There are typically growing pains associated with new Fed Chairmen, and we do not expect it to be any different this time around.

So far in his tenure, Powell has offered comments that were seen as less guarded than those offered at times by his academic economist predecessors. He has also expressed a degree of comfort with recent stock market volatility (suggesting the Fed under his leadership may be less willing to adapt policy to near-term fluctuations in the stock market or the economy).

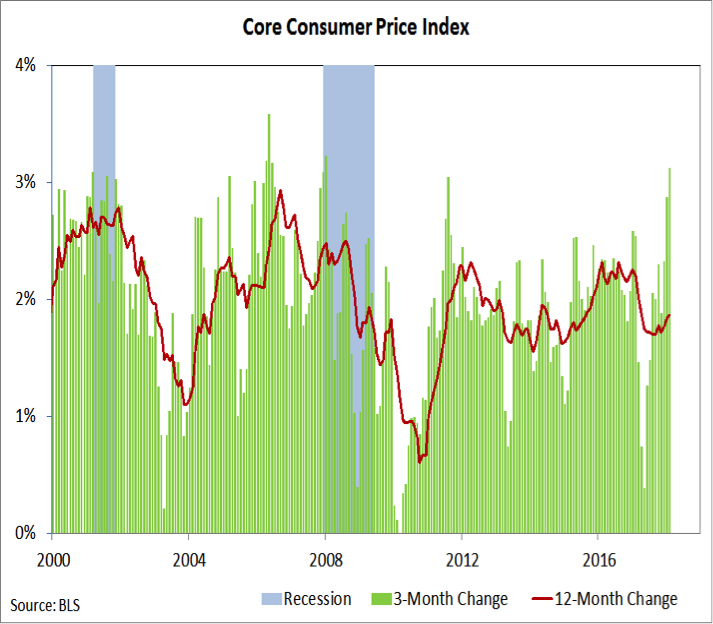

The primary focus in the near term may be discerning the degree to which the recent uptick in core consumer prices (the 3-month rate of change is at its highest level in 10 years) is sustainable and how much slack remains in the economy.

Economic Fundamentals remain Bullish. Arguing against an accelerated pace of tightening by the Fed is some evidence that there may be more slack in the economy than was previously assumed. The most recent round of employment data showed an uptick in the pace of hiring and increased labor force participation. The monthly employment trends index from the Conference Board is consistent with robust GDP growth. Surveys of CEOs and small-business owners reflect continued and increasing confidence in the economy. This has historically translated into economic growth as confident business leaders tend to invest in capital and hire employees.

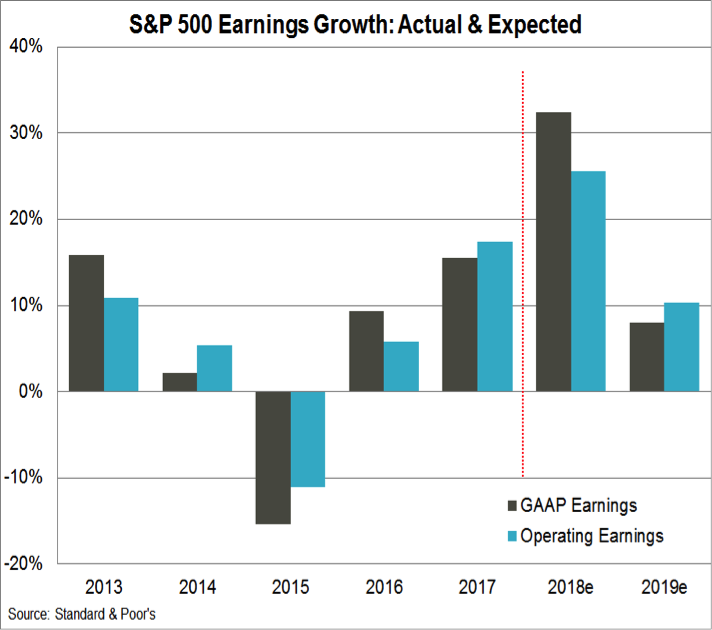

Of some concern is the degree to which expectations have already moved ahead of the data. The earnings impact of the recent tax cuts makes comparisons a bit of a challenge, but current estimates have S&P 500 earnings growing by 25% to 30% in 2018 (roughly half of that may be due to tax cuts). The recent trajectory of the Atlanta Fed’s GDPNow estimate of first-quarter growth could have important implications for earnings estimates over the next few months. After initially topping 5%, the most recent estimate from the Atlanta Fed is for growth of less than 2% in the first quarter. Quarterly earnings estimates have hardly budged and may need to be guided down as earnings season approaches. In other words, given the current level of expectations, even modest and improving economic growth may produce disappointments.

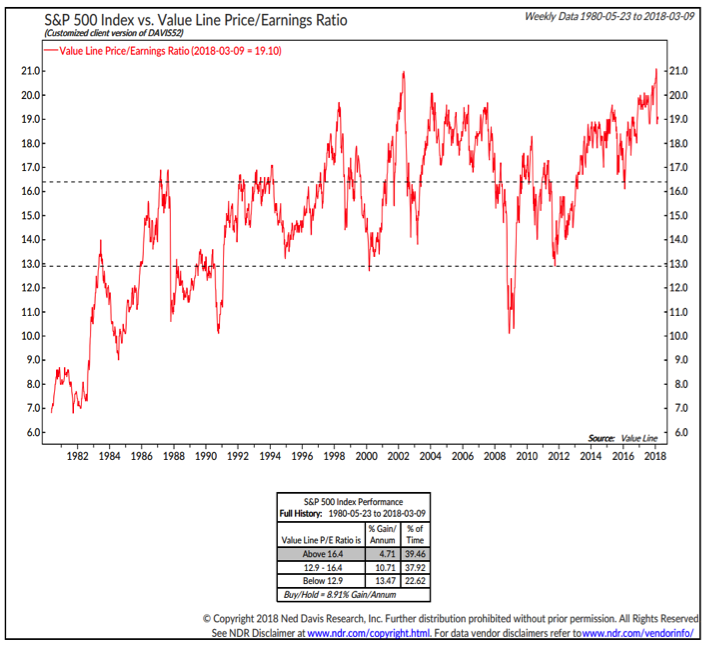

Valuations are still Bearish. While expectations for earnings are elevated, the most reliable valuation indicators rely on trailing earnings or (as is the case with the Value Line Price/Earnings Ratio) a blend of trailing and forward earnings. As the chart on the preceding page showed, earnings have risen in each of the past two years (2016 and 2017). But so too have stock prices ‑ the strong growth in earnings in 2017 was accompanied by, and even exceeded by, the rally in stock prices. With valuations already excessive and expectations for earnings growth elevated, stocks could be vulnerable to a failure for reality to match forecasts. Unfortunately, this has been an all too common experience in recent years. Initial expectations for earnings have tended to be revised lower over the course of the year.

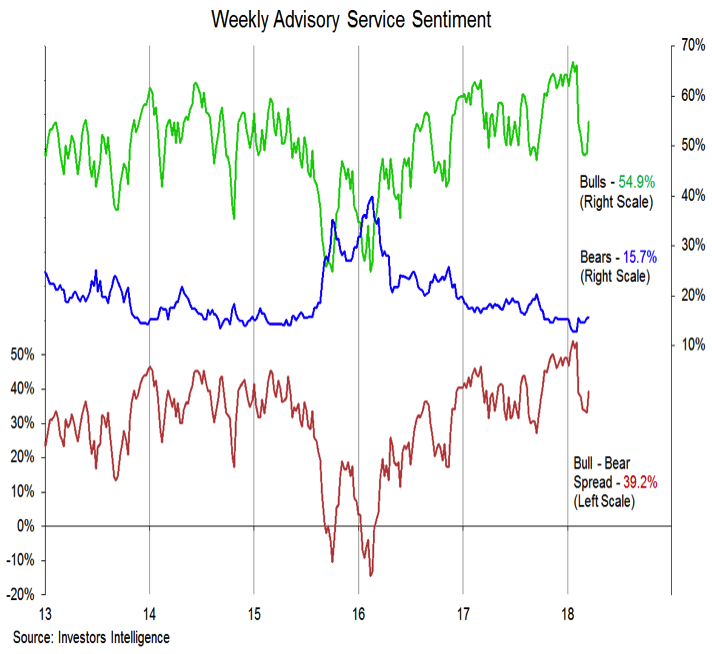

Investor Sentiment remains neutral. The February weakness in the stock market rattled some bulls and led to a decline in optimism. That was seen in weekly surveys (like the Investors Intelligence survey of Advisory Services) and showed up more discretely in shorter-term sentiment indicators that flipped from excessive optimism to excessive pessimism. Since then, two things have been seen. First, the weekly indicators have failed to show optimism moving to pessimism. Bears on the Investors Intelligence survey, for example, have scarcely budged and remain at a historically low level. Secondly, the bounce by stocks off of their lows has been greeted with renewed optimism. Bulls are again expanding on the Investors Intelligence data and the shorter-term indicators are on the cusp of excessive optimism.

Seasonal Patterns and Trends are holding at neutral. We are already dealing with the traditional headwind brought by a change in Federal Reserve leadership, but coming into sharper focus now is the tendency for stocks to experience weakness moving into mid-term elections. While we are keeping this indicator neutral for now, it will likely shift to bearish as we move into and through the second quarter. Even in years where economic conditions remain strong, stocks tend to experience heightened volatility and a period of weakness heading into mid-term elections. This tendency is even more pronounced for small-caps (which tend to weaken relative to large-caps, which themselves are weak). The good news is that absent economic weakness, stocks have tended to rally sharply once the election outcome is clarified.

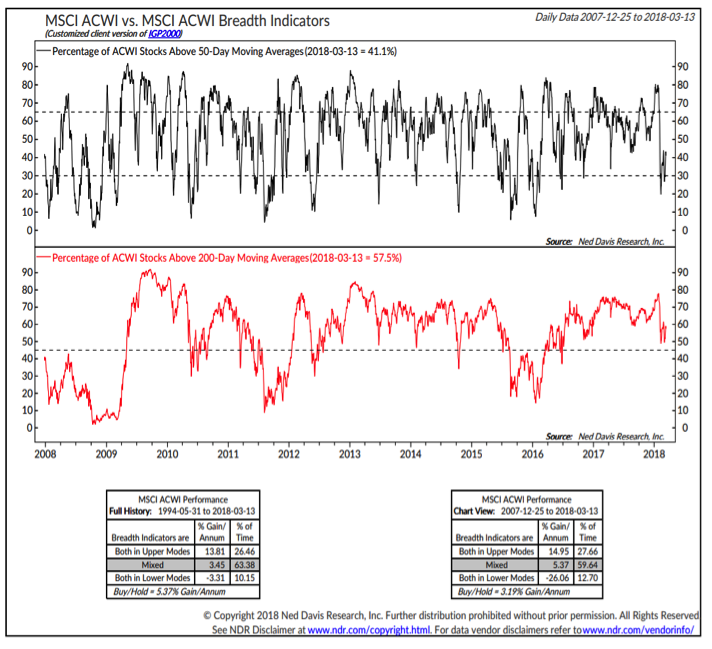

Breadth is still neutral. While the indexes have rallied (the NASDAQ Composite moved to a new all-time high), participation has not been exceedingly broad and we have yet to see evidence of upside momentum (a so-called ‘breadth thrust’) returning. The stock market generals have charged the field, but the troops have been more reluctant to join the fray. Measures of breadth have turned higher, but have thus far generally lagged. Only 40% of stocks in the ACWI (All-Country World Index) are even trading above their 50-day averages. The new all-time high on the NASDAQ came as less than 60% of the stocks which trade on the NASDAQ were even above their 50-day averages. While breadth may yet get back in gear, we do not yet have evidence that it is doing so. The failure to do so is strong evidence that risks remain elevated and a consolidation phase is ongoing.

Thanks for reading.

Twitter: @WillieDelwiche

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.