I was intrigued to see both Barron’s and the Wall Street Journal touting the “return of value” in recent days.

More interesting than the headlines themselves were the somewhat skeptical quotes that accompanied them.

“Value investors haven’t been wandering in the wilderness for 40 years, but it’s starting to feel that way,” wrote Jason Zweig before driving home the fact that over the long term, cheaper stocks have consistently outperformed.

While that is the case over the long term, in recent years we’ve actually seen growth produce stronger gains. Barron’s pointed out that for the last twelve years, growth stocks have seen almost double the returns of value stocks on a total return basis.

Of course, it’s rarely a good idea to bet against a certain phenomenon simply because it’s been in place for a certain period of time.

I distinctly remember being informed many times during the last seven years that the bull market was “fairly extended.”

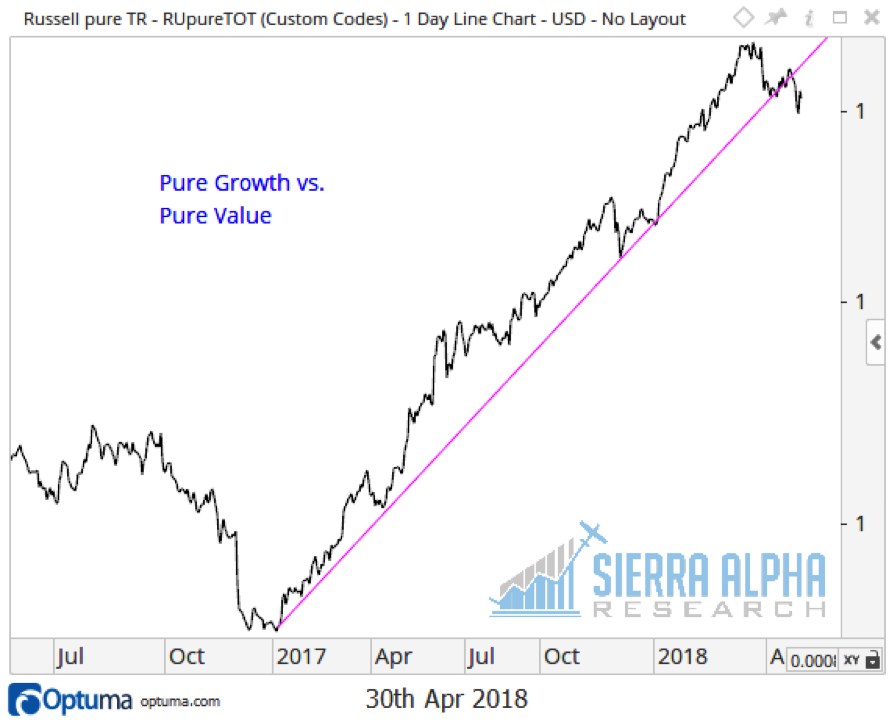

I become much more convinced that a market is changing direction when I actually see proof of the reversal on the charts. When I saw this breakdown on the growth vs. value chart over the last couple weeks, that was when I started to believe that a transition was indeed taking place.

It’s worth noting that there are many caveats to considering growth vs. value.

First off, the most commonly followed indices are the Russell Growth Index and Russell Value Index. While these are fine overall proxies for the performance of growth and value stocks, it’s worth noting that these are not exclusive indexes. That is, a stock like Microsoft (MSFT) is a member of both the growth index and the value index.

Russell and S&P both have Pure Growth and Pure Value indexes which eliminate this “double counting” issue.

Secondly, I would use total return indices if you can. Dividends are often a big driver of performance, particularly with value stocks. If you only look at the price of the stocks and ignore the dividends, you’re going to underrepresent the impact of many value names in your portfolio.

Finally, when you’re looking at a broad index following growth or value, remember that you’re also dealing with exposure to certain sectors. The Russell 1000 Growth ETF ($IWF) has about a 39% weight in technology names, while the Russell 1000 Value ETF ($IWD) has a 32% weight in financial stocks.

What’s next for value stocks? Honestly, no one really knows. Being aware of a potential transition to value and then pursuing a deeper understanding of the implications of this transition are what will separate informed investors from confused investors.

Note that you can gain deeper insights and more meaningful analysis from me over at Sierra Alpha Research. Thanks for reading.

RR#6,

Dave

Twitter: @DKellerCMT

The author does not have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.