It is difficult to characterize 2020 other than to say ‘unprecedented’.

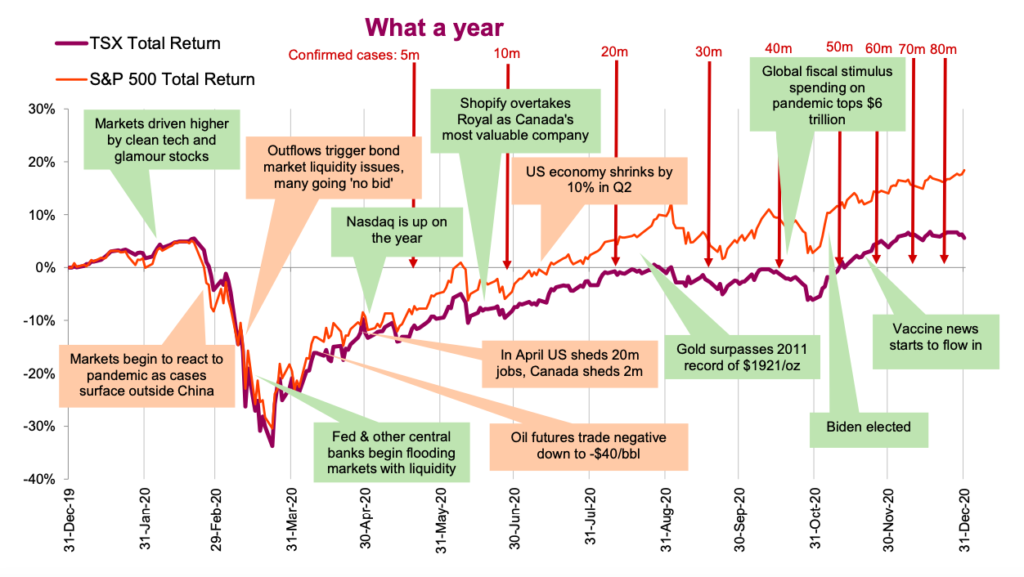

This year does not fit in any historical ‘box’. The pandemic has taken a terrible toll on humanity, while the sheer size of the cases and deaths have numbed the reader. Last count 84m confirmed cases and 1.8m deaths. To slow the spread social distancing has proven the most effective, which has taken a terrible toll on many parts of the global economy.

This led to the biggest drop in economic output in Q2. Yet other parts of the economy are relatively unscathed or have even benefited. The economy has been recovering and adjusting, with a lot of help from monetary and fiscal stimulus. But many millions are still out of work and many industries are struggling to get through to the other side.

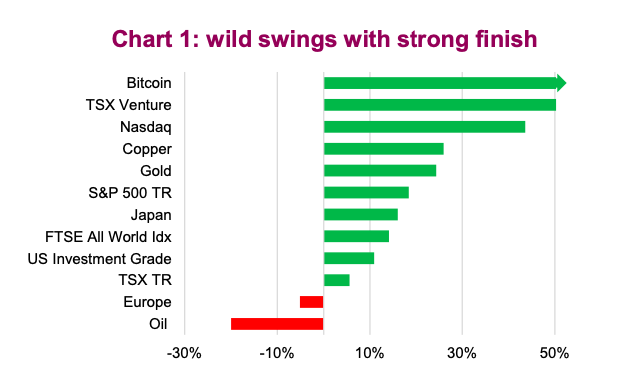

Astonishingly, capital markets and many other markets enjoyed outsized returns but not until going through the quickest bear market in history. 6 percent of the U.S. population has contracted COVID-19 at one point or another, total employment is 10 million below the February peak, and the S&P 500 Index finished 2020 up +18.4%. IPOs enjoyed one the best years ever.

Speculative bubble behaviour in clean tech, work from home stocks and bitcoin. Oh, and bonds did really well too. International markets were less robust, but still impressive given the environment.

Lessons from 2020

We would caution anyone drawing conclusions based on 2020 as this scenario of events is extremely unlikely to repeat. And we would really caution falling for new investment strategies designed based on the events of this past year. Still, becoming a better investor requires reflection to help provide context and help guide future investment decisions. Here are a few that are top of mind while reflecting on 2020:

The Market & the Economy – One recuring question this year has been divergence between the economy and the equity markets. It is good to think of the equity markets as a giant crowd sourced forecasting mechanism, attempting to ascertain the future. While often wrong, it does look farther forward compared to economic data that is often a snapshot of today. Markets continue to look past the pandemic and associated recession. It could very well be too optimistic, only time will tell.

Hooked on liquidity – The markets, real estate and other assets are firmly addicted to liquidity. The monetary response in 2020 has pushed the envelope of what central bankers can and are willing to do. No denying it worked, but has likely strengthened the addiction. And if there was any doubt before there is less now – ‘don’t fight the Fed’.

Emotions are an investors worst enemy – Given most markets and asset classes did relatively well once 2020 crossed the finish line, the only folks who really lost out were those that capitulated during the February/March sell-off. The lesson is to not let your emotions drive asset allocation decisions.

Source: Charts are sourced to Bloomberg L.P. and Richardson Wealth unless otherwise noted.

Twitter: @ConnectedWealth

Any opinions expressed herein are solely those of the authors, and do not in any way represent the views or opinions of any other person or entity.