The election has passed and many investors are now turning extremely bullish. As stated in my October 7th newsletter, I was bullish going into this event. Yet we all had to understand that going into such a potentially volatile event, risk had to be managed accordingly (with careful position sizing).

Investors have dealt with violent moves across assets classes: just as equities and the US Dollar have swung higher, other assets like gold and bonds have swung lower.

We are now swinging toward the other end of the pendulum and traders need to understand where the market is currently so they can manage positions accordingly. If you were on the wrong side of the market, be careful not to revenge trade. This is an attempt to get “back” at the market for taking your money and is emotionally fueled.

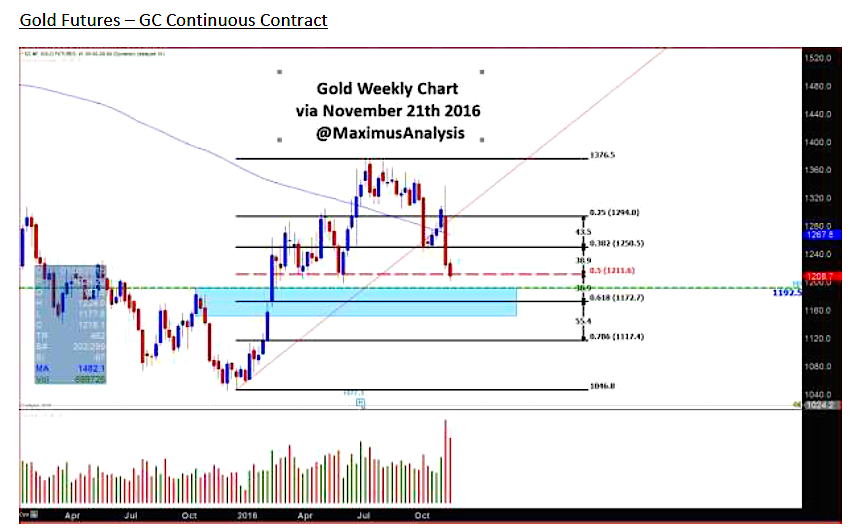

Today I want to take a gold futures. It’s extremely oversold at the same time when the US dollar is just the opposite. Gold futures continued their downward march into this week and price is now near the 50% Fibonacci retracement area (note spot gold prices closed Wednesday at 1189). Here’s what I’m watching:

- 1190 area

- We are beginning to see very oversold conditions.

- Watch US Dollar for signs of exhaustion.

- Have patience with this trade and wait for a buy signal on the weekly time frame.

Catch more of my work on my site MaximusAnalysis. Thanks for reading.

Twitter: @MaximusAnalysis

The author does not have a position in any of the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.