Timing the market is no easy task. In fact, many claim it’s impossible. However, at Market Inflections we employ an algorithm developed by a company called Parallax Financial Research which has an uncanny ability to indentify when trends are most likely to begin and end.

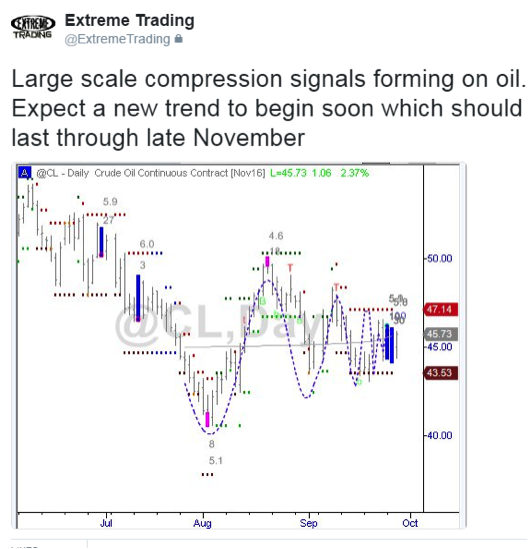

Last week, we noted on our private Twitter feed that this algorithm generated what we call a compression signal suggesting that a new trend was about to begin on the Crude Oil Futures Contract:

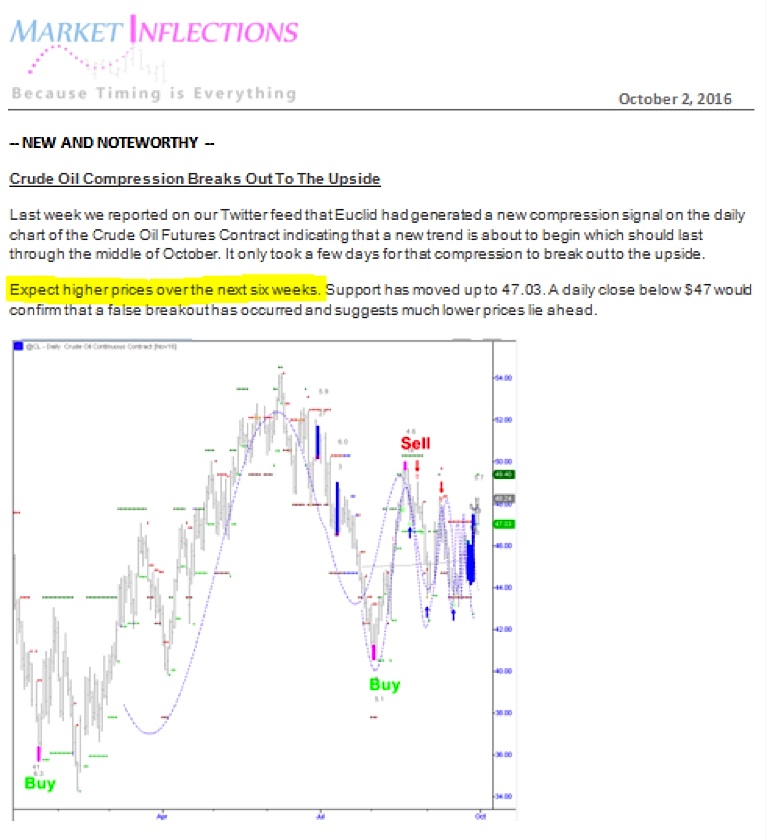

In short, we noted that a breakout above 47.14 would suggest that a new uptrend was about to begin (and thus provide a confirmation to buy) while a break below 43.53 would imply that a new downtrend was underway (confirming that one should be a seller). The crude oil rally took out 47.14 and thus the signal triggered.

And in this week’s ExtremeTrading Signals Service weekly report (distributed on Sunday October 2, 2016 – which you can access via the link download below), our conclusion was to “expect higher prices over the next six weeks.”

Crude Oil is already up over 4% this week alone and our systems indicate that the uptrend is just beginning.

If you would like to read about what our algorithms are saying about other securities such as the S&P 500, Dow, Russell 2000, Gold Miners ETF (GDX), Biotechnology ETF (IBB), 30 Year US Treasury Bond, Crude Oil, Gold, the US Dollar, Euro Currency and Japanese Yen, then we encourage you to download a complimentary copy of this week’s ExtremeTrading Signals Service report here.

Thanks for reading and have a great weekend.

Twitter: @interestratearb

The author may have positions in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.