I ended Liquidity Crisis in the Marking- Japan’s Role in Financial Stability- Part 1 with the following quote regarding inflation from BOJ Governor Haruhiko Kuroda: “The BoJ should persistently continue with the current aggressive money easing toward achieving the price stability target of 2% in a stable manner.”

While many central bankers are anxiously waging war against inflation, the Japanese are egging it on. Over the last few weeks, the BOJ has offered to buy as many 10-year notes at 0.25% as the market will offer them. In central bank parlance, we call that unlimited QE. While the BOJ caps bond yields with “aggressive” QE, they are doing so at the expense of the yen.

Carry Trade

In Part 1, I discussed how Japanese citizens and pension plans invested abroad to earn higher yields. They were not the only ones taking advantage of the difference in interest rates between Japan and many other countries.

Hedge funds and institutional investors worldwide were also making the most of the situation by borrowing yen cheaply in Japan, converting the yen to another currency, and investing the funds at much higher rates. Such a trade is called a carry trade.

To understand the allure of the carry trade, let’s consider a popular carry trade that many of you are actively engaged in.

Buying a house with a mortgage is a type of carry trade. If you purchase a home for $500,000 with a $400,000 mortgage and $100,000 in cash/equity, you are leveraged at a rate of 5:1. Any change in the home price affects your return on the investment by a factor of five. For instance, a 10% increase in the price ($50k) results in a 50% gain on your equity ($50k/$100k).

Leverage can be much greater than 5:1 in financial market carry trades, thus resulting in more significant gains and losses than in our example.

Yen Carry Trades

Unlike mortgage payments and house values denominated in dollars, the yen carry trade introduces currency risk. If you borrow in yen and it appreciates, you pay back the loan with more expensive yen. Therefore, appreciation of the yen eats into profits and discourages the yen carry trade.

For example, you go to a Japanese bank and put down $100,000 in assets to borrow 1,000,000 yen for one year at 0%. You convert the yen to dollars and buy a one-year U.S. Treasury note at 3%. Assuming the yen’s value doesn’t change versus the dollar, the return will be 30% (3% * 10x leverage). If the yen appreciates by 1% over the year, and you did not hedge the currency risk, the return falls to 20%. 5% appreciation of the yen results in a 20% loss.

As you might surmise, yen carry trades are very sensitive to yen price movement. Understanding this, the BOJ has acted numerous times to arrest the yen’s appreciation. I share the following from the book The Rise of Carry:

“Over a period of just seven months up to March 2004, the BOJ/MOF accumulated well over US$250 billion in foreign reserves in the attempt to prevent the yen from appreciating. At the end of this period, the yen dollar exchange rate was basically flatlining as the BOJ stood in the market and absorbed all the dollars that yen purchasers wished to sell.”

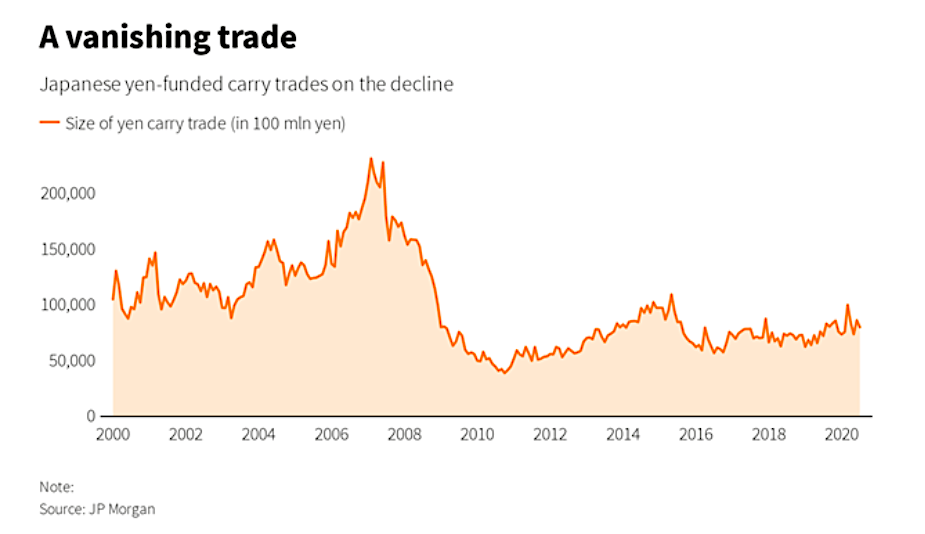

At that time and many other times, the BOJ bought dollars and sold yen to keep the exchange rate stable. By minimizing currency risk, the yen carry trade retained its attractiveness to foreign investors. The size of the yen carry trade has declined in recent years, as shown below. Even at 100 trillion yen, carry trade investors control approximately $80 billion worth of assets worldwide.

Japan’s Achilles Heel

Currently, the yen is rapidly depreciating. It is the direct consequence of the BOJ’s aggressive actions to halt yields from rising. As we share in Part 1, Japan can ill afford higher interest rates with its massive debt levels.

However, as the BOJ tries to stop rates from rising, they weaken the yen. Japan is in a trap. They can protect interest rates or the yen but not both. Further, its actions are circular. As the yen depreciates, inflation increases and the Japanese central bank must do even more QE to keep interest rates capped.

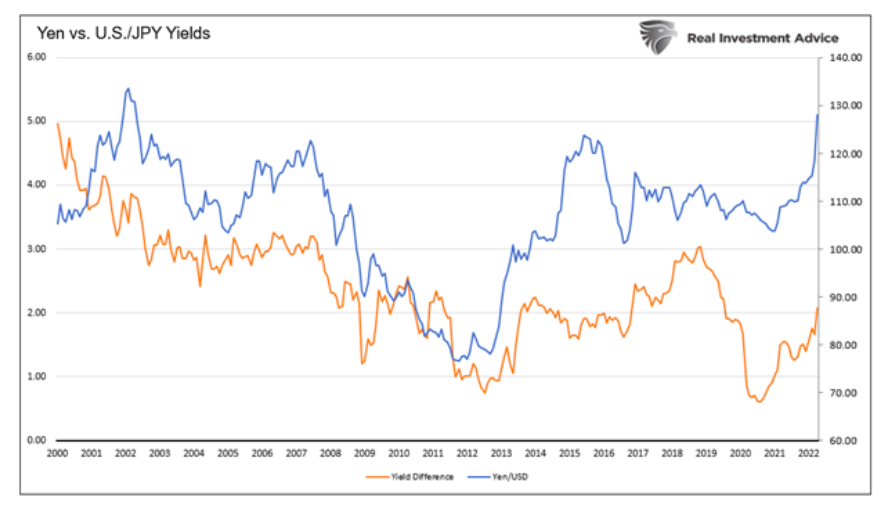

The graph below shows the recent depreciation of the yen in blue. The graph charts the amount of yen needed to buy a dollar; ergo, the rising amount represents depreciation. With interest rates capped in Japan and in rising in America, you can see the widening difference in yields in orange. Essentially the graph highlights the stark contrast between the Fed’s hawkish policy and the BOJ’s dovish policy.

The BOJ, with full government support, appears willing and able to do everything in its power to keep monetary policy extremely aggressive regardless of what other central banks do. Such a stance by the Japanese central bank might be possible if inflation remains tame.

Japanese CPI and PPI

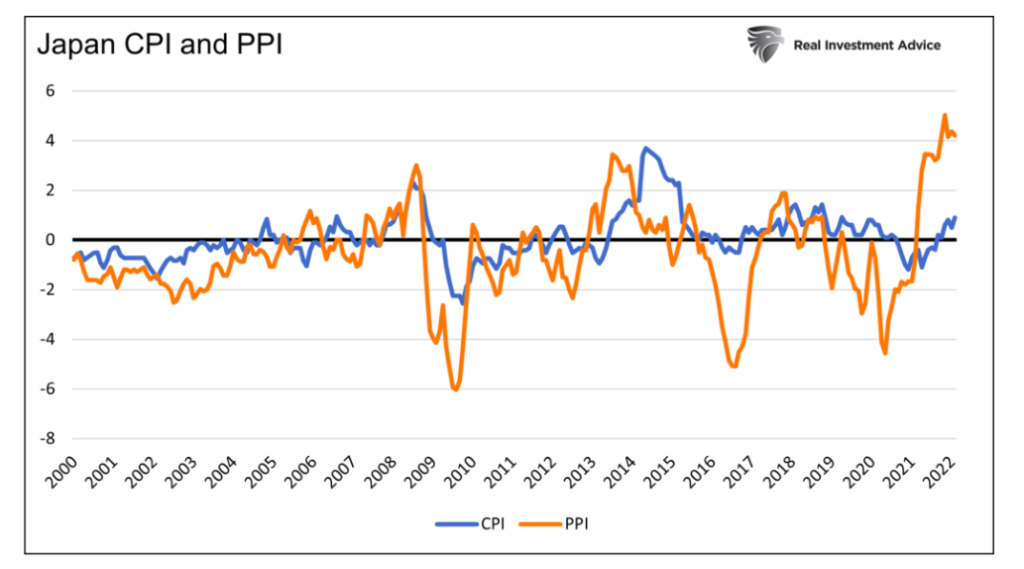

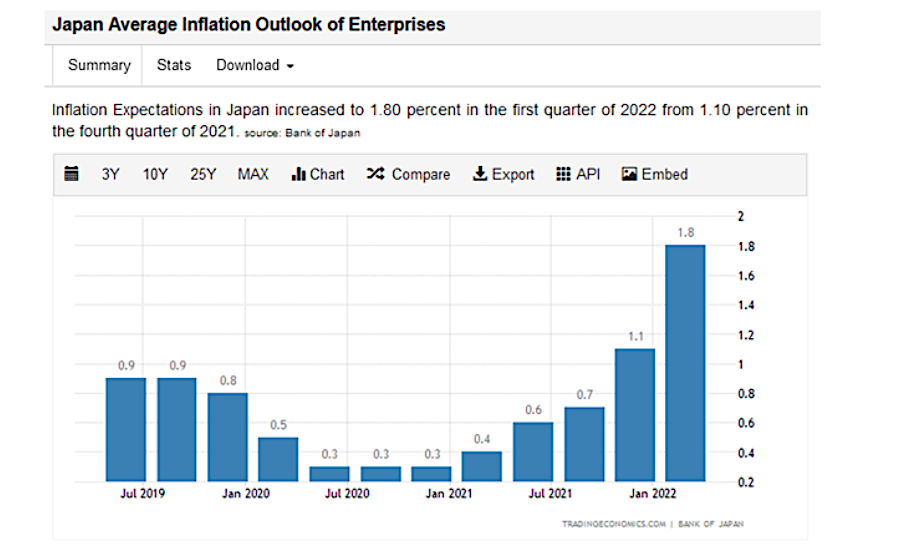

Japanese inflation is much lower than in most other major economic nations. However, there are signs that prices may catch up. For instance, the prices of input goods (PPI) have begun to rise rapidly. While CPI is still low at .9%, we must consider that PPI and inflation expectations, shown below, often lead CPI.

Japan may be already experiencing a jump in CPI that the government is minimizing, or the data is simply lagging. Either way, this inflationary impulse is far different from minor impulses in the past. Further, given the surging price of global commodities and Japan’s lack of natural resources, it will be near impossible to avoid inflation.

Inflation and Demographics

Many politicians say inflation is good because of Japan’s massive debt levels. It can essentially reduce the amount of debt as a percentage of the economy.

It appears that for this reason, the BOJ wants more inflation. However, with more inflation, the BOJ must expend even greater efforts to ensure interest rates do not follow inflation higher.

Let’s review Japan’s demographic situation. As we wrote in Part 1- “A poor demographic profile also hamstrings Japan’s economy. The working-age population is almost 15% below its peak of 1995. To make matters worse, over a third of their population is 65 or older and quickly becoming dependent on the remaining population.”

A large percentage of Japan’s elderly population relies on fixed income portfolios. High inflation will be devastating to them. It will severely crush their purchasing power if interest rates do not rise in line with higher prices.

Regardless of whether the Japanese government accurately measures inflation, the citizens already feel it. In an admission that inflation is becoming problematic, the Japanese government is trying to ease citizens’ pain. Per Nikkei Asia- “Japan plans to spend 6.2 trillion yen ($48.2 billion) on additional gasoline subsidies, low-interest loans and cash assistance to alleviate the pain of consumers and small businesses facing rising prices, Nikkei has learned.”

The Stage Is Set

So, what happens if CPI data starts rising rapidly? More importantly, might high inflation and the limited means of many of Japan’s citizens force the BOJ to take a more hawkish stance to limit inflation? Doing so would involve fighting yen depreciation at the expense of interest rates. This hawkish scenario, which hasn’t been seen in Japan in thirty years, is deeply troubling.

A strong yen and higher rates will entice liquidity to flow back to Japan. Yen carry trades will be reversed as their borrowing costs rise alongside an appreciating yen. Such is a recipe for a global drain of liquidity and possibly a financial crisis. Japanese citizens and pension funds will start to bring their money home to take advantage of higher yields without the currency risk.

Such a reversal of liquidity is not a Japan-centric problem as the tentacles of the yen carry trade spread through global financial markets. The loss of liquidity will be felt worldwide.

Summary

The BOJ is trapped. They are conducting unlimited QE to keep rates low and but at the same time, weaken the yen, which promotes inflation. Unlike many other economic pundits, it is not the collapse of the yen that is our chief concern. It is the opposite. The BOJ has avoided inflation for thirty years. The onset of inflation might be too much for them to evade.

Wayne Gretzky claims he was such a good hockey player because he went to where the puck would be. As investors, we should consider what Japan is doing today but focus on what they may have to do tomorrow.

Twitter: @michaellebowitz

The author or his firm may have positions in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.