The following research was contributed to by Christine Short, VP of Research at Wall Street Horizon.

Executive Summary

- Traders’ eyes turn to big oil as big earnings numbers are expected

- Volatility has been driven by tech shares recently, leading to an awful month for the Nasdaq

- An Industrials stock and a household Consumer Discretionary name cross our radar with unusual earnings dates

This earnings season continues to be a wild ride. While the EPS beat rate has been strong, close to 80%, many stocks have seen severe price declines even after posting decent results. Early last week, more than 80 firms reported, and a whopping 87% of them beat on the bottom line, but the typical share price change the following day was a drop of 2%, according to Bespoke Investments. Sometimes it is just a “sell first, ask questions later” trading environment. When volatility runs high and market pessimism persists, managing risk is all the more important.

A Bear Market Driven by Big Tech?

And risk is elevated right now. Through Wednesday last week, the S&P 500 was on pace for its worst monthly drop since March 2020 while the Nasdaq’s 12.2% April plunge would be the worst dating back to October 2008. The blame can be placed on several of the big-cap tech stocks that were holding up the market. Consider that small/mid-cap growth names, like those in Cathie Wood’s Ark Innovation fund, peaked in February 2021, but the S&P 500 actually made an all-time high on the first trading day of this year. But now, shares of stalwarts like Alphabet (GOOGL), Microsoft (MSFT), Meta (FB), Tesla (TSLA), Amazon (AMZN), and Nvidia (NVDA) have all entered technical bear market territory, down 20% from recent highs. The sellers have finally targeted the market’s big guns.

Meta Provides Relief

On the bright side, the market reacted positively to Meta’s results this time. Recall how shares gapped down from $325 to $245 in early February following its Q4 earnings release. The 26% drop on Groundhog Day was not repeated last week when the stock soared 17% after its first-quarter results hit the tape. Those are some huge swings for a high market cap stock. Options traders had their hands full navigating volatility. It goes to show that earnings announcements often drive up implied volatility — this will be discussed during the Data Minds event on May 3.

Meta (FB) 1-year Price History

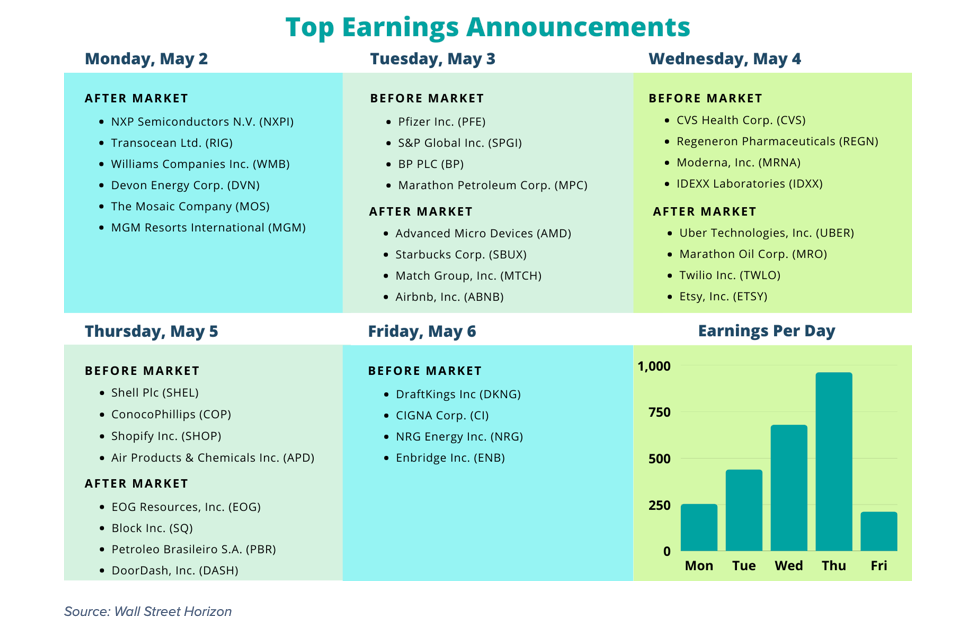

Another Busy Week of Earnings

This week is the busiest of the reporting season across the globe. In the U.S., more major players are confirmed to report, and a few companies catch our eye as outliers that traders should pay particular attention to. From a sector perspective, some of this year’s best-performing areas like Energy, Materials, Utilities, and Real Estate report results. Keep a watchful eye on how these stocks react to earnings reports.

Who Stands Out: Rockwell & Starbucks

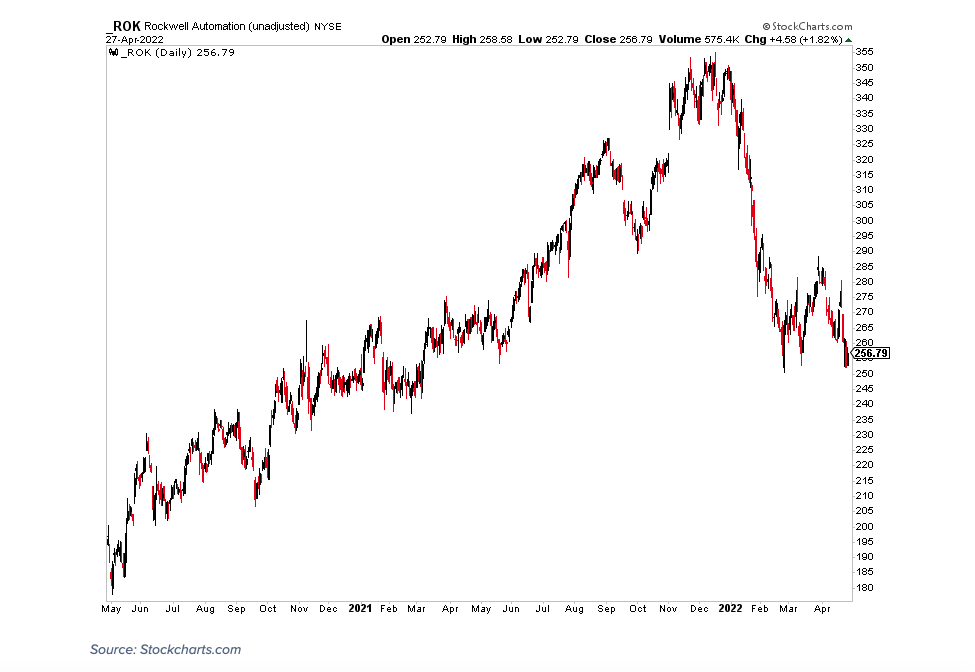

A few individual names are on our radar that could feature particularly interesting numbers. On Tuesday morning, Rockwell Automation (ROK), a $29 billion market cap Industrials stock, is confirmed to report. While the company has beaten analyst EPS estimates in each of the last four quarters, the stock is stuck in reverse. Shares sit near 52-week lows as supply chain issues in the automotive industry continue to hurt business. ROK’s earnings report is also much later than usual, featuring a DateBreaks Factor* of –3. A later-than-usual earnings report could have bearish implications for the stock price.

*The DateBreaks Factor is a Wall Street Horizon proprietary measure, using a modified z-score protocol which looks at standard deviations from the norm and that captures the extent to which a confirmed earnings date deviates or breaks from historical trend (last 5 years) for the same quarter. Negative means the earnings date is confirmed to be later than historical average while Positive is earlier.

Rockwell Automation (ROK) 2-Year Price History

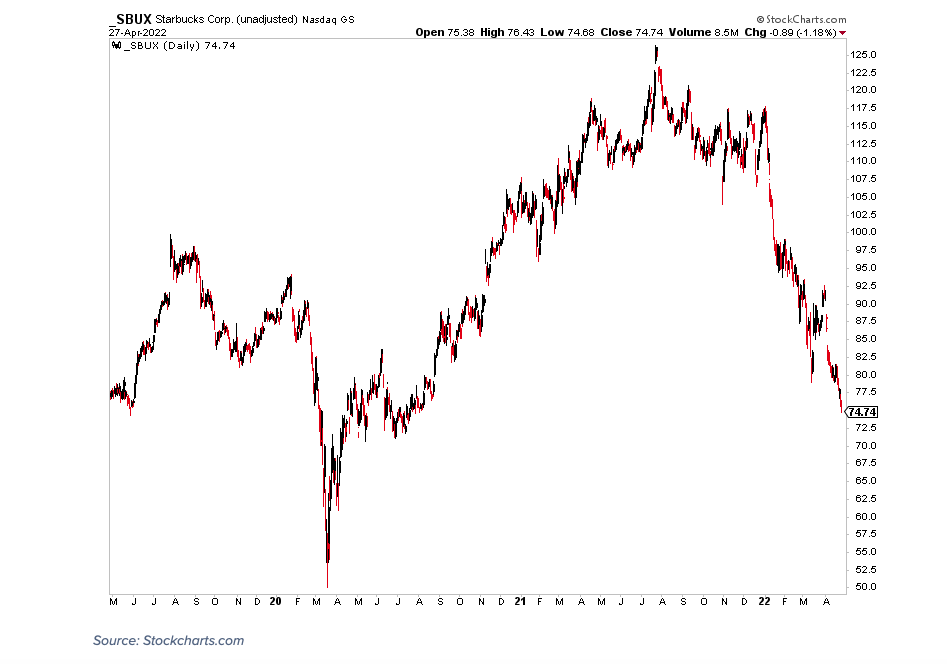

Starbucks (SBUX) has a Q2 earnings report to be issued on Tuesday evening. The $87 billion market cap multinational Consumer Discretionary stock is about 40% below its 2021 high as investors turned cautious on the once trendy name. A slew of bearish trends has impacted shares. China’s slowdown and a suspension of sales in Russia have certainly hurt performance recently. So too has rising coffee futures prices. Finally, surging labor costs among low-income jobs in the economy and unionization at the company level could threaten margins. There has been enough tumultuous news to draw former CEO Howard Schultz back into the fray. We noticed that Starbucks was late to confirm this week’s earnings date, perhaps a sign of bad news to be reported on Tuesday evening.

Starbucks 3-Year Price History

What Else to Watch For? Energy Earnings and More Growth Names.

Keep an eye on what Energy companies do as the sector is expected to boast the highest EPS growth this earnings season, according to FactSet. What might be more interesting is what firms like Transocean (RIG), Cabot (CBT), Marathon (MPC), Marathon Oil (MRO), ConocoPhillips (COP), and EOG Resources (EOG) plan to do with capital for the balance of the year. All are scheduled to report this week. Share buybacks and dividend hikes could be on the docket.

But don’t turn your back on the speculative growth stocks that seem to be getting hammered one by one this year. Match Group (MTCH), one of the S&P 500’s biggest April laggards at –29% through last Wednesday, reports this Tuesday AMC along with Advanced Micro Devices (AMD). More fireworks might come on Wednesday when Uber (UBER), Twilio (TWLO), and Etsy (ETSY) post results. The end of the week features reports from Block (SQ), Shopify (SHOP), DoorDash (DASH) on Thursday and DraftKings (DKNG) on Friday.

Let’s not forget about Costco’s (COST) interim sales data that crosses the wires Wednesday AMC.

Earnings Wave

This week is the most active week with over 4,000 companies expected to report. At this point, 68% of companies have confirmed their earnings date (out of our universe of 10,000 global names).

Conclusion

Volatility continues to run high and single-stock earnings reactions have been severe during the Q1 reporting period. Traders must stay on top of the corporate event calendar to stay a step ahead. Preserving capital appears to be a prominent strategy this year versus the bull market fervor of 2021. Wall Street Horizon’s data solutions help portfolio managers manage risk in this highly uncertain market.

For more information on the data sourced in this report, please email: info@wallstreethorizon.com

Wall Street Horizon provides institutional traders and investors with the most accurate and comprehensive forward-looking event data. Covering 9,000 companies worldwide, we offer more than 40 corporate event types via a range of delivery options from machine-readable files to API solutions to streaming feeds. By keeping clients apprised of critical market-moving events and event revisions, our data empowers financial professionals to take advantage of or avoid the ensuing volatility.

Christine Short, VP of Research at Wall Street Horizon, is focused on publishing research on Wall Street Horizon event data covering 9,000 global equities in the marketplace. Over the past 15 years in the financial data industry, her research has been widely featured in financial news outlets including regular appearances on networks such as CNBC and Fox to talk corporate earnings and the economy.

Twitter: @ChristineLShort