IBM (NYSE: IBM) soared 10% higher on Wednesday morning, after posting earnings that beat Wall Street expectations.

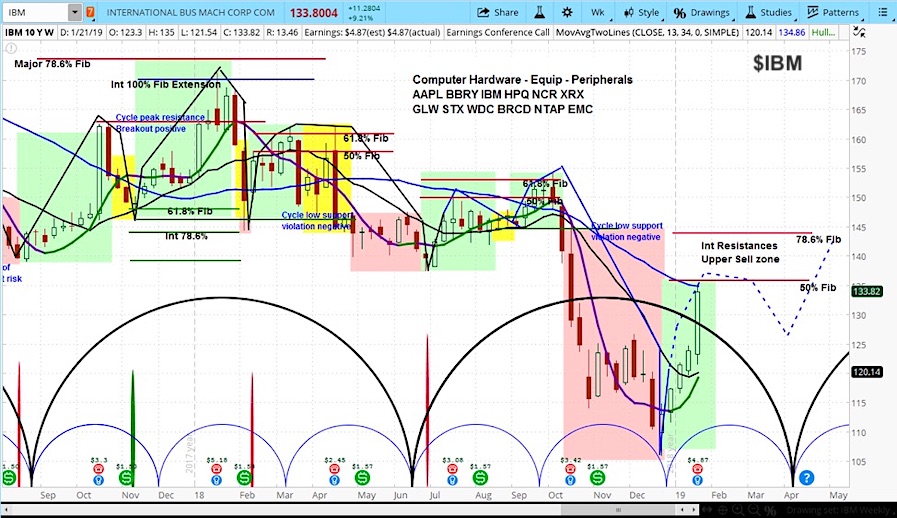

IBM’s stock “market cycles” point to a bit more upside and then a pullback, as its declining phase approaches. Looks like IBM earnings report may have been priced into the stock.

IBM Earnings Recap

The company reported earnings per share of $4.87 and total revenue of $21.76 billion, above analyst estimates of $4.82 and $21.75 billion. IBM Management forecast its fiscal year revenue at $13.90, which was also above expectations.

With cloud revenue up 12 percent, CEO Ginni Rometty explained that. “We returned to full-year revenue growth, reflecting growing demand for our services and leadership solutions in hybrid cloud, AI, analytics and security,”

Takeaways for the stock price: With regard to IBM’s market cycles, we can see that it is in the rising phase of its current minor cycle, with the declining phase of the intermediate cycle in sight. We previously saw IBM as in a negative pattern, but it is now repairing itself. Nearing resistance, we expect the stock to pull back from around $136, with a better buying opportunity coming in late March or April.

IBM (IBM) Stock Weekly Chart

For more from Slim, or to learn about cycle analysis, check out the askSlim Market Week show every Friday on our YouTube channel.

Twitter: @askslim

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.