Last week Mish released her yearly outlook report with dozens of ideas on trends and trades going into the new year.

Greece ETF (GREK) is one of those picks.

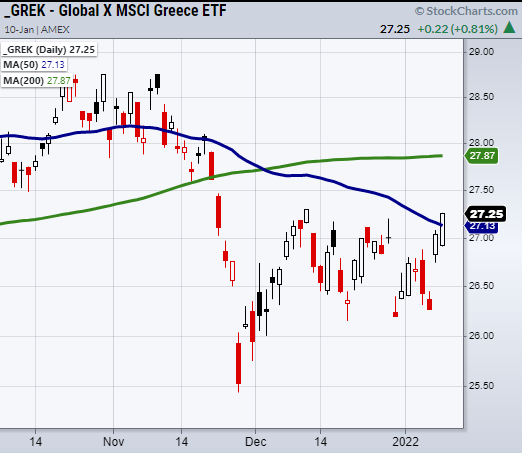

While the major indices were selling off Monday, GREK held near an important breakout area.

Though Mish has called GREK the sleeper trade of the year, it could be waking up earlier than expected.

Looking at the above chart of GREK, we can see that it has made a close over its 50-Day moving average at $27.13 and came just shy of clearing its range high at $27.30.

Its current range is from $26.15 to 27.30.

If it’s able to clear and hold over $27.30 on Tuesday, this can be a new support level going forward.

Additionally, a second close over the 50-DMA would put GREK in a recuperation phase showing that buying interest is growing.

With that said, GREK could also get boosted from the major indices.

Though the four major indexes gapped lower Monday, each was able to rally near Friday’s closing price.

While the indices weakness does merit extra caution, we should now watch for the indices to follow through with strong upside price action on Tuesday.

Watch Mish’s latest appearance on Cheddar News!

Cheddar TV 1-10-2022 – YouTube

Stock Market ETFs Trading Analysis & Summary:

S&P 500 (SPY) With Monday’s strength watching for it to clear the 50-DMA at 466.48.

Russell 2000 (IWM) Watching for follow through with a close over 216 area on Tuesday.

Dow (DIA) Watch to hold over the 50-DMA at 358.37.

Nasdaq (QQQ) 377.37 to hold.

KRE (Regional Banks) 75.76 support.

SMH (Semiconductors) Main support area 288.14.

IYT (Transportation) Sitting on the 50-DMA at 271.90.

IBB (Biotechnology) 143.25 to clear.

XRT (Retail) Potential double bottom pattern.

Twitter: @marketminute

The author may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author and do not represent the views or opinions of any other person or entity.