If you ever want to study human psychology, the capital markets may be one of the best windows into the mind.

Markets move based on the aggregation of millions of investors’ opinions on whether something is too expensive or too cheap. And these opinions are subject to, among many factors, emotion, moods and even unrelated news or random circumstances. And the often give way to animal spirits.

For instance, sunny days generally make people happier compared with overcast cloudy days. Moreover, there are several comprehensive studies that have found daily stock market returns to be statistically higher on sunny days compared with overcast. Clearly, that should not impact the value of a stock or a market from a “fundamental” perspective, but it does.

The market is at times simply in a good mood and sometimes angry.

There is always a very valid-sounding narrative (story) that can explain what is happening, and as humans we enjoy those stories. They enable us to neatly categorize what is happening and to believe we know and understand what is occurring. That is a comforting feeling.

However, stories are written to explain events after the fact. As a result, it’s not always clear how much real value there is in this approach.

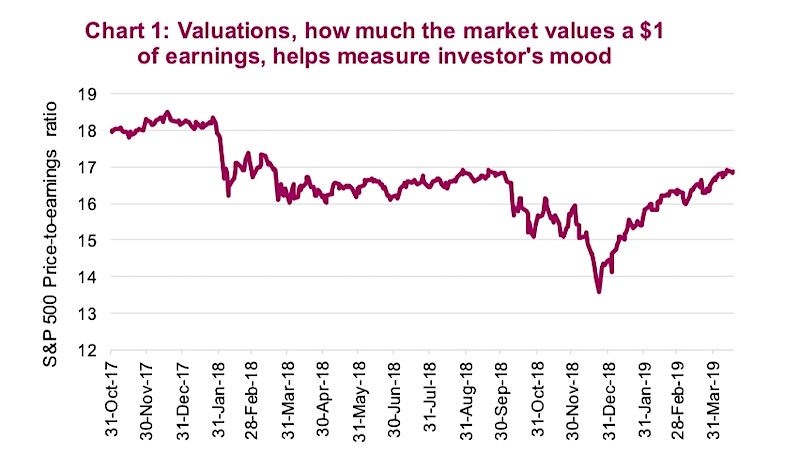

A good example is the fourth quarter: remember how “angry” the markets were? Let’s say, changing valuations for the S&P 500 reflect changing aggregate investor moods. At the end of 2017, the price-earnings (PE) ratio for the S&P 500 was 18.5x. This fell to 16.8x by September of 2018, then fell all the way down to 13.5x for the S&P 500 in late December. ANGRY!!! And animal spirits work in both directions.

Sure, there is a narrative: slowing global economic data calling into question if a recession is on the horizon. Suppose now with the markets back near highs, the risk of recession is gone? The data is important, but the aggregate mood of investors is arguably just as much so. Who knows, maybe there have simply been many more sunny days!

Animal spirits are wide awake

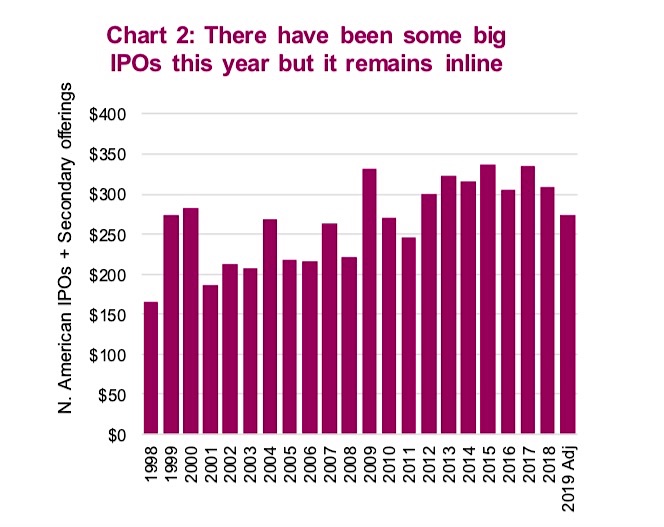

There is no denying the market’s “mood” is certainly good these days. After the great whipsaw from the fourth quarter to the current year to date, the TSX reached a new all-time high on Thursday (April 18) and the S&P 500 was a mere 1% off its high. This positive environment has many companies tapping the equity market for fresh capital, including some large initial public offerings (IPO) in the past few weeks from Lyft, Pinterest and Zoom Video. Profitability, or even the near-term prospect of it, does not seem to be a requirement for some.

We can thank those animal spirits, or at least the market’s overall good mood. These IPOs may not have gone so well if attempted during the more volatile fourth quarter.

Chart 2 illustrates total equity issuance in North America each calendar year, including 2019 if the current pace continues for the rest of the year. While there have been some large deals, the current pace isn’t abnormally high. Still, the market remains rather supportive and there is a long line of big IPOs on the schedule.

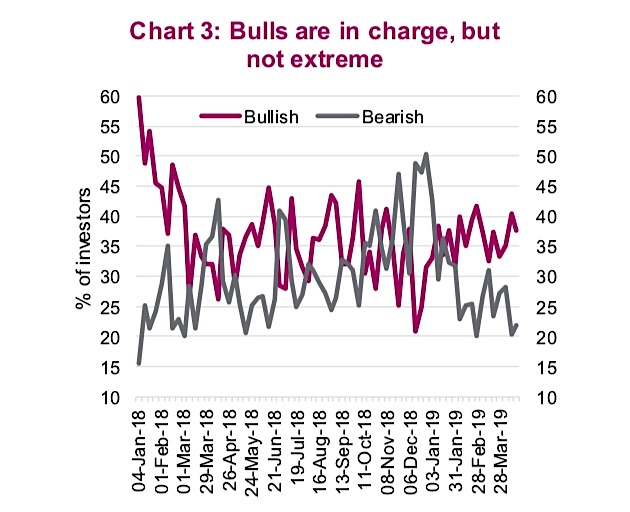

Indeed, there is much evidence that the markets are in a better mood. The American Association of Individual Investors conducts a weekly poll, asking people if they believe the market will be higher or lower in the six-month period ahead – a fairly direct measure of peoples’ moods. Chart 3 below tracks the percentage of bullish and bearish investors over the past 18 months. At 38% bullish versus 22% bearish, investors are currently in a good mood. In comparison, during the market bottom in late December 2018, only 21% of investors were bullish versus 49% bearish.

This measure of investor sentiment can be a helpful indicator for contrarian investors, meaning when everyone is bullish you shouldn’t be and vice versa. At the beginning of 2018, the majority of investors were bullish, leaving them exposed during the market correction in February-March that year. Conversely, the bearish market in December would have been a profitable buying opportunity for contrarian investors. Still, while there are more bulls than bears today, it isn’t extreme, so this isn’t necessarily a warning signal. In fact, with over 40% of investors “undecided”, this rally could keep running.

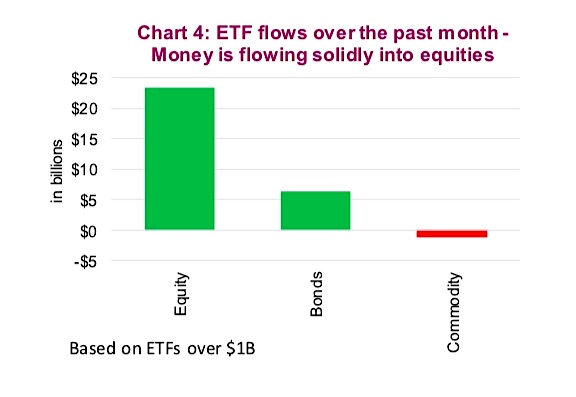

Surveys are nice but, let’s face it, some respondents aren’t entirely truthful. In fact, much survey data is flawed because there is a human tendency to tell the surveyor what we think they want to hear – even if the respondent doesn’t necessarily believe it. But money talks much louder and more accurately than survey data. And money has been flowing into the market.

Tracking all U.S.-listed Exchange Traded Funds that have over $1 billion in assets, funds have been flowing into equities, with much less directed towards bonds. In the past four weeks, almost $25 billion of capital was allocated to equities. This allocation has been mainly focused on large-cap ETFs that invest in the U.S. International and emerging market-focused ETFs have seen very little net new flows. Clearly this is supportive with investors buying into the sustainablilty of this rally.

Conclusion

The aggregate mood of the market can change quickly, but currently investors are acting as if everyday is a nice cloudless spring day.

Source: all charts are sourced to Bloomberg & Richardson GMP

Twitter: @ConnectedWealth

Any opinions expressed herein are solely those of the authors, and do not in any way represent the views or opinions of any other person or entity.