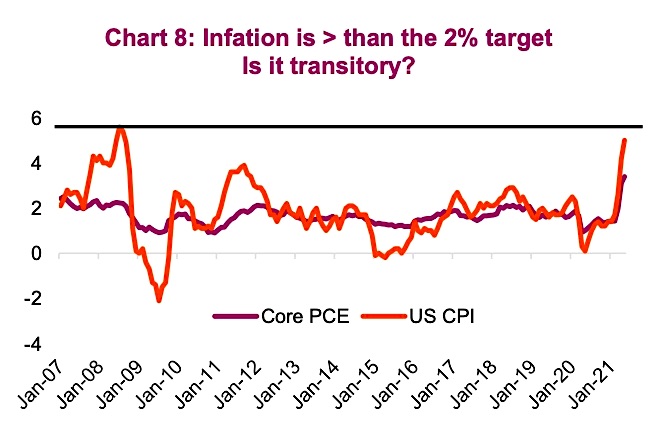

In the United States, personal consumption (PCE) Inflation rose to 3.4% year over year, the highest levels since the 1990s.

The consumer price index for urban consumers reached 5.0%, a level not seen since the last recession in 2008.

Despite rising inflation, the Federal Reserve held steadfast to its view that they will not react preemptively to higher inflation. “We will not raise interest rates pre-emptively because we fear the possible onset of inflation. We will wait for evidence of actual inflation or other imbalances.” – Federal Reserve Chairman, Jay Powell

Several fundamental factors drove prices higher. Most industries had to reconfigure their business model, supply chains have been disrupted and commodity prices have risen across the board.

The math behind how inflation is calculated on a year over year basis, coupled with the reduction in stimulus checks, makes it quite plausible that we are experiencing peak cycle inflation.

Incomes in the U.S. fell for a second straight month in May as more states are dialing back stimulus, making a rise in prices even more challenging for items like houses and cars. Used car prices have spiked the highest out of any line item of CPI (outside energy), up 29.7% YoY.

Median home prices in the U.S. rose 24% year over year on low inventories and strong demand. However, the lack of affordability has weighed on the pace of sales; existing home sales pulled back for the fourth straight month.

On a positive note for retailers, we have seen a surge in U.S. retail sales over the past four months, while there has been retracement in Canada. This is likely to reverse and accelerate over summer.

The largest contributing factor to rise in inflation has been the rise in oil prices. CPI data for urban consumers in the United States show that consumers are paying 28.5% more for energy than they were a year ago

Oil prices closed out the quarter with the strongest half year performance since 2009. Recovery driven demand proved to be enough to offset increasing supply from North America and abroad as OPEC+ begins opening the taps.

Oil is one of the only commodities not to correct so far, and historically there has been a high correlation between headline inflation and WTI.

Most commodities, not just oil, capped off historic runs, but more recently have undergone healthy corrections. Lumber is off more than 30% from the peak while semiconductors, wheat and iron ore are all down 15%+

Source: Charts are sourced to Bloomberg L.P. and Richardson Wealth unless otherwise noted.

Twitter: @ConnectedWealth

Any opinions expressed herein are solely those of the authors, and do not in any way represent the views or opinions of any other person or entity.