Liquidity Crisis in the Making is part one of a two-part article. Part 1 sheds light on the Bank of Japan and its three-decade attempt at a soft landing following the bursting of massive asset bubbles.

In propping up Japan’s economy and financial markets, they indirectly provided liquidity to the world’s financial markets. While the liquidity was well received by investors, certain events, as we discuss in Part 2, leave us concerned the BOJ could unleash a liquidity vacuum felt around the world.

Part 1- Liquidity Crisis in the Making

Over the last three decades, the Bank of Japan (BOJ) has employed the world’s easiest monetary policy. Initially, the motivation for the bank was to soften the blow resulting from the popping of enormous equity and property bubbles thirty years ago. While the bubbles are well in the rearview mirror, Japan has become reliant on the BOJ.

The BOJ’s policies to avoid a massive liquidity crisis not only severely impacted Japan’s markets and economy but have and continue to benefit asset prices around the world.

Inflation is finally perking up in Japan. Accordingly, this massive source of liquidity for global markets may be on the verge of drying up, resulting in a liquidity crisis felt around the world.

If you would like to learn much more about Japan’s bubbles and the role of the banks and BOJ, we highly recommend Richard Werner’s book the Princes of the Yen. You can also watch a movie adaptation of the book via YouTube- LINK

Bubble Economy– バブル景気, baburu keiki

In late 1991 Japan’s real estate and financial market bubbles popped. Instead of allowing significant bankruptcies and defaults in its banking/investment sectors, the government and central banks supported the banks by enabling them to hold onto non-performing, defunct assets. Instead of having a bad recession or a depression lasting multiple years, they stymied growth for decades. The nominal GDP is currently at the same level as in 1998.

As an aside, stagnant economic growth is not entirely the fault of the BOJ and government. A poor demographic profile also hamstrings Japan’s economy. The working-age population is almost 15% below its peak of 1995. Over a third of their population is 65 or older, to make matters worse. They are becoming increasingly dependent on the remaining population.

Easy Money Distortions

One of the BOJ’s critical policy tools of the last 30 years has been extremely easy monetary policy. Low and even negative interest rates and later QE support massive government deficits and keep interest rates extraordinarily low. Banks could fund non, or poorly-performing assets given borrowing money was nearly free. They did not need to write off the loans and take appropriate losses. However, their ability to conduct new lending was hindered

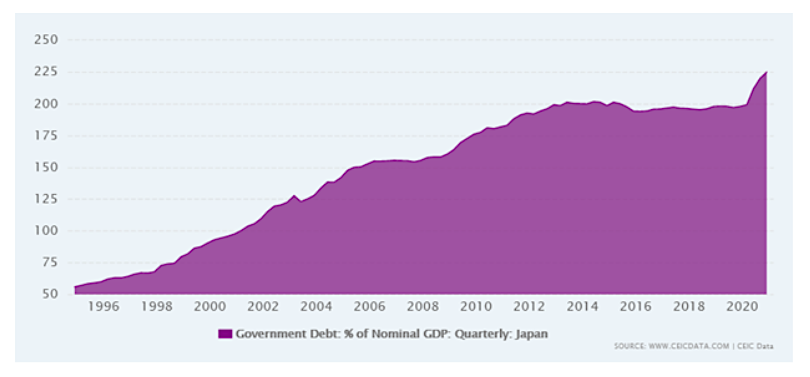

The graph below shows Japan’s debt to GDP ratio at 2.25x is nearly twice that of the United States. For context, many economists, ourselves included, think the United States ratio at 1.23x is problematic.

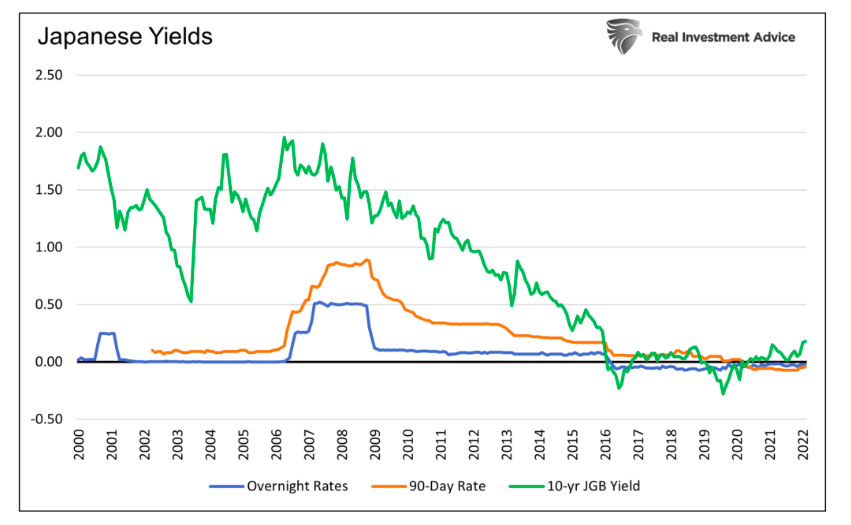

As we show below, the BOJ has maintained its overnight discount rate, like Fed Funds, near zero percent for the last 20 years. Since 2016 it has been negative. Also shown, three-month bill and ten-year note yields have hovered above and below zero percent over the previous five years.

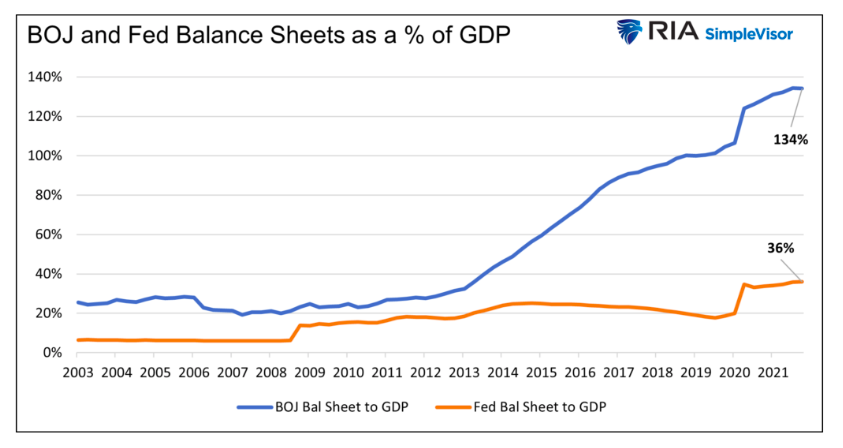

Like many central banks electing to keep interest rates at zero or negative, Japan relies on QE. The BOJ’s assets have risen by six trillion since 1998. While nominally somewhat on par with the Fed, Japan’s economy is less than a quarter of the size of the U.S. The following graph shows how much more egregious the BOJ’s asset purchases are versus the Fed.

As a result of QE, the BOJ now owns more than half of the nation’s Treasury debt and is the largest holder of its stocks.

Liquidity

The excessive liquidity spewed by the BOJ grossly distorted asset and interest rate markets in Japan and provided liquidity to the world. Japanese citizens and large pension funds are crowded out of local bond markets by the BOJ. Between the BOJ’s massive holdings and the large number of bonds held to maturity by pension funds, liquidity in its bond market evaporated. The lack of supply resulted in negative rates and no incentive to invest in bonds.

With limited choices, domestic retail and institutional investors went to foreign markets and sent their money abroad in search of extra yield and liquidity.

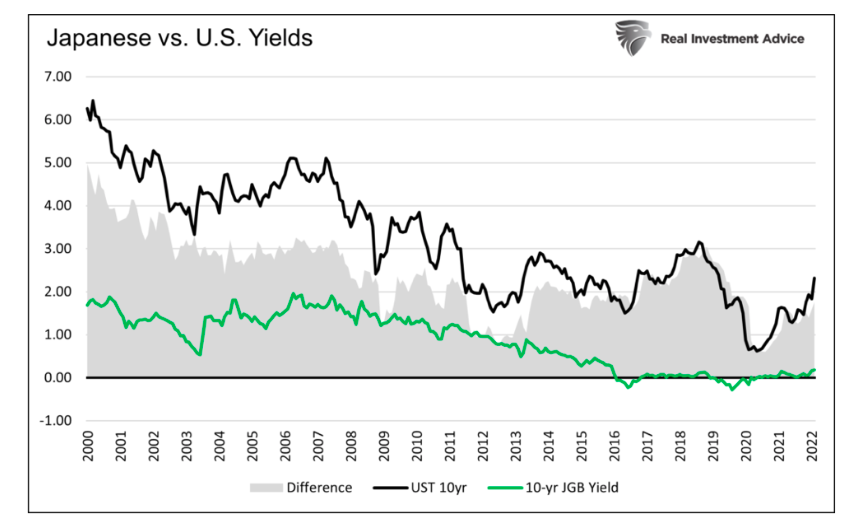

The graph below shows the significant yield pick-up between Japanese and U.S. Treasury 10-year notes.

Per the U.S. Treasury Department, as of January 2022, Japan holds over $1.3 trillion of U.S. Treasury debt, $286 billion of U.S. agency bonds, $310 billion of U.S. corporate bonds, and $861 in U.S. stocks.

Summary Part 1

It wasn’t just Japanese investors sending liquidity abroad. In Part 2, we introduce the yen carry trade and inflation, the potential fly in the ointment. Stay tuned; the story gets more intriguing.

We leave you with a recent quote and teaser for part of this article from BOJ Governor Haruhiko Kuroda:

“The BOJ should persistently continue with the current aggressive money easing toward achieving the price stability target of 2% in a stable manner.”

Twitter: @michaellebowitz

The author or his firm may have positions in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.