CURRENCIES

Euro: Eurozone industrial production rebounded in April, rising 1.1 percent. This comes on the heels of back-to-back decline of 0.7 percent in March and 1.2 percent in February.

In the meantime, Eurozone consumer prices fell 0.1 percent y/y in May, but slower than the 0.2-percent decline in April. Despite oodles of QE (quantitative easing) money sloshing around, inflation is missing in action.

The euro acted as if it did not know which data to react to, trading within a relatively wide range – 113 on the high and 111.3 on the low. Thursday’s weekly low nearly tested the 200-day moving average (111.09), which is flat to slightly declining. And on Wednesday, the currency was just about repelled by the 50-day moving average, which is slightly dropping. The euro is right underneath that average, and could go either way near term, with a slight upward bias.

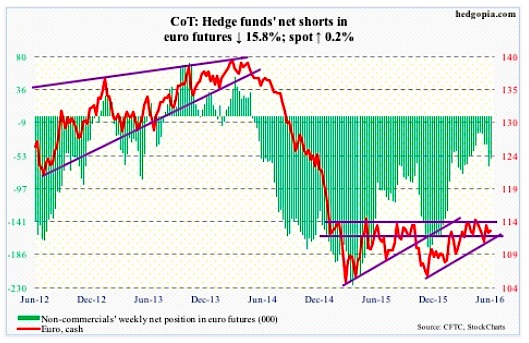

June 17 COT Report: Currently net long 118.2k, up 150k.

US Dollar Index: Hugged the 50-day moving average in all five sessions this week. Thursday was a long-legged doji session, with a high of 95.54 and a low of 94.26 – very volatile. Currency traders are probably struggling to decide which way to position ahead of the Brexit vote next week. As is the case with the euro, the dollar index could go either way near term, with a slight downward bias.

Non-commercials continue to cut back net longs, with holdings at two-year lows.

June 17 COT Report: Currently net long 4.7k, down 5.1k.

Thanks for reading.

Twitter: @hedgopia

Read more from Paban on his blog.

Author may hold a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.