Ongoing Debate: Correction Or New Bear Market?

No one knows where the stock market is headed next. However, we can use charts to help us assess probabilities.

The S&P 500 has quietly closed above its 50 day moving average for several sessions now (see chart below).

This appears to be a good start, but how does this type of action in relation to the 50 day MA stack up to past periods?

S&P 500 Chart – 2015

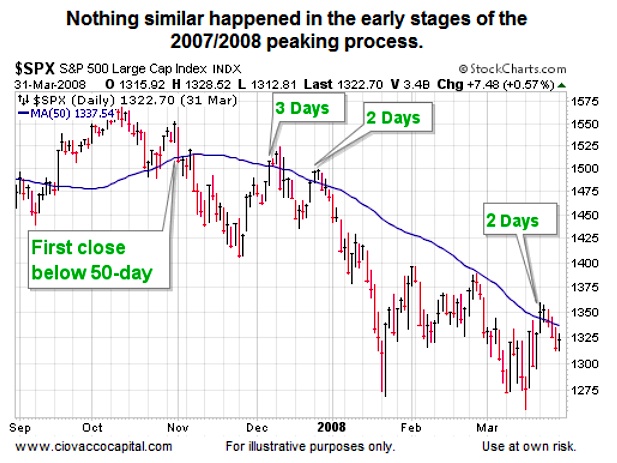

Did We See Something Similar In 2007/2008?

The answer to the question above is “no, not in the early stages of the new bear market”. The longest stay above the 50 day MA was 3 sessions.

What Happened After The First Occurrence In 2008?

The answer to the question above is “stocks rallied for an additional 39 calendar days”. In this 2008 case, the rally was fully retraced. If the S&P 500 rallied for 39 additional days from Monday’s close, it would not peak until the day after Thanksgiving or November 27, 2015.

How About 2011?

In 2011, the S&P 500 closed above its 50 day MA for 8 consecutive trading days for the first time in mid-October. Even though stocks did get a big scare in November, “the bottom” was already in on the day of the 8th consecutive daily close above the 50 day moving average. More importantly, after closing above the 50 day MA for the 8th consecutive trading day, not only did the S&P 500 fail to make a lower low, it rallied an additional 17.6%.

Does This Mean Stocks Go Higher Next?

No, the analysis simply speaks to probabilities, just as the evidence does that was presented on October 2, October 9, and October 16. All of the evidence that has accrued since the big intraday reversal in the stock market on October 2 tells us to keep an open mind about all outcomes; both bullish and bearish. The market will guide us if we are willing to listen with a flexible, unbiased, and open mind.

Thanks for reading.

Twitter: @CiovaccoCapital.

Author and/or his clients have positions in S&P 500 related securities. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.