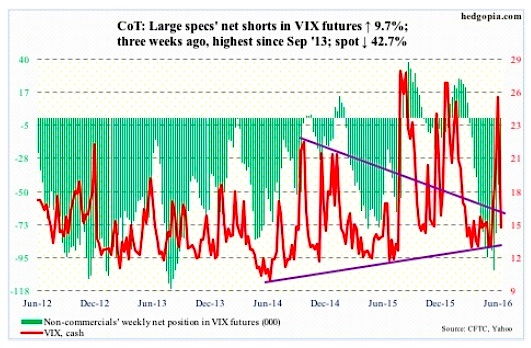

VIX Volatility Index

On Monday, the S&P 500 lost 1.8 percent, following a 3.6-percent drop last Friday. In that session, spot VIX briefly surpassed last Friday’s high, then sold off hard. In the end, it shed nearly two points. This on a down day for the S&P 500! That was a tell. Tuesday through Friday, the S&P 500 rallied 5.1 percent, and spot VIX gave back north of 12 points from Monday’s intra-day high.

As well, the VIX-to-VXV ratio last Friday jumped to 1.076 – way overbought. This week, it ended at 0.837. Ideally, there is still some room for unwinding, but is just about done. The ratio’s surge preceded weeks of readings in high 0.70s/low 0.80s.

July 1 Commitment of Traders Report: Currently net short 50.1k, up 4.5k.

CURRENCIES

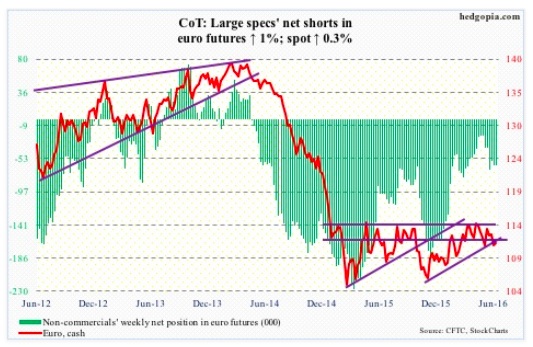

Euro

Eurozone consumer inflation crawled out of negative territory in June. This was a first estimate for the month. Prices rose 0.1 percent, after slipping by the same amount in May. Not much to write home about. The ECB has a target of close to two percent, has pushed benchmark interest rates into negative territory, and grown its balance sheet from €2.04 trillion in September 2014 to €3.08 trillion in May this year. Inflation is a no-show.

The euro tried to stabilize this week, but was nowhere near recouping post-Brexit losses. Has room to rally near term.

July 1 Commitment of Traders Report: Currently net short 61.9k, up 588.

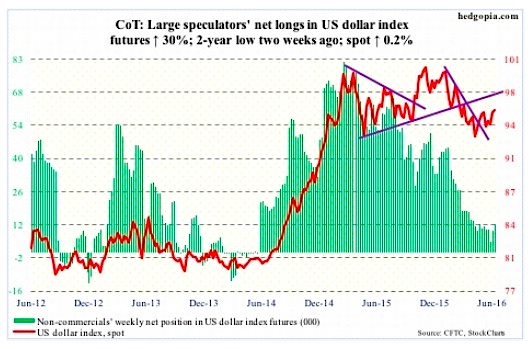

US Dollar Index

From last week’s Thursday close through this Monday, the US dollar index jumped 3.4 percent. This was the sharpest two-session increase since it rallied 3.6 percent on September 29, 1992.

Even after this surge, the dollar index is stuck in the middle of a 15-month range. Last Thursday, it dropped all the way to 93.03 to test the lower bound of that range before reversing with a hammer. The subsequent two-day rally had it break out of a seven-month declining channel.

It is all fear-driven, not fundamentals.

In recent sessions, the dollar index has diverged from two-year Treasury yields. The latter tends to be sensitive to the Fed’s monetary policy forecasts. Rate-hike odds have tumbled.

That said, non-commercials did react to Brexit by slightly adding to net longs (per cot report data). Longs were at two-year lows two weeks ago.

July 1 Commitment of Traders Report: Currently net long 12.2k, up 2.8k.

ECONOMIC RELEASES

Major economic releases next week are as follows. Happy Independence Day! Markets are closed on Monday.

May’s durable goods were reported on June 24th. Revised and more detailed estimates will be reported on Tuesday. Orders for non-defense capital goods ex-aircraft – proxy for business capex – were down 0.7 percent in May to a seasonally adjusted annual rate of $62.4 billion. This was the second straight month-over-month drop. On a year-over-year basis, orders fell 3.6 percent, for a 7th consecutive drop and 16th out of last 17 months.

Wednesday brings the ISM non-manufacturing index (June), and FOMC minutes for the June 14-15 meeting.

Services activity declined 2.8 points m/m in May to 52.9. The non-manufacturing index has decelerated from 59.6 last July. Similarly, orders fell 5.7 points m/m to 54.2 in May. That said, services are faring better than manufacturing.

June’s employment report is published on Friday. May was a big negative surprise, with the economy only adding 38,000 non-farm payroll jobs. The January-May monthly average this year is 150,000, which is substantially less than the 2015 monthly average of 219,000, and the 2014 average of 251,000. Momentum is in deceleration.

Three FOMC members have scheduled appearances on weekdays.

Thanks for reading.

Twitter: @hedgopia

Author may hold a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.