Volatility has been eerily absent from the market lately with the ViX Volatility Index (INDEXCBOE:VIX) trading at levels not seen since 2017.

Short volatility has certainly been the number one game in town so far this year. For Iron condor traders, particularly those that trade the Russell 2000 (INDEXRUSSELL:RUT,), 2017 has been a bumper year so far.

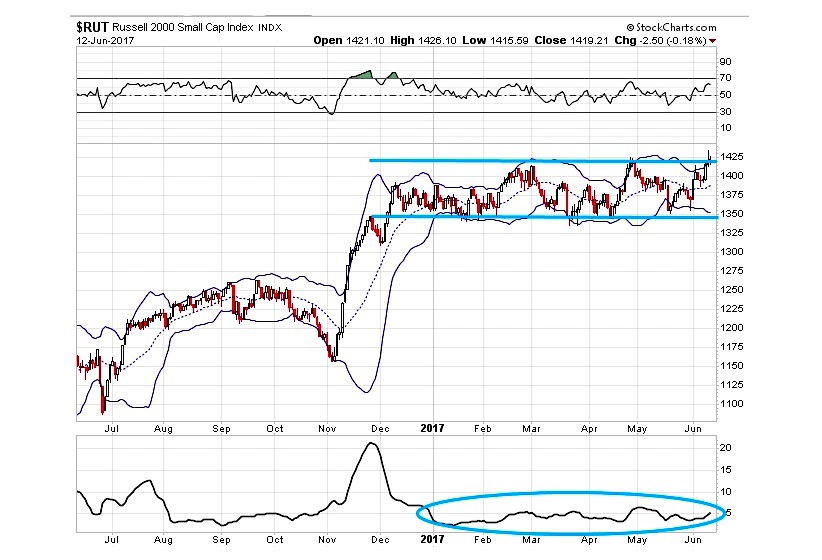

Looking at the chart of Russell 2000 Index (RUT), you can see that the index has traded in a range between 1340 and 1420 for the past six months. That is an incredibly narrow range.

I can’t recall an easier time for trading RUT Condors than the last few months, but will it last?

I have a saying that after periods of consolidation, come periods of expansion and after periods of expansion, come periods of consolidation.

Nothing ever stays the same in the markets.

If we look at the Bollinger Band width on the Russell 2000, it has been very narrow for 6 months now. My bet is that we see some expansion over the next 6 months.

That could be on the upside or the downside, I don’t know.

ALSO READ: Russell 2000 Bollinger Bands ‘Squeeze”: A Massive Move Is Brewing

Leading technician Carter Worth agrees that a big move is brewing, he thinks it will be resolved to the upside.

Worth stated “Here is the tight range of the Russell 2000, and it’s about 6 months in the making. It’s only happened one other time in the history of the index … and the last time it was resolved by a huge explosion on the upside,” Worth explained. “I think that you’ve got a better bet [in small caps] than you do in some of the very extended super-cap names, and I think you want to be along IWM”

With volatility so low, Long Strangles would be one way to play a RUT breakout if you are unsure which direction the index will move.

Catch more of my options trading analysis over at my site Options Trading IQ. Thanks for reading and trade safe!

Twitter: @OptiontradinIQ

The author does not have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.