Marathon Oil (NYSE: MRO) traded 4% lower on Friday morning.

This occurs as crude oil looks likely to lock in its seventh consecutive week of losses.

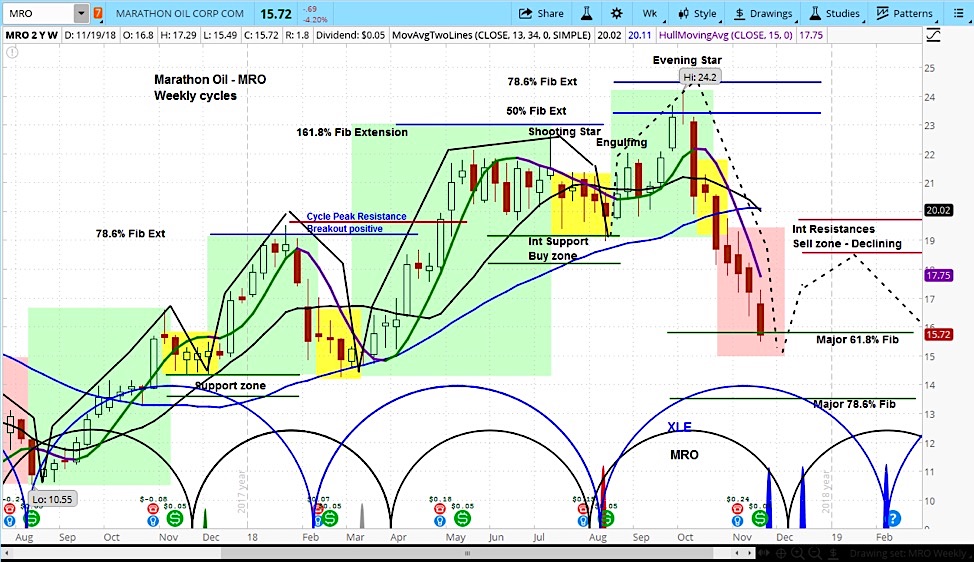

However, our read of the stock’s market cycles suggests that Marathon Oil (MRO) is close to a cycle bottom and due for a modest bounce.

In analyzing the market cycles for MRO, we can see the stock is in the declining phase of the shorter of its two cycles. However, we believe the stock is at a Fibonacci support zone, as this cycle begins to wind down. As such, we are expecting a bounce, with an $18.60 target.

Marathon Oil (MRO) Stock Weekly Chart

Crude oil (/CL) futures fell 7% on Friday and by 30% since early October, as market participants continue to express concern about an oil glut. This is the result of continued robust supply in the face of the economic weakness that affects much of the globe.

OPEC and other countries will meet in early December to consider limiting their production in an effort to prop up oil prices. In the meantime, the dip in prices is affecting the energy sector broadly, with the Energy Select Index (XLE) down by 3% today and Marathon Oil down by 4%.

For more from Slim, or to learn about cycle analysis, check out the askSlim Market Week show every Friday on our YouTube channel.

Twitter: @askslim

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.