November Stock Market / Investing Highlights:

– Bond Yields Support Fed Moving to Sidelines

– Global Economy Seeing Green Shoots

– Valuations Elevated but Improving

– Pockets of Skepticism Amid Increased Investor Optimism

– Seasonals Argue for Small-Cap Strength

– Breadth Bullish Despite Blemishes

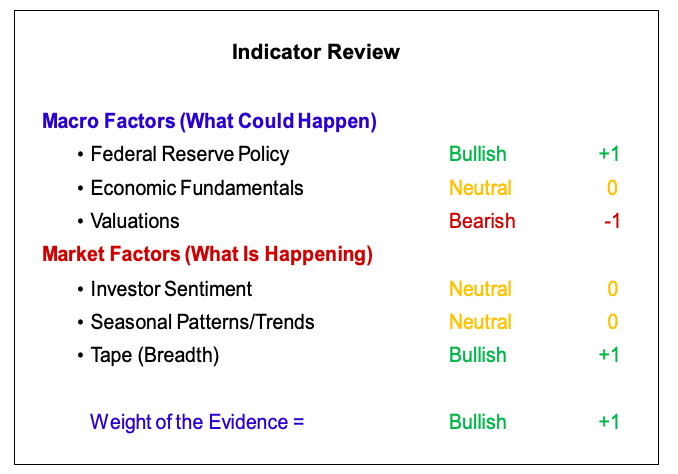

Since our last Investment Strategy Outlook was published (September 26), the Weight of the Evidence has been upgraded from neutral to bullish on the back of an improved breadth backdrop. This suggests there is a path for stocks to work higher into year-end, capping what has been a year of remarkable strength across almost all asset classes. While considering the current evidence, we also want to begin to look forward to next year and the beginning of a new decade.

Large-cap US stocks have enjoyed a decade of remarkable success versus small-cap stocks and indeed the rest of the world. They are likely to struggle to match those absolute or relative gains over the coming decade. Broadly distributed strength in 2019 seems to be the initial evidence of shifting leadership trends. Investors will need to adapt to this emerging reality.

The path toward success may include a renewed focus on portfolio diversification and a willingness to tactically adjust exposure as risks and opportunities emerge. A well-constructed financial plan will help prepare for such environment, as will setting aside emotional decision-making and continuing instead to lean on the weight of the evidence.

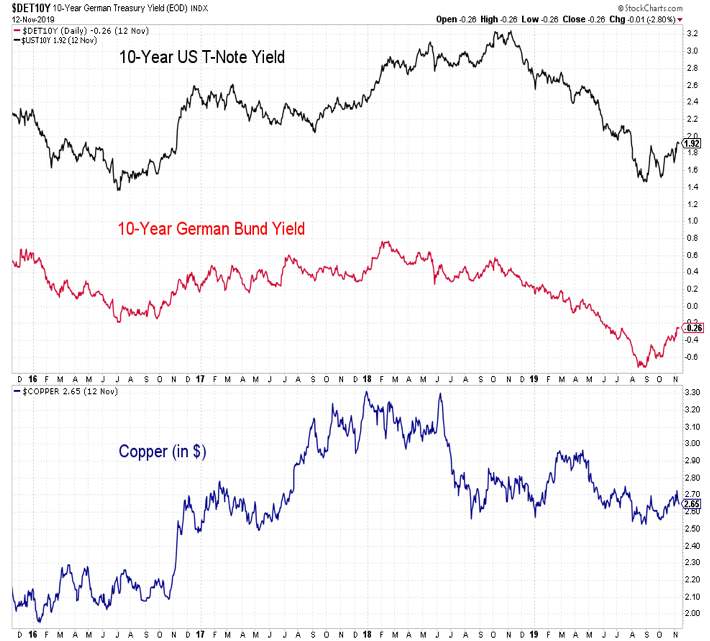

Federal Reserve Policy is bullish. The Fed cut rates three times in the second half of 2019 but now appears poised to move to the sidelines as the effects of this mid-cycle adjustment are absorbed by the financial markets and the economy.

Around the world, more than 85% of central banks are in easing mode (all of the net gains in the all-country world stock index over the past 30+ years have come when more than 50% of central banks were easing). The direction of bond yields could help guide Fed moves going forward. With yields in both the US and Germany moving higher since their late-summer lows, the bond market is supporting a continued wait-and-see stance from the Fed.

Whether the discussion moves from waiting-and-seeing about further rate cuts to waiting-and-seeing about the path toward tightening may continue to rest with inflation trends. The Cleveland Federal Reserve Bank calculates a median CPI measure to identify the trend in inflation (rather than arbitrarily removing food and energy prices from the calculation, which is the core CPI approach). The median CPI has shown more inflation in recent years than has the core CPI.

While it may limit the Fed’s flexibility, an uptick in inflation would suggest a healthy and organic strength in the economy and the emergence from a decade of economic stagnation.

Economic Fundamentals are neutral. The US economy has been resilient in the face of policy uncertainty, but from our perspective it is not out of the woods with respect to a growth scare. Leading economic indicators are deteriorating at a time when concerns about recession (as measured by internet searches of the subject) are plummeting.

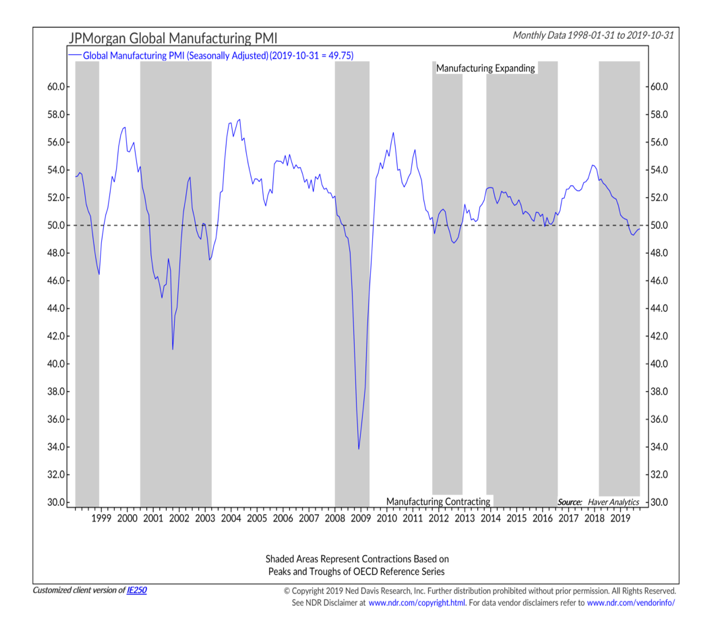

While the US may be vulnerable to some disappointment, there is encouraging economic evidence from abroad. The global manufacturing PMI is hinting at the emergence of global green shoots. October had the most countries (54%) reporting an uptick in their PMI’s since the global slowdown began.

While expressed concern about recession in the US appears to be ebbing, confidence measures remain under pressure. Consumer confidence (as measured by the Conference Board) is still at a high level from an absolute perspective, but as the chart to the left shows, it is falling at its fastest pace in a decade.

Further deterioration (fueled by unconsummated trade deals, political developments or something else) would suggest downside risks in the economy are expanding.

Continue reading on the next page…