One month ago, on March 23, the stock market hit its lowest point since December 2016, down 34% from its all-time high on February 18.

Since that time it has retraced 27% of that loss.

The rally occurred during a global pandemic that brought a sudden stop to our economy along with dire economic forecasts and massive record unemployment.

The rise in investor optimism and the stock market rally can be attributed to confidence in the monetary and fiscal stimulus, pharmaceutical breakthroughs, several foreign economies successfully opening, metropolitan areas like New Orleans, Houston, and Detroit showing slower infection and mortality rates, and plans to reopen the economy.

However, companies in the S&P 500 Index are currently trading at 19.1 times their expected next 12-months earnings, which is above the five-year average and ten-year average (FactSet 4/24) and higher than the stock market peak in mid-February which was trading at 18.9 times forward earnings.

The current valuations seem to underestimate the threat of a deep decline in corporate earnings, the impact of high unemployment and the economic damage triggered by the pandemic. While we have never seen this kind of liquidity injected into our economic system, historically stocks generally do not go up during periods of declining earnings. Our economy will recover but expectations may have gotten ahead of tangible data.

The question continues to be how long will this virus be with us and when can all businesses reopen. The White House Coronavirus Task Force Coordinator said yesterday that social distancing measures will be a constant fixture through the summer. She said we need a significant breakthrough on testing to see who has had the virus, whether they can spread the virus or develop a second infection.

A positive economic forecast centers on the development of a virus vaccine and/or promising treatments. Additionally, we need to see a successful reopening of the economy state by state and a return to single-digit unemployment rates. These are things that the stock market cares about.

Generally, after a large pullback in the market, stocks rally and then retest their lows. Subsequently, a sustained move up in the market is almost always led by small-cap stocks. The current rally has been comprised mainly of the five largest stocks in the S&P 500, the FAANG stocks (Facebook, Amazon, Apple, Netflix, Google) and a few healthcare companies. This has been a large-cap rally and will stay a large-cap rally until we see a rotation into the cyclicals, small-caps, financials, industrials and materials which will show the economy coming out of the current recession.

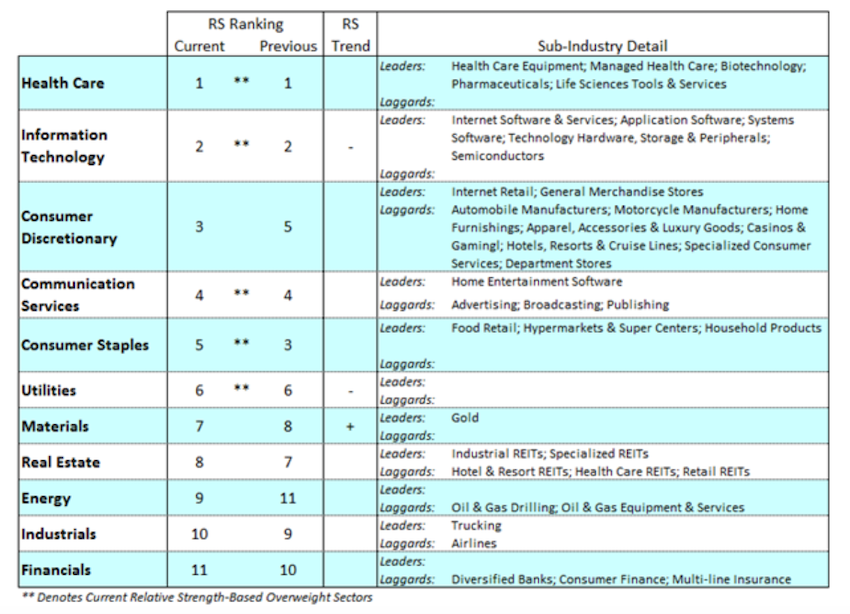

Meanwhile, the sectors that are performing well and should continue to perform are:

Technology – companies improve their IT structures to accommodate remote workers

Healthcare – more emphasis on treatments and testing

Consumer Staples – essential household products while we are sheltering in place

Communication Services – home entertainment software; remote work needs for data processing

The technical data has improved. The Federal Reserve continues to stimulate the economy. The breadth in the market is improving but this has yet to be confirmed by longer-term measures. Recent gains have removed oversold conditions with 42% of stocks in the S&P 500 now trading above their 50-day moving average from just 5% at the end of March.

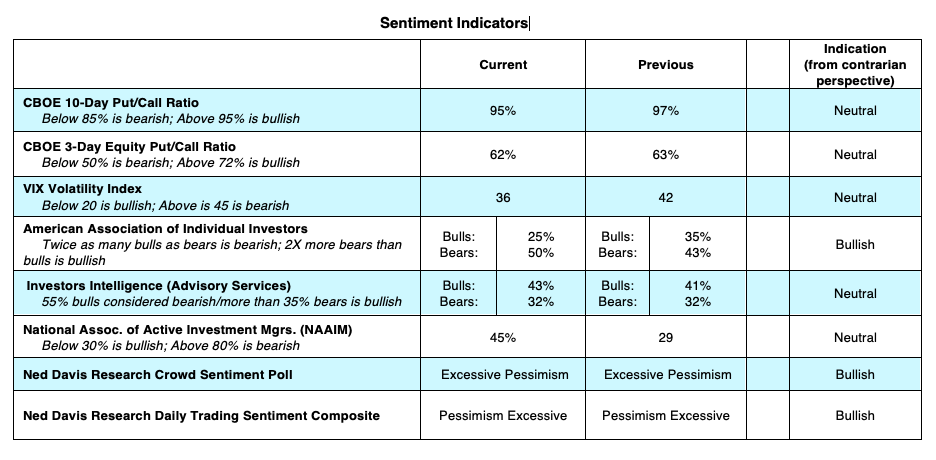

This data does not mean we will not retest the lows. While many economists believe that the economy will rebound in the second half of the year, it is likely that the economic damage will be with us for a while and that the stock market will continue to experience large swings as economic news and news of the virus impact investor sentiment. We urge clients not to sell as the market falls and not to buy during euphoric rallies. A better strategy is to be patient, focus on a long-term time horizon and use pullbacks to buy quality stocks and bonds.

Twitter: @WillieDelwiche

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.