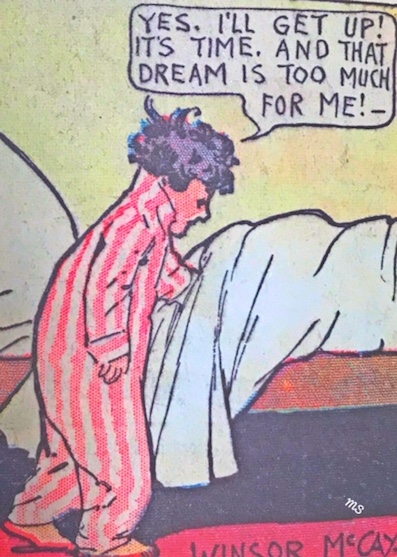

I imagine that investors’ dreams vary to a large degree.

There are some who dream of a stock market collapse.

There are others who dream of new highs for stocks.

Both dreams can wind up too much for investors as those dreams may be lofty.

Furthermore, a long-range plan is one thing.

A trading bias based on hope and desire is another.

Even more challenging to all our psyches, whether it be in a sleep state of fully awake, are the misleading headlines that keep emerging over the last couple of days.

China coming to the table, says Trump.

China not coming to the table, says White House officials.

It’s enough to keep investors’ afraid of falling asleep.

Dreams and hopes aside, what facts are the market’s main influencers?

First, the U.S. Dollar (NYSEARCA: UUP) ended lower for the week. Last Friday’s closing price was 25.79. This week’s closing price is 25.71.

We have been concerned about a weakening dollar because of rumors that it could lose its status as the world’s currency and it could ignite more inflation.

Secondly, the Federal Reserve continues to declare its intention of raising rates. The most dovish statement they have said is that if growth slows, they will pause on that plan.

Of all the years I have studied monetary policy, I am most impressed with Powell’s steady hand. He seems to have a handle on what is at stake if he sounds too dovish.

The amount of our debt that foreign countries are buying has been reduced big time. This is a major concern.

Third, household debt increased for the 17th consecutive quarter, or more than 20% of where is was in 2013.

One in four Americans have student loan debt. The total amount of student loan debt as of August is $1.5 trillion.

“Outstanding auto loan debt is at a record high, north of $1.2 trillion. Loans with terms that last 84, even 96 months, are becoming more common, putting car buyers more at risk of default. A record 6.3 million people are more than 90 days behind on their payment.” Jalopnik.com

The U.S. National Debt is $21.4 trillion. More importantly, while many countries ordinarily consider buying U.S. debt as safe, currently foreign governments have reduced buying our debt by about $10 billion with Russia stepping back by nearly 50%.

Is there good news?

The G-20 is coming up. What Trump and Xi decide concerning tariffs is a wildcard.

Gasoline has come down in price. This is good for the consumer, but also could be a sign of declining global demand.

This past week solar energy stocks rose along with Tesla. Perhaps the megatrend of alternative energy over fuel oil will catch on more and more.

Black Friday is around the corner. Given consumer debt, I take a huge boost in retail sales with a grain of salt. Nonetheless, it could at least spark a bit of a Santa rally.

And one last technical tidbit.

Transportation (IYT), may have found a bottom between 175.50 and 176.62. However, that will only confirm if IYT clears back over 194.

Henceforth, whatever the market brings next, stay awake if the dreams are not to your liking, and stay in reality-as much as that is possible.

Trading levels for key stock market ETFs:

S&P 500 (SPY) – We did not get the close over 275.30, so this could still be the low risk rally to sell if Monday turns lower

Russell 2000 (IWM) – Still has lots of resistance to plow through-153.50 to start. And now must hold 150.

Dow Jones Industrials (DIA) – Best looking index. But does that matter if IWM turns lower?

Nasdaq (QQQ) – Inside day.170 resistance and 162.50 closest support. Also note this is back under the 50 WMA at 170.35.

KRE (Regional Banks) – 55 is the big pivotal number for Monday as it closed right there.

SMH (Semiconductors) – When SMH had its death cross on 10/4, the price was right at the MAs offering a low risk short. Rare & beautiful. Now, SMH could rally to the 50 DMA near 100, can even overtake it. But, can it clear 104? If not, you’ll have a 2nd chance at shorting with a very low risk. And, must hold 94.00.

IYT (Transportation) – Held 186.50 and could possibly setup well for a short if it cannot clear 193-195 while the 50 DMA declines in slope to meet the 200 DMA for a possible death cross. 190 pivotal for Monday.

IBB (Biotechnology) – The 200 WMA at 104.75-closed just above making that number pivotal

XRT (Retail) – Closed under 47.50 the 50 WMA with 45.00 the big support this must defend.

Twitter: @marketminute

The authors may have a position in the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.