The Federal Reserve and Foreigners are MIA

As discussed, the Fed is reducing their U.S. Treasury holdings and foreign entities are not adding to their Treasury holdings. This reduced demand is occurring as the U.S. Treasury is ramping up issuance to fund a staggering $1 trillion+ annual deficit. The CBO forecasts the pace of heavy Treasury debtsupply will continue for at least four more years.

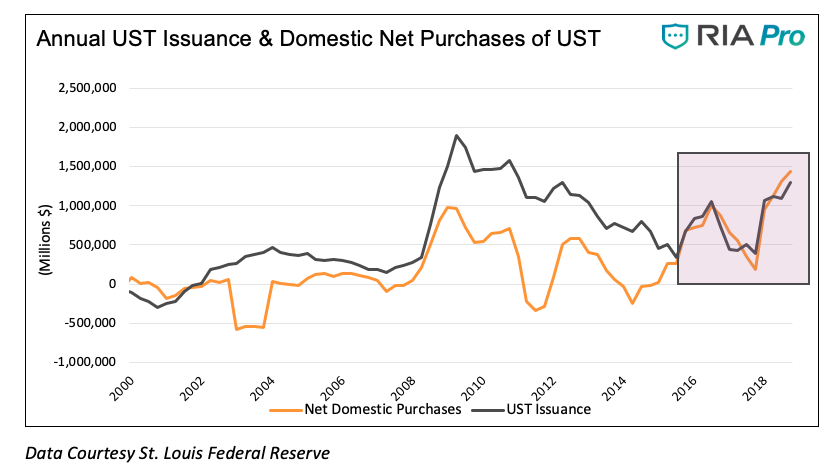

Because foreign entities and the Fed are not buying, domestic investors are left to fill the gap. The graph below charts the change in U.S. Treasury debt issuance along with the net amount of domestic investor purchases (Total debt issuance less net purchases of foreign entities and the Fed.)

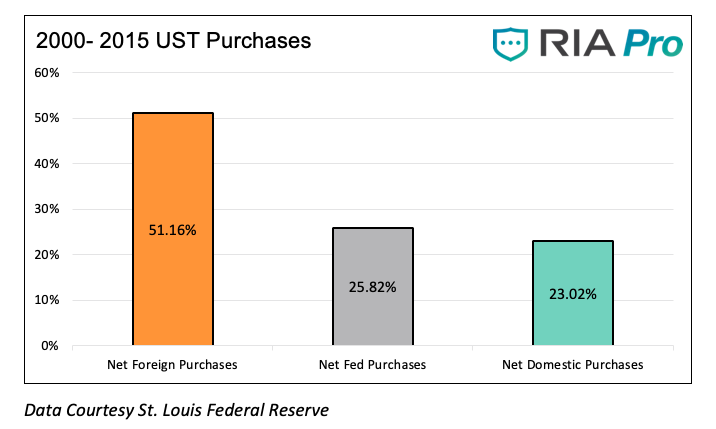

As highlighted in the yellow box, domestic purchases have indeed taken up the slack. The graph below shows investor breakout of net purchases from 2000 to 2015.

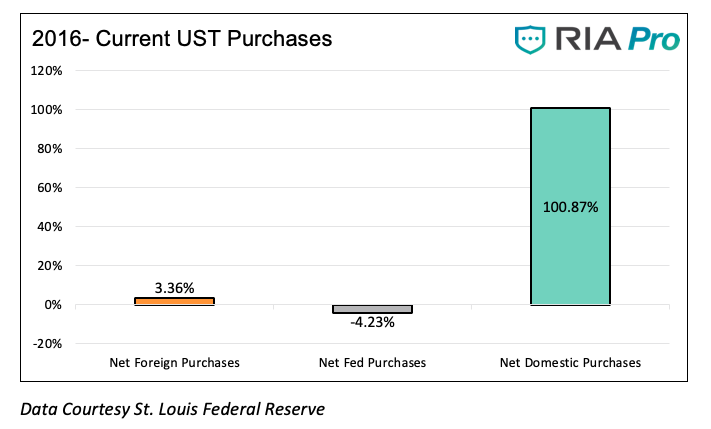

Note that domestic investor demand accounted for roughly a quarter of the Treasury’s issuance. Now consider the period from 2016 to current as shown below.

Quite a stark difference! Domestic investors have bought over 100% of Treasury issuance.

This leads to two important consequences worth considering.

- Given the amount of debt that is expected to be issued, will interest rates need to rise further to attract domestic buyers?

- If domestic investors are forced to buy 100% net Treasury issuance plus that which is sold by the Fed and foreigners where will the money will come from?

Now, before answering those questions here is the punch line. According the Office of Management and Budget (OMB), Treasury debt is expected to increase by $1.086 trillion in 2019. As the Fed modifies their balance sheet reduction but does not resume buying, and foreign entities remain neutral, domestic savers will still be on the hook to purchase at least the entire $1.086 trillion in U.S. Treasury securities in 2019 alone.

Looking beyond 2019, net debt issuance over the next ten years is expected to average $1.2 trillion per year, and that forecast by the CBO, OMB and primary dealers does not include a recession which could easily double the annual estimate for a few years.

It is probable that, barring deflation or a notable stock market decline, higher interest rates will be required to attract marginal domestic investors to purchase U.S. Treasuries. It is also fair to say that the onus of buying more U.S. Treasuries that is falling on domestic investors will likely result in a higher savings rate which negatively effects consumption.

The bottom line is that investors will need to consume less and shift from other assets into U.S. Treasuries to match the growing supply. This presents a big problem for equity investors that are buying assets at record high valuations and are unaware of, or unconcerned with, this situation.

Summary

Just because something has gone on for what seems to be “forever” does not mean it will continue.

Deficits do indeed matter. The post Bretton Woods agreement formalizing a fiat currency global system had the support of all major developed world nations. Against better judgement and a lack of understanding about the implications, monetary policy was fashioned towards ever larger debt burdens. The story plays a bit like an old Monty Python skit:

Cleese: “The amount of debt we owe is creating a problem, sir.”

Palin: “Don’t be ridiculous! That’s pure horse hockey! It’s just a bloody flesh wound.”

Cleese: “But the amount of debt outstanding can no longer be described using numbers and we have no way of paying the interest.”

Gilliam: “Are you an idiot, man? We’ll issue more debt to pay the current debt we owe, of course!”

Cleese: “But we’ve been doing that and the problem keeps getting worse and you say the same thing!”

Chapman: “Is that a penguin on the telly?”

Now that we actually have to fund our debt, the reality is hitting home and diverting attention to “penguins on the telly” will do us no good. If foreign investors remain uninterested and the Fed avoids restarting QE, this situation will become much more obvious. Regardless, history is chock full of warnings about countries that continuously spent more than they had. Simply, it is completely unsustainable and the investment implications across all assets are meaningful.

Twitter: @michaellebowitz

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.