Nike (NYSE:NKE) just reported quarterly earnings and the overall figures were pretty strong. Overall, Nike quarterly earnings and sales for fiscal second quarter came in better than expected.

Revenues for Nike grew 6% to $8.2 billion, and up 8% on a currency neutral basis. Gross margins fell 1.4% on the back of higher input costs, along with currency headwinds.

Inside Nike Second Quarter Earning Results

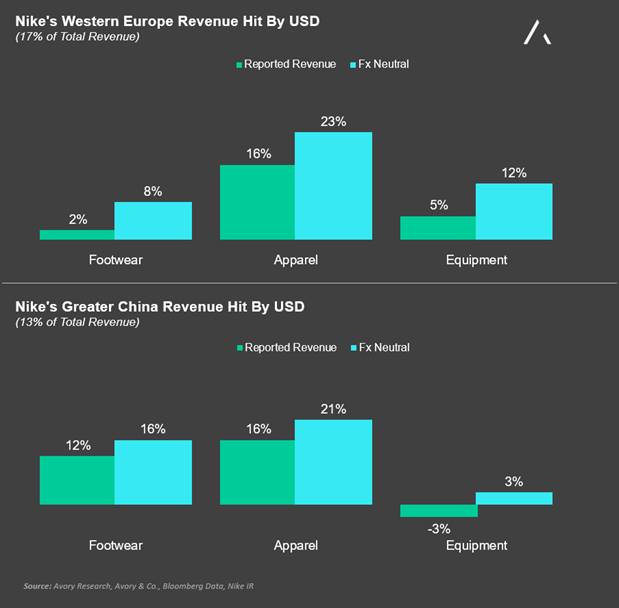

A stronger US Dollar really effected international sales as it hampered Western Europe, which makes up 17% of revenue and Greater China, which makes up 13% of revenue. Below we highlight how currency impacted each of their 3 core lines of business (footwear, apparel, and equipment). While Nike experienced currency headwinds, management was able to capture expense leverage. Nike’s net income increased 7% to $842 million, with diluted earnings per share increasing by 11% to $0.50. This reflected revenue growth of 6-8%, selling and administrative expense leverage and a 3% decline in the company’s weighted average diluted common shares outstanding.

One area of concern was the 9% increase in inventories relative to 6-8% revenue growth. Company management expressed how the increase in inventories was driven by an increase in the average product costs per unit (which we saw in gross margin also), along with growth in their direct to consumer business “DTC”.

Heading into 2016 Nike stock was being valued at 30 times trailing earnings per share, in our view a steep price for an apparel company that has already reached $30 billion in annual revenue. Today, the company trades at a much more reasonable 21 times forward earnings, and 2.3 times sales. The overall industry is becoming much more competitive, however Nike continues to establish its dominance. With return on invested capital above 31%, and improving, Nike continues to prove its worth. See you next quarter.

In full disclosure, I currently do not own any Nike (NKE), but I am going through my due diligence on the business as valuation has become more attractive.

Thanks for reading.

Twitter: @_SeanDavid

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.