Looks like the stock market rally is back on – last week markets surged to within a few percent of all-time highs.

A turbulent August has led to what seems like a back-to-school rally into September.

We don’t know if markets will make new highs, how high they could go, or even if the planned trade meeting between China and the U.S. in October will solve all of the world’s woes (it won’t).

What we do know is that the fall period and September stock market seasonality tends to be one with elevated volatility.

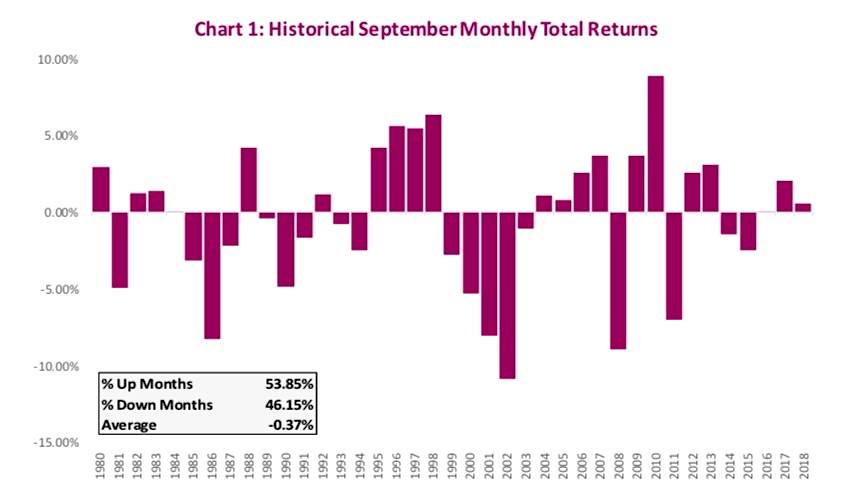

As well, if you believe in the seasonality of equity markets, this is the time of year to be a tad more cautious. September has a reputation as a volatile month. Looking back to 1980, September stock market seasonality produced an average loss of 0.37%, and was positive 54% of the time.

Yes, history has not been kind to September but, as the chart below illustrates, there’s more to these numbers.

The chart, which plots the return for each September from 1980 to 2018, shows the average is negative; but averages can be misleading, hiding many important details. Between some of the big drawdowns coinciding with bear markets, September has had some decent displays; however, the swings are bigger than other months, elevating volatility.

Clearly, something else must be up.

Cycle analysis

Seasonal investing and cycle analysis have been around for a long time. Humans generally have a natural inclination to find patterns (even if they are not there) and the stock market is a prime example.

Time is an important consideration; it’s represented on the horizontal axis on almost every stock chart.

In fact, time, price and volume are the key dimensions, alongside psychology, that determine trends in the stock market. Prices tend to move in periodic fluctuations known as cycles. These cycles can last days to decades, and at any one time there is always more than one cycle operating simultaneously.

Stocks don’t care what month it is, but the investment industry follows a calendar that is influenced by habitual human and cultural behavior.

continue reading on the next page…