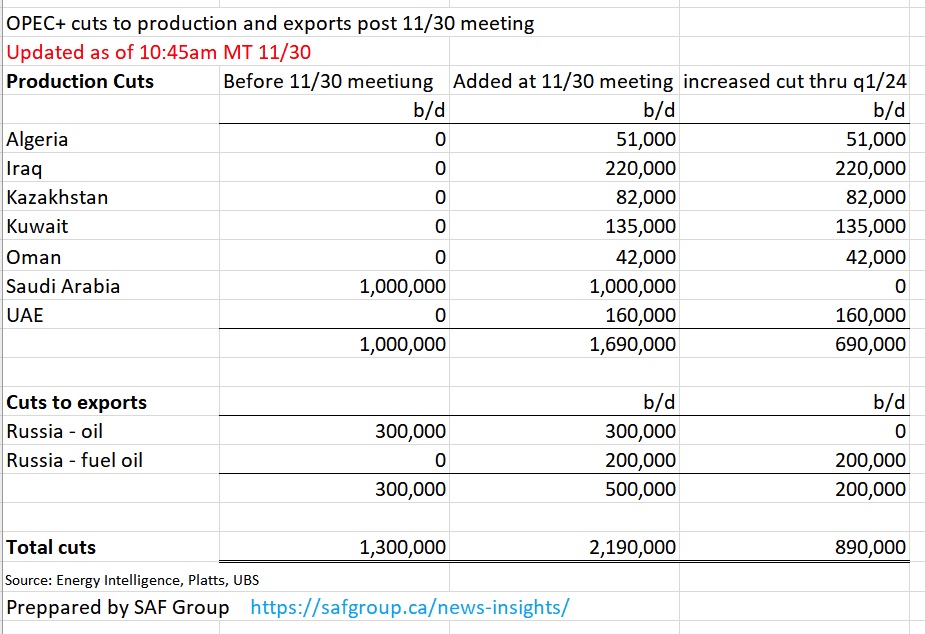

Despite the total cuts by all countries added at the November 30th OPEC+ meeting, oil sold off testing key support.

Countries like Angola have threatened not to stick to the new quota, promising to produce above target.

Meanwhile, Brazil confirmed it will join OPEC+. That means that some of the pressure by non-OPEC producing countries offsetting the cuts is now somewhat mitigated.

Nonetheless, the question is once the dust settles, will these 2.2 million barrels a day cuts hurt supply?

Furthermore, in a story by Consumer Reports, they wrote, EVs are less reliable than conventional vehicles, having nearly 80% more problems and are generally less reliable than cars propelled by conventional internal combustion engines.”

That could certainly help drive demand towards gas-fueled cars or at least hybrids.

The real question is though, what does price tell us?

Looking at WTI crude oil, $75 is a great line on the sand for support.

$80 is the resistance to clear.

The best we can say after today’s action is oil is ranging and trying to figure out next moves.

The monthly chart which will change tomorrow December 1, shows price sitting right on both the 23 and 80-month moving averages.

70.43 in the US Oil Fund ETF USO is a good near-term point to hold to make the case for more upside.

We begin December above that level, good.

And if USO gets and holds above 73 even better.

With weaker global economic expectations keeping prices under pressure, oil in general seems vulnerable to any wild shift in price and very much headline dependent.

Twitter: @marketminute

The author may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author and do not represent the views or opinions of any other person or entity.