In efforts to avoid a term woefully overused in financial commentaries (the term is also the title of a George Clooney fishing movie), we have opted for the literal definition instead.

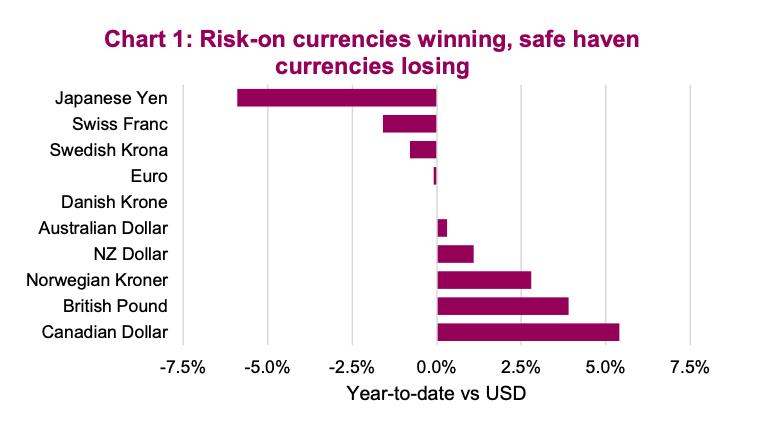

Over the past few months there have been several combining factors that have helped propel the Canadian dollar (CAD) higher and/or the U.S. dollar (USD) lower, lifting the CAD to 83 cents. This run has made the CAD the top performing currency among the big 11 currencies so far in 2021, up 5.3% (chart 1).

A move like that over five months has turned some heads, notably when investors see their U.S. denominated assets fighting this strong headwind.

Versus the USD it is clear 2021 has seen risk-on currencies such as the CAD, Norwegian kroner and Australian dollar performing much better. Meanwhile safe haven currencies including the yen and Swiss Franc have been laggards. The USD is also considered a safe haven currency. With global growth accelerating out of the pandemic, this has been a risk-on currency friendly market.

CAD tailwinds

There are many contributing factors that have helped the CAD rise to 83 cents. Everyone would agree the Bank of Canada and the U.S. Federal Reserve remain dovish by any historical metric, including the overnight lending rates and active bond buying activities (quantitative easing). However, it is the relative moves or the degree of dovishness that has favoured the CAD. The Bank of Canada has started to reduce its quantitative easing while the Fed continues. One would be hard pressed to call the Bank of Canada hawkish, but in this crazy money printing world, less dovish is the new hawkish.

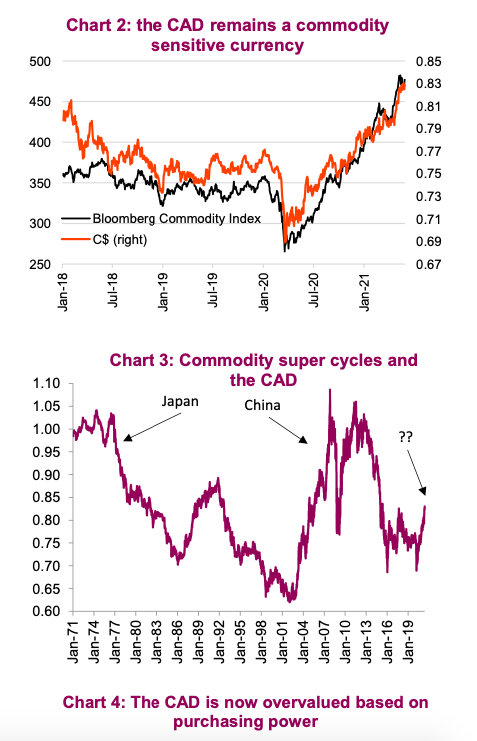

Perhaps the biggest tailwind of late for the CAD has been the rise in commodity prices. Like it or not, our currency is viewed in the global currency markets as a commodity currency. And the rise in commodity prices has many posturing or wondering if we are in the early innings of a new commodity super cycle. (chart 2)

If you believe we are in a commodity super cycle, the CAD has further upside potential. This is not our investment committee’s view. While many commodity

prices have appreciated to levels not seen since the last commodity super cycle, we believe this is a temporary phenomenon for a few reasons. The most obvious is changed consumer behaviour during the social distancing of the pandemic has resulted in increased spending on durable goods. Durable goods require more commodities than non-durables and services. This behaviour change has caused a demand spike for commodities while logistics and capacity remain constrained due to the pandemic. We believe this demand spike will fade with re-opening and supply chain bottlenecks ease.

To have a new commodity super cycle, the world requires consistently high aggregate demand growth over many years. Similar to the ones experienced during the rapid industrialization of Japan or urbanization of China (chart 3). We do not see one of these secular demand shifts developing and believe this commodity price spike will fade. Along with it, so will the strength in the Canadian dollar.

Where to from here?

There are many reasons to be both bullish the CAD and bearish the CAD, in USD terms. In the short-term the CAD bulls can cite global growth recovery, the magnitude of stimulus in the U.S. economy, commodity prices and relative yields being pretty tight. Longer term, well there are often rumblings of the U.S. gradually losing its reserve currency status as global trade becomes more balanced.

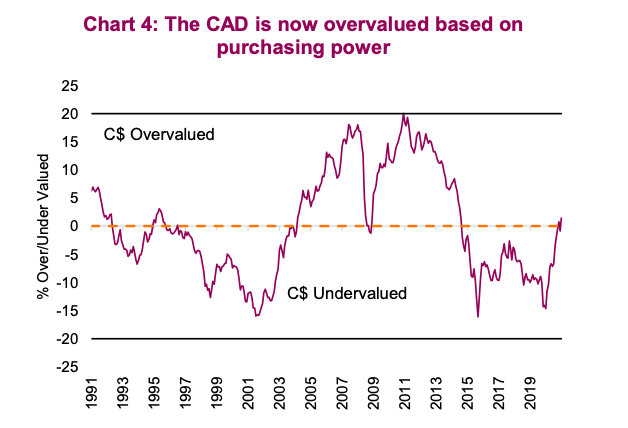

For Canadian investors the USD/CAD impact is often a zero-sum game. In CAD terms, the USD goes up in risk-off market environments and down in risk-on periods. Clearly that does make USD exposure a good diversification tool for Canadians. Now at 83 cents and enjoying a concurrence of factors, we believe the CAD has priced in a lot (or most) of good news making a move lower for the CAD as the higher probability event (aka USD higher).

After this run and at 83 cents, this does look like a good time to be adding a bit to U.S. dollar exposure.

Source: Charts are sourced to Bloomberg L.P. and Richardson Wealth unless otherwise noted.

Twitter: @ConnectedWealth

Any opinions expressed herein are solely those of the authors, and do not in any way represent the views or opinions of any other person or entity.