The Big Picture

When the market seems uncertain, it’s helpful to step back and ask yourself what participants might be thinking at different price levels rather than just focusing on what the market is doing. The stock market talks to us in terms of support, resistance, consolidation, and trends, but the movement is the result of people (and machines designed by people) hitting the buy and sell buttons.

Different participants have different objectives, but they all experience emotions that flow with market volatility. Emotions tend to drive behavior and when the market sentiment shifts, it frequently means the emotion of participants has shifted.

When we see a change take place in the market it makes sense to consider why the change has come about, who is causing it, and how different participants might feel about the change. The intraday turn in the stock market we saw on Thursday was validated on Friday and the obvious feeling for many participants is relief.

The financial industry is built on the promise that investors can buy stocks that will increase in value over time. The promise of increasing prices over time is made with great certainty, but timing is frequently absent from the conversation. The industry has major problems if prices don’t rise or people question the validity of the promise. Naturally when stocks decrease in value, that creates fear, stress, and anxiety… and usually leads to an uptick in market volatility. In the stock market, most participants feel relief when a decline slows, stops, and reverses.

Relief comes about for different reasons, but it involves the reduction or removal of stress and anxiety. In trading, we tend to feel relief when the market has pushed our position to the edge of our comfort zone and backed off. When our trading positions are under pressure, we need to be careful not to view the pain as happening “to us” because that means we’re placing ourselves in the way of the market. It’s important to remember that we’re just playing a game with money and the market does not exist to validate us.

Rather than getting caught up in the emotions of trading and the market, it’s important to remain objective about what’s really happening. The rally on Thursday and Friday came about, at least in part, because sellers failed to push the stock market lower.

The failure to hold at or below new lows creates a reason to question the downside in the short run. On Friday, the stock market traded around the weekly volume weighted average price before trading higher into the close. That activity was constructive and validated the failure to hold new lows for stocks. That said, it’s still early to call a reversal in the longer term trend and failure to push lower does not automatically mean significantly higher prices are inevitable. Price is equally (if not more) likely to consolidate as it digests the ugly start to 2016.

Ultimately, where the market goes today, tomorrow, or next year is less important than how we react. As I’ve talked about on the daily videos and in last weekend’s commentary, we’re just trying to recognize changes and where the potential for change exists rather than predicting what might happen. As non-directional options traders we can move with the market and as long as we can remain open minded and control risk, we have the potential to succeed.

The reality is that nobody knows where price will go until after the fact. The price action on Friday was productive and brought the markets back into their previous ranges, but the tide in 2016 has consistently been going out. Right now it makes sense to be cautious on both sides of the market. The ranges are wide and there’s the potential for pain in both directions as investors navigate the ebb and flow of market volatility.

Market Volatility

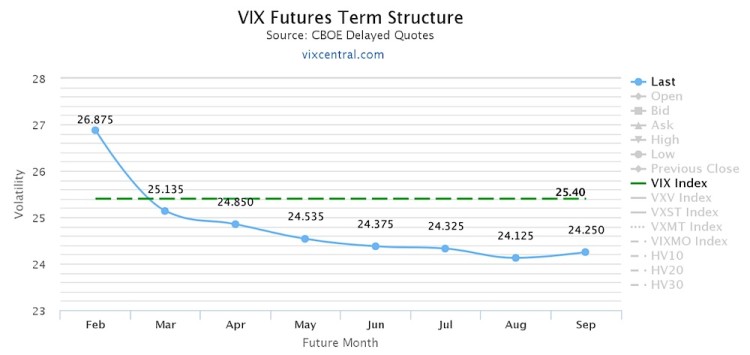

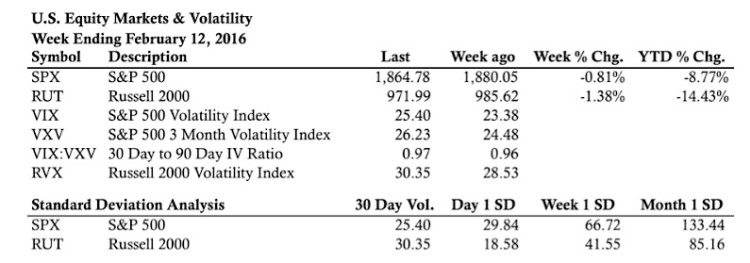

Volatility has been a very telling indicator this year and something to watch closely. For the time being, market volatility is still relatively controlled, but it did end the week at an elevated level and the VIX Futures term structure remains in Backwardation. Additionally, both the S&P 500 Index and Russell 2000 Index have demonstrated steadily rising implied and realized volatility all year. Absent a high volatility V-Bottom rally in stocks, we need to see volatility begin to trend lower with a return to Contango to trust any move higher in the stock market.

As it relates to price, volatility is suggesting that the stock market is not completely healthy yet. At the same time, the market is not in panic mode and has not been in panic mode at all this year. If you want to humanize the market, you could think about volatility as having a moderate cold. It’s not completely healthy, but it isn’t incapacitated or sick in bed either.

S&P 500 Index vs Volatility Measures (VIX, VIX:VXV)

Russell 2000 vs RVX

Market Volatility Term Structure

Market Stats

Stock Market Levels of Interest

In the levels of interest section, we’ll take a quick look at the daily charts for the S&P 500 and Russell 2000.

S&P 500 Daily Chart

Russell 2000 Daily Chart

Thanks for reading and good luck in the week ahead.

Twitter: @ThetaTrend

Author holds positions in S&P 500 and Russell 2000 related securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.