What Are Riskier Segments Of The Market Telling Us?

The major U.S. market indexes got off to their worst start in history this year, which is a very strong statement. Are other areas of the market waving red flags as well?

Well, junk bonds are one area of concern, for example.

Check out this from Bloomberg:

The junk-bond market is indicating a 44 percent chance of a recession in the U.S. within one year, according to Martin Fridson, a money manager at Lehmann, Livian, Fridson Advisors LLC. “I am not an economic forecaster — this is what the market is saying,” said Fridson, who started his career as a corporate-debt trader in 1976. “There are lots and lots of caveats, but if you accept all of the assumptions, it’s a pretty startling comment.”

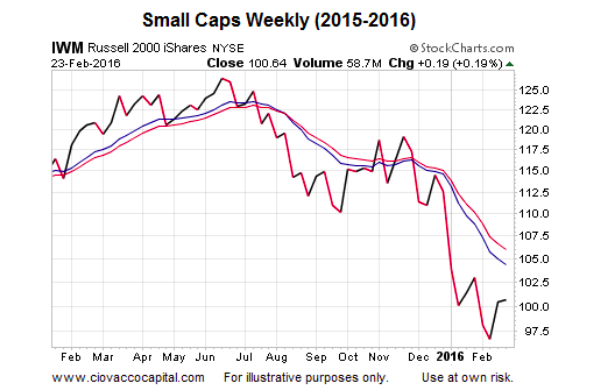

Small Caps Lean Risk-Off

All things being equal, investors tend to migrate to smaller growth companies when they feel good about future economic outcomes. Conversely, they tend to migrate away from small caps when deflationary or recessionary concerns are gathering steam. Small caps are in a clearly defined bearish weekly trend. See the 2015-2016 chart of the Russell 2000 ETF (IWM).

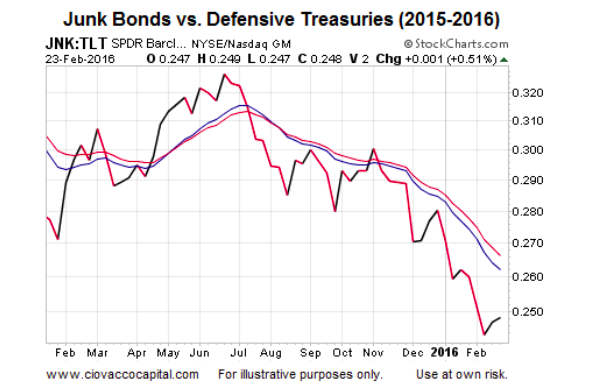

Credit Markets Look Concerned

Another way of keeping tabs on the market’s tolerance for risk is to compare the performance of riskier junk bonds to more conservative long-term Treasuries. When the ratio below is rising, it tends to be bullish for stocks since it reflects confidence that holders of junk bonds will receive their principal and interest payments in a timely manner. Currently, the ratio is in a clearly defined bearish weekly trend. If you prefer to compare the High Yield “junk bonds” ETF (JNK) to the 20+ Year Treasury Bonds ETF (TLT), that ratio paints the same concerning picture.

Investment Implications – The Weight of The Evidence

As outlined in detail on February 19, numerous forms of hard evidence remain in a risk-off posture, especially on a longer-term time horizon (weeks, months, years). Countertrend moves and big up days are common in the context of bearish trends. Therefore, while we are always open to improvement, the recent gains in stocks have had little impact on the longer-term data tracked by our market model. As always, we will keep an open mind and adjust to the markets.

Thanks for reading.

Twitter: @CiovaccoCapital

Read more from Chris on the CCM blog.

Author or his funds have long positions in related securities. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.