As in the past, one group of traders that bear close watching are non-commercials.

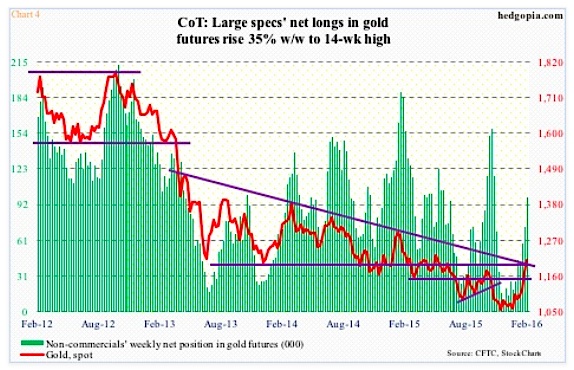

That group has been adding to net longs in gold futures – it hit a 14-week high last week (see the chart below). This data is through last Tuesday and before the 4.1-percent spike in Gold last Thursday… so that session may have changed the supply-demand dynamics – we’ll know more when this week’s COT Report is released.

Thus far, gold bugs have the backing of these traders, and will need their support going forward in order to defend $1180 at best and $1140 at worst. Might be wise to also keep an eye on how fast the Gold Volatility index slides.

Twitter: @hedgopia

Read more from Paban on his blog.

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.