This is a quick update for readers who have been following our analysis of the iShares MSCI Italy ETF (NYSEARCA: EWI).

The initial downward thrust from last year may be complete, suggesting that a sideways-upward consolidation comes next.

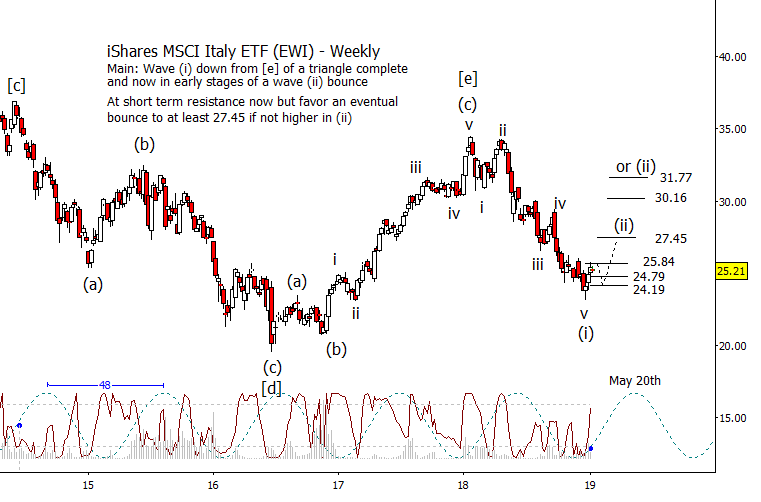

Recall that we have been charting a range-bound Elliott wave triangle for the Italy ETF (EWI) for several years, and in May we pointed out that the fund appeared ready to break downward from the final leg [e] of the triangle.

Our post in November showed how the bearish forecast had worked well, and it also suggested that traders should begin watching for a consolidation soon.

After the November post, EWI broke still lower and established a fairly clear downward impulsive move. On the chart below, we have labeled the impulse as wave (i).

The downward momentum has been fairly strong, but a potentially completed five-wave count and the inflection of the 48-week price cycle both favor a bounce from nearby to form upward wave (ii). In fact that bounce may have begun already.

Fibonacci resistance near 25.84 represents the initial area where a bounce could pause. That area was tested last week. A minor decline would allow EWI to take another shot at breaking the first resistance.

Beyond 25.84, the next Fibonacci resistance levels to watch sit near 27.45, 30.16, and 31.77. Those represent the areas where EWI bears might look for another chance to get aboard.

The same areas represent the places where fast-trading EWI bulls might look to close positions. Cycle timing suggests the consolidation could reach into spring 2019, with an ideal peak around May 20.

Follow Trading On The Mark on Twitter for more frequent updates about ETFs and futures!

Twitter: @TradingOnMark

The authors may have a position in the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.