It’s been an uneasy consolidation for stocks following the February correction.

If the bulls want to win the battle here (and get the bull market back on track) they will need to see market breadth improve. In this 2Q investment outlook we look at the technicals, fundamentals, sentiment, and market breadth.

Highlights:

- New Fed Leadership Finding Its Voice

- Economic Optimism Fuels Earnings Expectations

- Market Volatility Not Leading To Investor Pessimism

- Small-Caps Could Struggle Into Mid-Term Elections

- Breadth Lacking Conviction

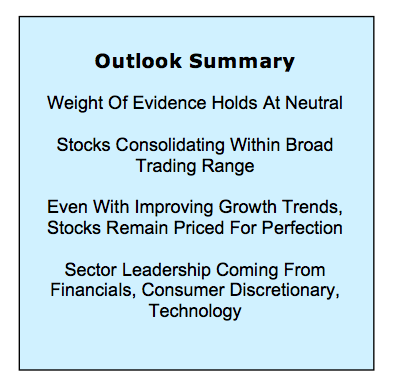

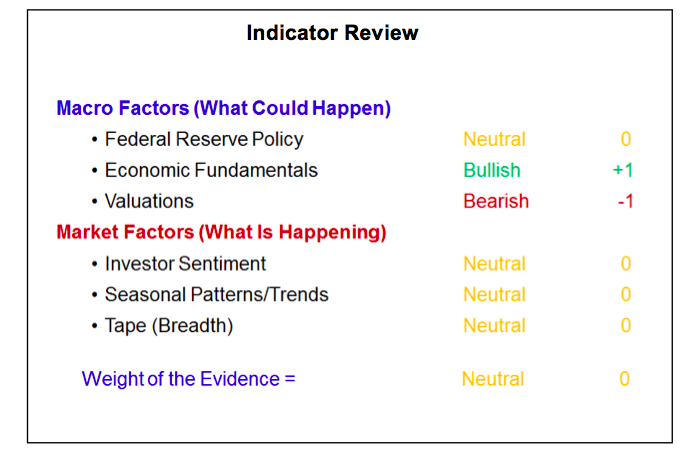

Stocks have rallied off of their February lows but, for the most part, have remained shy of their January highs. For now the overall weight of the evidence remains neutral, a message consistent with a continued trading-range environment. We have yet to see a sufficient unwinding in Investor Sentiment or recovery in Breadth indicators to argue for a more bullish view. Neither Federal Reserve Policy nor Seasonal Patterns have deteriorated to the point of arguing for a more bearish view. We continue to see positive trends in Economic Fundamentals but Valuations that suggest a lot of good news has already been priced in.

Most vividly, through the noise and narratives of the first quarter, we have seen a continued re-emergence of the volatility that was missing in 2017. In that regard, last month’s theme (Volatility Returns) remains very much intact. As we review the weight of the evidence, there is little to suggest that this theme is going to ebb any time soon. In such an environment it is all the more important to tune out the noise and put narratives aside. After nearly two years of strong stock market gains (from February 2016 to January 2018), much of the remainder of this year may be spent in a broad (and volatile) trading range that allows expectations to be re-set and fundamentals to catch up to price. Relying on the weight of the evidence will allow us to test the view and update it as necessary. A disciplined approach to risk management is of the utmost importance.

To provide some context as we consider the weight of the evidence, it might be useful to review what we have already seen in 2018.

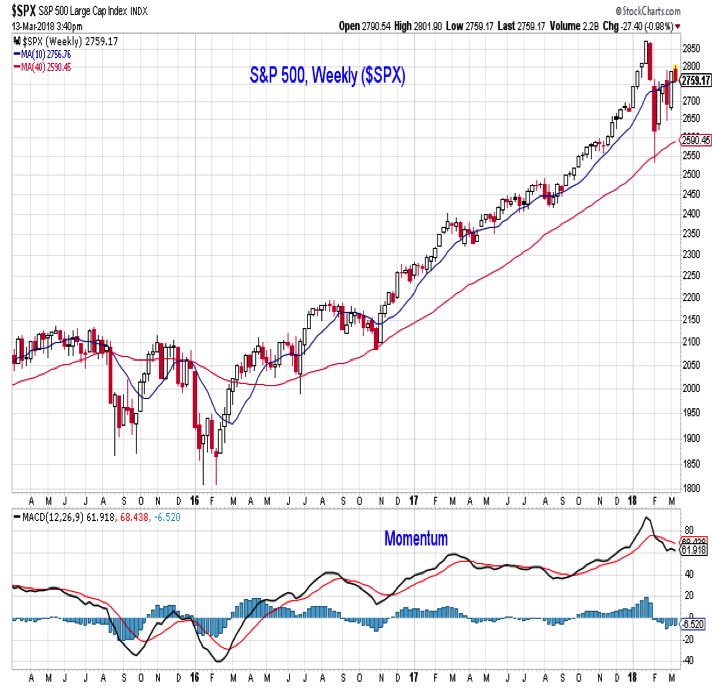

The rally that carried the S&P 500 from its early 2016 lows to its early 2018 highs may still be intact – there is not sufficient evidence to argue that it is not. What we have seen over the past two months, however, has been a surge in price volatility (more on that in a moment) and a distinct loss in upside momentum. Since the February 2016 lows, the S&P 500 has struggled to make headway when weekly momentum has been moving lower. Among other things, a turn higher in the momentum trend would be evidence that the two-year-old cyclical bull market in stocks remains intact and the path of least resistance is still higher. Absent that the coming months may provide more of the same in terms of the volatility we have seen recently.

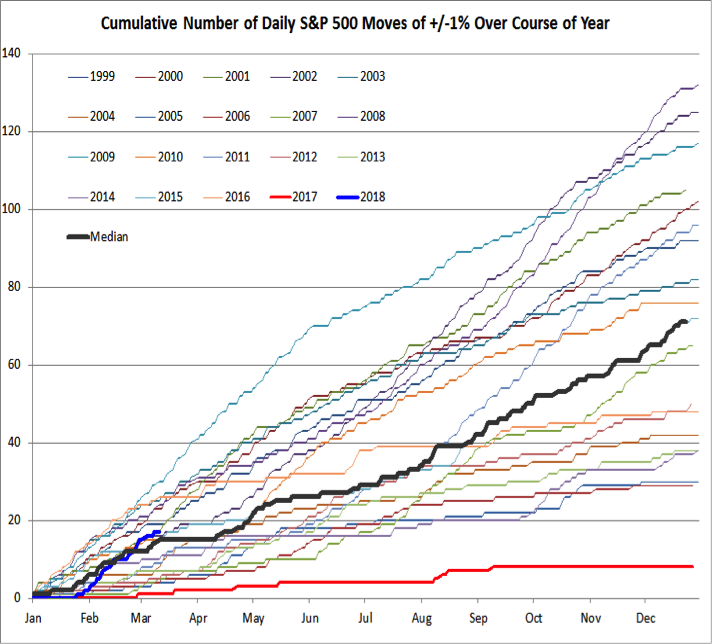

While volatility has surged relative to 2017, we are not out of bounds of what has been the typical experience over the past 20 years. In fact, the reality is that 2017 was a clear outlier. So far in 2018, the S&P 500 has experienced 17 daily moves of +/- 1%. This is just ahead of the median, but well shy of the maximum. By this point in 2009, the S&P 500 had seen 30 such moves. The effect this year might be heightened, however, because at this point in 2017 the S&P 500 had experienced just one daily move of more than 1% (a 1.3% gain on March 1, 2017). If our expectations are anchored to the outlier experience of 2017, the volatility of 2018 may border on the unbearable. Anchored on the experience of the past 20 years, volatility in 2018 looks much more normal.

Federal Reserve Policy remains Neutral. The yield on the 10-year T-Note moved from 2.4% at the beginning of the year to a recent high of 2.9%. The pace of this ascent (not the overall level per se) may already be a headwind for stocks and from that perspective some near-term moderation in bond yields would be welcome. For now, however, we are keeping Fed policy at neutral. The market, as reflected by Fed Funds Futures, has priced in the three rate hikes that the Fed has telegraphed for 2018 as it continues to normalize interest rates (the first rate hike of the year is expected to come following the March 20-21 FOMC meeting). Also coming at that meeting will be an updated set of economic projections from the Fed and it will be Chairman Powell’s first opportunity to conduct a post-meeting press conference.

continue reading on the next page…