The following research was contributed to by Christine Short, VP of Research at Wall Street Horizon.

Key Takeaways:

- Home Depot, Macy’s and Lowe’s all beat expectations last week, while ecommerce still lags with disappointing results from Wayfair and eBay

- Not many S&P 500 companies are mentioning the Russia-Ukraine Conflict at this point, expect more comments next quarter as it could exacerbate record high inflation

- Despite headwinds, consumer spending still looks healthy

- Potential surprises this week: Hormel Foods, CarParts.com

- Q4 peak earnings season is over, last few names trickle in over the coming weeks

Despite impressive results from a number of retailers last week, many of those names initially got caught up in the geopolitical sell-off as Russia’s invasion of Ukraine consumed investors, only to close higher by the end of the week. Home Depot, Macy’s, Lowe’s put up better than expected results, while TJ Maxx and Wayfair missed analyst expectations, and eBay guided lower for the year.

How S&P 500 Companies are Talking about the Russia – Ukraine Conflict

According to FactSet, only 18 S&P 500 companies have mentioned Ukraine on Q4 calls. There were more mentions in 2014 during the Russo-Ukrainian war as Russia annexed Crimea, but that may change once Q1 reports roll around. Thus far the sectors with the most mentions include Energy (Halliburton, Marathon Petroleum, Pioneer Natural Resources), Industrials (Generac, General Dynamics, United Airlines, Wabtec Corp) and Materials (Ecolab, Ball Corp).

While the S&P 500 is only minimally exposed to Russia/Ukraine (only 1% of revenues come from the region), there are broader implications that a war in Europe will have on US companies and the global financial ecosystem. Inflation and higher costs were already the #1 concerns mentioned by executives on Q4 earnings calls, current geopolitical tensions will only exacerbate that. Oil prices in particular are of concern, as they will certainly rise and squeeze the US consumer.

Retail Roundup and the Health of the US Consumer

Despite current headwinds, the US consumer seems mostly intact at this point, although that could change at any moment as higher costs begin to take their toll.

Once again, however, sentiment readings seem at odds with how consumers are actually behaving. While the University of Michigan Consumer Sentiment reading for February was the lowest in a decade, Retail Sales for January grew to 3.8%, the best reading in 10 months.

Towards the end of the week investors seemed assured that the Russia-Ukraine crisis would deescalate after President Vladimir Putin agreed to send a delegation to negotiate with Ukraine, but if that isn’t the case consumers could be in for increased prices at the pump, grocery stores, and a hit to retirement accounts. That would of course mean discretionary spending would dwindle as consumers focus on staples; not good news for retailers.

This week we continue to see retail earnings report, with names like Target, Nordstrom and Ross Stores in focus.

Potential Surprises this Week

Hormel Foods (HRL)

Company Confirmed Report Date: Tuesday, March 1, BMO

Projected Report Date (based on historical data): Thursday, February 17

Z-Score: 3.45

Since 2007, Hormel has reported Q4 earnings results in a range from February 15 – 23, typically on a Tuesday or Thursday. As such we set a report date of February 17. On February 7 the company confirmed they would report on March 1, eight days later than we had anticipated based on their historical reporting range, suggesting there may be bad news shared on the upcoming call.

There’s no doubt consumer staples are feeling the squeeze of higher prices. Peers in the space also faced tough comparisons, with names like Conagra, Kellogg and Post Holdings all recording YoY profit losses.

CarParts.com (PRTS)

Company Confirmed Report Date: Tuesday, March 1, AMC

Projected Report Date (based on historical data): Monday, March 7

Z-Score: -3.31

For the last eight years CarParts.com has reported Q4 results during the second week of March (6th – 9th), with no day of the week trend. As such we set a report date of March 7. On February 8 the company confirmed they would report on March 1, a week earlier than we had anticipated, suggesting results for the quarter may surprise to the upside.

It’s no secret that autoparts companies are having a moment as the value of used cars have increased significantly due to supply-chain disruptions caused by the pandemic. As COVID infections recede, more people are using their vehicles, especially heading into the summer season, which should also help miles driven metrics. Peers such as Advance Auto Parts and O’Reilly Automotive handily beat Q4 expectations and posted double digit profit growth.

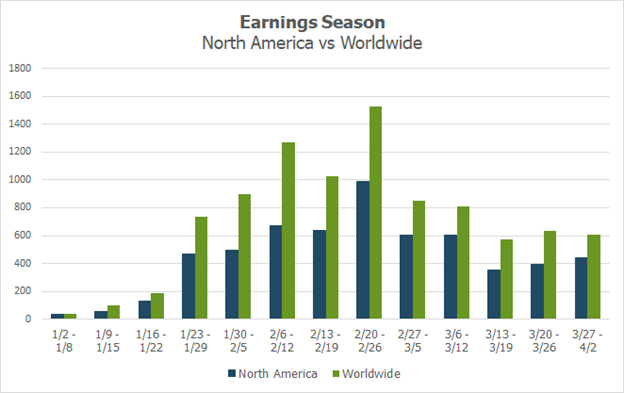

Earnings Season Coming to an End

Last week marked the final peak week of Q4 earnings season, with 95% of S&P 500 companies having reported. Over the next few weeks some stragglers will trickle in, with the Q1 season not scheduled to start until the week of April 11.

Graph data provided by Wall Street Horizon

For more information on the data sourced in this report, please email: info@wallstreethorizon.com

Wall Street Horizon provides institutional traders and investors with the most accurate and comprehensive forward-looking event data. Covering 9,000 companies worldwide, we offer more than 40 corporate event types via a range of delivery options from machine-readable files to API solutions to streaming feeds. By keeping clients apprised of critical market-moving events and event revisions, our data empowers financial professionals to take advantage of or avoid the ensuing volatility.

Christine Short, VP of Research at Wall Street Horizon, is focused on publishing research on Wall Street Horizon event data covering 9,000 global equities in the marketplace. Over the past 15 years in the financial data industry, her research has been widely featured in financial news outlets including regular appearances on networks such as CNBC and Fox to talk corporate earnings and the economy.