One of the themes of 2016 has been the revival of Gold prices (NYSEARCA:GLD). After reaching new multi-year lows in late 2015, Gold has regained some luster with a strong multi-month rally in 2016.

But it isn’t fully out of the bear market woods just yet. Both Gold and Silver prices (NYSEARCA:SLV) took a breather this summer, and now is the time to find out how healthy that pullback has been, as they are both nearing critical levels.

Let’s look at both via their ETFs. Note that this summary comes from Mark’s newsletter and the charts are through Wednesday.

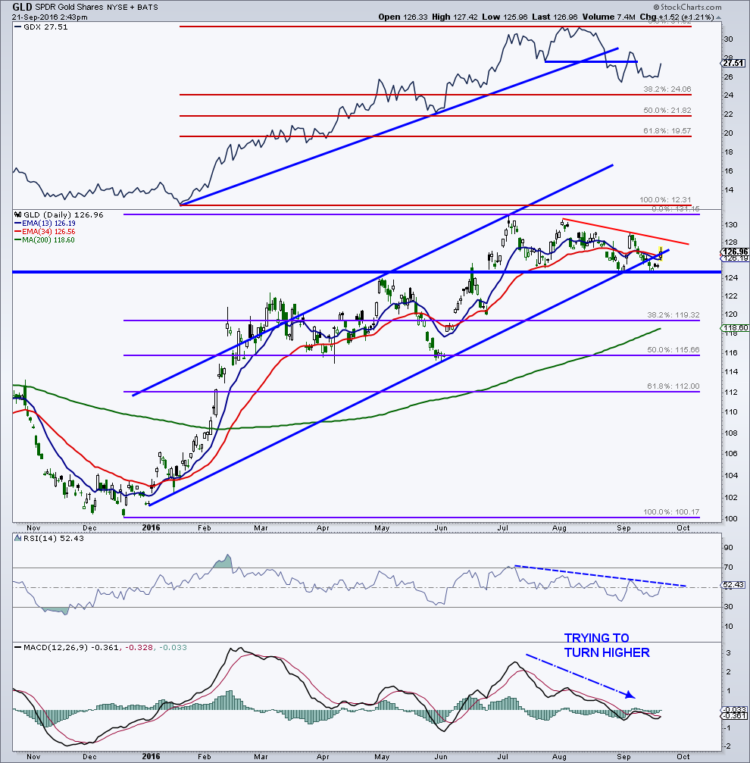

Looking at the SPDR Gold Shares ETF (GLD), you can see that it is trying to recapture the trendline off the lows since early this year. The gold market may be the true read here as it failed to break down despite a run higher in interest rates recently. If the trendline off the recent highs at 128.50 is taken out, we could very well see new highs for GLD and gold prices.

The Gold Miners (GDX) bounced sharply Wednesday and may be in the process of tracing out a double bottom.

Silver looks a bit more interesting than gold at this point. I think a break out this triangle would be pretty bullish and open the door for new recovery highs. During the pullback, there was a nice reset of daily momentum. Both the 14-day RSI and MACD had moved into extreme overbought territory following the parabolic move in June and July.

Thanks for reading.

You can contact me at arbetermark@gmail.com for premium newsletter inquiries.

Twitter: @MarkArbeter

The author does not have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.