This past week, I got to talk a lot about inflation, something many have thrown in the towel about. But not us!

I sat down with Charles Payne during his show Making Money with Charles Payne on Fox Business. He prepared a list of questions for me.

Charles: You say inflation has cooled but its only taking a break and not over- what reignites it?

According to the research I did for How to Grow Your Wealth in 2023, I developed a list of TEN potential sparkplugs.

Charles: That’s a long list! Two years ago some of the most brilliant minds on the street were calling for a commodities super cycle and for a while they looked spot on – you say it’s still happening – walk us through it and how to be positioned?

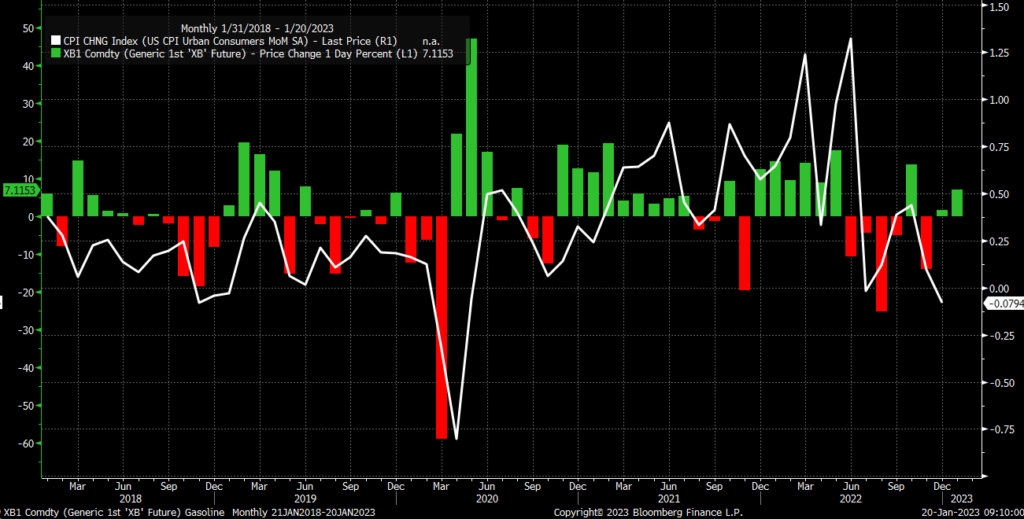

First off, by nature commodities are volatile.

Furthermore, Super Cycles do not last 1-2 years-typically they last 3-4 years.

So, if 2021 was the start-then 2024 to even 2025 is when it could cycle away.

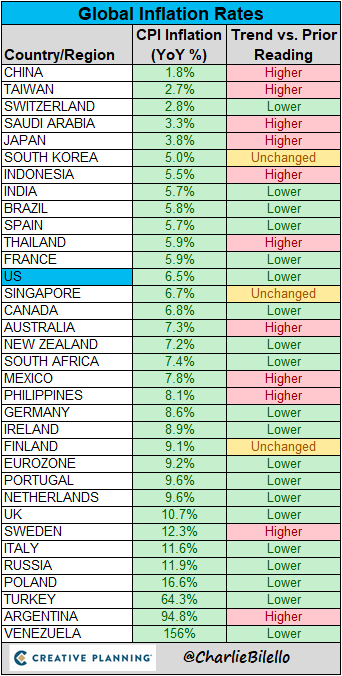

Statistically, inflation rates over 6% (we have had it at 9% and all it has done is cool to over 6%) take at least 6 years to fix. That’s if we are really committed to fixing it. Seems the Fed is wishy washy, and sovereigns everywhere are trying to spend their way out of a recession-also inflationary.

As far as actionable information, we think Gold doubles over time. The weekly chart shows a clean breakout above the moving averages.

Our Real Motion indicator reveals even with the rally, momentum has not caught up. We would love a correction to add to the position. However, the circle on the chart shows you a gap that had not been filled going back to mid-April 2022.

That gap has now been filled. We consider that a positive.

Plus, the Triple Play Leadership indicator has GLD well outperforming the SPY.

Gold is our main focus, but that also takes other commodities along for the ride-particularly miners.

Finally, looking at the rise in gas prices, we assume that that is inflationary in and of itself. Moreover, we also see higher oil prices as long as crude oil holds around $80 a barrel.

Charles: I like this line from your note: But one thing we know-it’s more important to adapt to changing landscape then get stuck on a macro theme. – How does that apply to investing?

One must be flexible and open-minded, especially those of us who are active and not passive investors.

Best case scenario is that these headwinds abate and companies plus consumers adjust to higher rates topping at 5%. That could lead to the “soft landing” while the market finds footing and a decent trading range.

Worst case scenario is that volatility and inflation continue to move higher, The Fed has more fat to trim yet are still unable to stop the price of gold and other hard assets from moving up.

Mish in the Media:

Making Money with Charles Payne, Fox Business 01-19-23What Could Spur Inflation – Let Us Count the Ways

CNBC Asia 01-18-23

Risk On or Off – Meme Stocks hold a Clue

Stock Market ETFs Trading Analysis & Summary:

S&P 500 (SPY) Jan calendar range reset this week and SPY fails the 200 and is now slightly below the 200-DMA again and closed crossing above the 50-DMA, but very narrow price range to 200-DMA. Held pivotal support at 390 and 200-DMA is resistance.

Russell 2000 (IWM) In better shape than SPY but still a nasty reversal and must hold 180 still. Filled the gap and first level of resistance 182 and overhead resitance at 187

Dow Jones Industrials (DIA) Back under the 50-DMA STILL as industrials lose ground. Needs to continue to hold pivotal support at 330.

Nasdaq (QQQ) Crossed the 50-DMA on Friday to close above. First level of tight support Support 277 and 283 resistance.

Regional banks (KRE) Led the way down and now must continue to hold 57.50 and now close to crossing 60.72 (50-DMA). First level of support is 58 and resistance is 50-DMA.

Semiconductors (SMH) Still holding key support easily at the 50-WMA and 200-WMA. 221 support and 228 resistance.

Transportation (IYT) Still holding 225 key support here and now holding first level of support holding 227.

Biotechnology (IBB) Still best sector with 132 key support still holding and holding first level of support at 134 now with 137 resistance.

Retail (XRT) Holding pivotal support at 63. Resistance at 66.

Twitter: @marketminute

The author may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author and do not represent the views or opinions of any other person or entity.