity.

The model does have an important caveat. Other factors become the predominant driver of market returns when the Fed is inactive and liquidity is relatively stable.

Summary

The Fed is not the only game in town, but they are the biggest game in town. While many other factors account for stock price performance, liquidity may be the most important to grasp.

To drive home this point, recall March 2020, when covid struck the economy. Global economies were shutting down worldwide. Unemployment was soaring, and the economy was careening toward a depression. Despite zero clarity on the economic future, stocks began to rally strongly in late March. Why? Liquidity via fiscal stimulus and a surge in Fed QE purchases drove markets higher. The economic situation was awful, and earnings outlooks were crumbling, but liquidity trumped fundamentals.

By accepting what the Fed does, right or wrong, and closely following its actions, we can quantify how liquidity will steer markets. On top of fundamental and technical analysis, this additional layer of research helps us better navigate the market’s twists, turns, and trends when the Fed is active.

Twitter: @michaellebowitz

The author or his firm may have positions in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.