With nominal bond yields now back to levels on par with before the onset of the pandemic, one of the most important questions for asset allocation is “Where do they go from here?”

At the root of this question is inflation.

So far during this economic recovery, inflation has remained low and stable thanks to a number of counteracting forces remaining in balance.

We believe this will change soon with a near-term cyclical uptick in inflation in the coming quarters and a more secular rise as the decade progresses.

Near-term – we expect some signs of inflation as re-opening accelerates (now to a few years)

You don’t have to look very hard to find higher prices (that is inflation) on many things today. From lumber and other commodities to the price of a cup of coffee, prices are up. But at the same time, prices of things such as accommodations, travel (if allowed) are down. This is combining to keep inflation measures subdued.

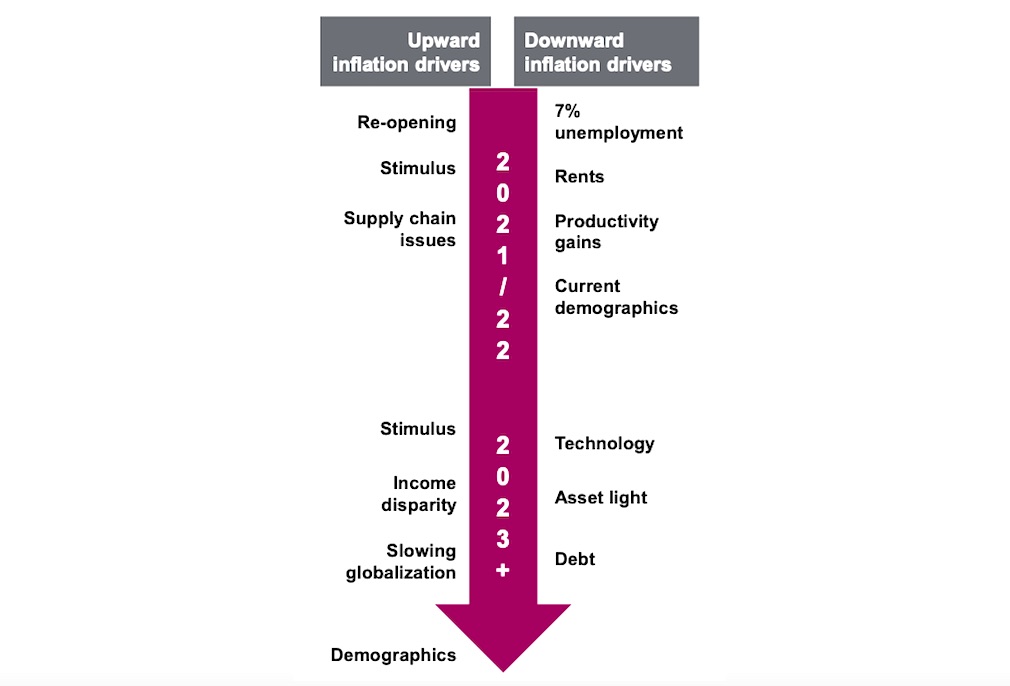

Lower rents, productivity gains (Zoom calls instead of travel) and still-elevated unemployment are putting downward pressure on inflation. These are countering accelerating economic growth due to the re-opening, the impact of stimulus and supply chain issues. Many supply chains reduced output as a rebound this quick was not expected. Add to this pandemic issues plus a God awful parking job in the Suez.

This balance will not last. Assuming the vaccines gradually beat back the pandemic, many of those unemployed will begin working again. The consumer has saved billions, a good portion of which will likely be released when we can go out and eat or travel again. The roaring 20s maybe be afoot.

We believe this pushes inflation above the 2% level along with higher nominal yields. It’s unlikely this goes too far as there are still secular deflationary pressures and the central banks will act to counter the trend at some point. This could result in a more textbook recession but that is a ways down the road.

For now, this is good inflation, building on the back of improving economics and a more normal world.

Longer-term – there are a number of secular trends that will likely cause higher inflation this decade.

Technological advances such as autonomous vehicles, high levels of debt and an asset-light economy will be offsetting forces that are likely to persist during the next 10 years and beyond.

But a number of deflationary forces that have been present for much of the past few decades are starting to diminish. Demographics with baby boomers retiring kept inflation low but this is gradually giving way to millennials hitting that key household formation age. Global trade, or more specifically global trade growth, is slowing. Policies to address income disparity and climate change: these are all incrementally inflationary.

Add it all up, we are likely entering a decade that will see a broad trend towards higher inflation, with a few bumps along the way.

Source: Charts are sourced to Bloomberg L.P. and Richardson Wealth unless otherwise noted.

Twitter: @ConnectedWealth

Any opinions expressed herein are solely those of the authors, and do not in any way represent the views or opinions of any other person or entity.