Pure Storage (PSTG) has been a poor performer since its debut in October 2015 when the IPO saw shares trade above $20/share, but now just 9 months later shares closed below $10 for the first time. Recent options activity has signaled it may be a time to be a buyer of PSTG, so I wanted to look closer at this Tech name that has been discarded.

To first cover the options activity, the first signal was on 5-26 when shares dropped more than 15% on earnings, but traders came in selling 5,000 November $10 puts to open at $1.15 down to $0.95, showing a willingness to be a buyer of 500,000 shares of stock at $10. This past week another strategy was very interesting with traders selling over 10,000 November $7.50 puts to open while also purchasing over 10,000 August $12.50 calls to open, net credit on the spread.

Pure Storage is positioned to capture a greater market shares as data center infrastructure changes with a shift to flash and cloud friendly storage away from complex, disk-centric designs. Pure Storage technology reduces costs to customers and improves application performance. In terms of overall storage vendors, PSTG is growing ~ 10X faster than anyone else in the top 10 vendor list. Pure Storage launched FlashBlade in Q1, which in combination with FlashArray, can address a $24B market for data center storage and related software. FlashBlade shipments and revenues are on schedule for Q3. The uncertainty from the Dell-EMC merger is also expected to push more customers to Pure Storage.

The $2B provider of flash-based memory storage for enterprise hardware is now trading 3.35X cash value with no debt, and just 2.3X FY17 EV/Sales. Pure Storage (PSTG) is projecting 61% revenue growth in FY17, 42% in FY18, and 36% in FY19, but not seeing profitability until 2020. In its latest quarter PSTG posted 89% Y/Y revenue growth, ahead of tis guidance, and also saw gross margins jump Y/Y. PSTG also saw customers near the 2,000 mark and jumped 124% Y/Y with Fortune 500 customers jumping 60% Y/Y to 72. PSTG shares traded lower after results as Product Revenues declined Q/Q for the first time in its history, but Q1 has not been its best quarter historically, tending to see strong Q3 growth sequentially as 1H sales and marketing efforts results in ramping sales in 2H. FCF also went back to negative territory after seeing a strong jump in Q4. PSTG sees sustained FCF positive by 2H 2017. PSTG saw 170% growth Y/Y in support revenues in Q1 which now accounts for 20% of total revenues.

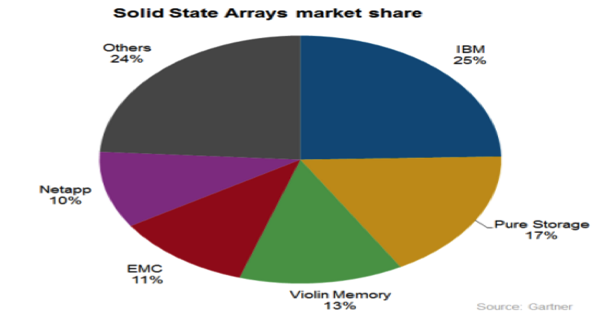

The market is highly competitive, and Nimble Storage (NMBL) is competitor that has seen shares fall 72% over the past year, now with a $720M market cap and trading 3.55X Cash and 1.3X FY17 EV/Sales. NMBL expects profitability by 2019, and revenue growth rates in the 20-25% range 2017-2019, so although shares are a bit cheaper than PSTG, it is not growing as fast, and its technology is not as good to capture market share. The chart below shows market share from Gartner in All-Flash Array:

The industry could also see the smaller growth players seen as M&A targets by the larger players seen to be losing market share. EMC, NetApp, and IBM all have plenty of cash and could easily swallow up PSTG or NMBL. In May, The Register suggested that Cisco buy either Pure Storage (PSTG) or Nutanix. CRN reported in March that Cisco attempted to acquire Nutanix for $4B in 2015, but was turned down with an asking price of $6B-$7B. Nutanix is expected to IPO in 2016, but the recent market conditions have put that on hold for now, and the company recently borrowed $75M from Goldman Sachs. Recent reports also suggest the Company is nearing a strategic partnership with Cisco (CSCO). There was one notable deal in this space, late 2015 when NetApp (NTAP) agreed to acquired SolidFire for $870M, and estimates see it as a < $50M revenues company at the time of the acquisition.

Analysts have an average target of $17.55 on shares with 14 Buy, 8 Hold, and 1 Sell rating. On 6-2 UBS upgraded shares to Buy with a $16 price target, noting the long term operating margin target of 15-20%, but currently losing money in an effort to secure market share. On 4-27 Needham started coverage at Buy with an $18 target, seeing it as a prime beneficiary of the next-generation storage transition.

Short interest remains elevated at 48.5% of the float, but has come down from above 80% of the float short at the end of March. Institutional ownership fell 4.45% in Q1 filings, though 25 new fund positions and 33 adds to positions compared to 18 funds selling out and 19 reducing. Tiger Global has a $72M position as its 15th largest holding and Altimeter Capital with a $38M position as its 7th largest position. Stanley Druckenmiller pitched PSTG as a long idea near $16/share at Ira Sohn in October, and reported a 6.4% passive stake.

In closing, PSTG is a Tech company trading cheaply on EV/Sales and a cash basis while seeing strong growth in customers and revenues, rising margins, and a large future opportunity as more companies shift to its better storage technology in data centers. With a strong balance sheet that has $600M in cash and no debt, PSTG is an attractive long term investment as its newest product, FlashBlade, starts to contribute to revenues later this year. Despite the highly competitive environment, PSTG will continue to take market share away from the larger players, until potentially, it is acquired by one of these players.

Thanks for reading.

Twitter: @OptionsHawk

The author does not have a position at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.